-

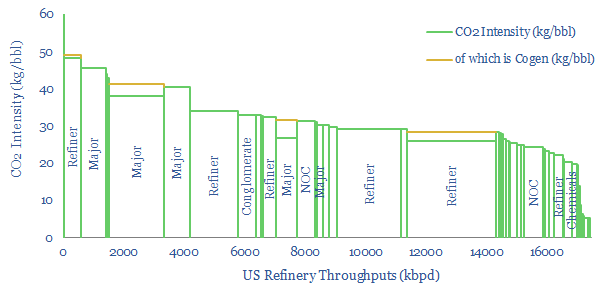

US Refinery Database: CO2 intensity by facility?

This US refinery database covers 125 US refining facilities, with an average capacity of 150kbpd, and an average CO2 intensity of 33 kg/bbl. Upper quartile performers emitted less than 20 kg/bbl, while lower quartile performers emitted over 40 kg/bbl. The goal of this refinery database is to disaggregate US refining CO2 intensity by company and…

-

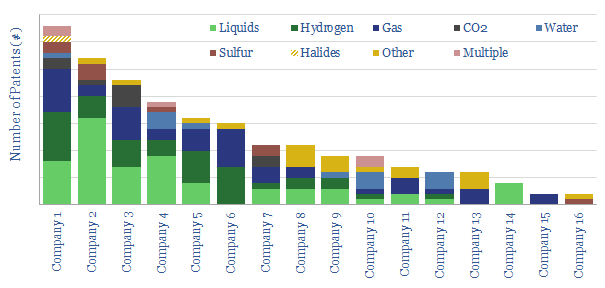

Refinery membranes: where’s the IP?

This data-file reviews over 1,000 patents to identify the technology leaders aiming to use membranes instead of other separation processes (e.g., distillation) within refineries. Operational data are also presented for an ExxonMobil breakthrough and Air Products’s hydrogen recovery technology.

-

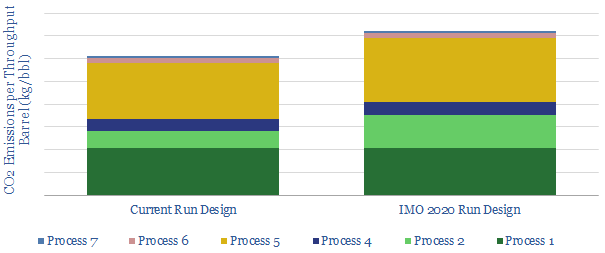

Carbon Costs of IMO 2020?

CO2 intensity of oil refineries could rise by 20% due to IMO 2020 sulphur regulations, if all high-sulphur fuel oil is upgraded into low-sulphur diesel, we estimate. The drivers are an extra stage of cracking, plus higher-temperature hydrotreating, which will also increase hydrogen demands. This one change could undo 30-years of efficiency gains.

-

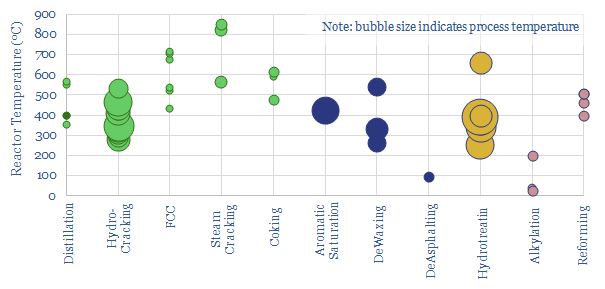

Upgrading Catalysts: lower refinery temperatures and pressures?

Refineries are CO2-intensive, as their average process takes place at 450C. But improved catalysts can help, based on reviewing over 50 patents from leading energy Majors, and their requisite temperatures and pressures. Combining all the best-in-class new catalysts, we think the average refinery could save 5kg/bbl of CO2 intensity.

-

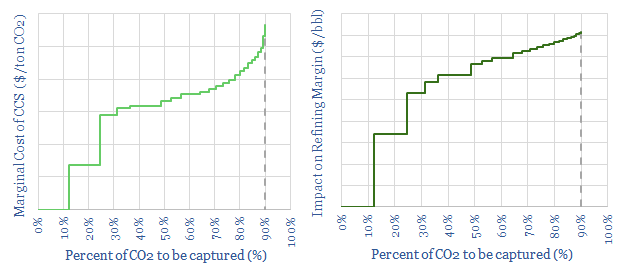

Carbon Capture Costs at Refineries?

Refineries emit 1bn tons pa of CO2, or around 30kg per bbl of throughputs. Hence this model tests the relative costs of retro-fitting carbon capture and storage (CCS), to test the economic impacts. c10-20% of emissions will be lowest-cost to capture. The middle c50% will cost c3x more. But the final 25% could cost up…

-

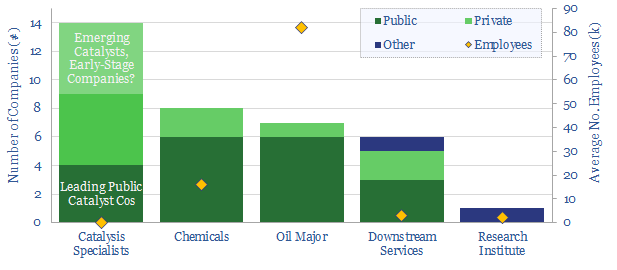

Overview of Downstream Catalyst Companies

This data-file tabulates headline details of c35 companies commercialising catalysts for the refining industry, in order to improve conversion efficiencies and lower CO2 emissions. Five early-stage private companies stand out, while we also profile which Majors have recently filed the most patents to improve downstream catalysis.

-

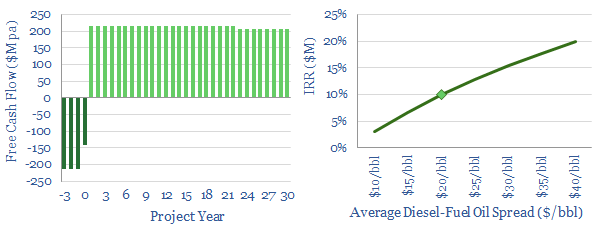

Eni Slurry Technology. A leader for IMO 2020?

This data-file models the economics of Eni’s Slurry Technology, for hydro-converting heavy crudes and fuel oils into light products. It is among the top technologies we have reviewed for the arrival of IMO 2020 sulfur regulation, achieving >97% conversion of heavy fractions.

Content by Category

- Batteries (87)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (829)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (277)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (126)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (350)