-

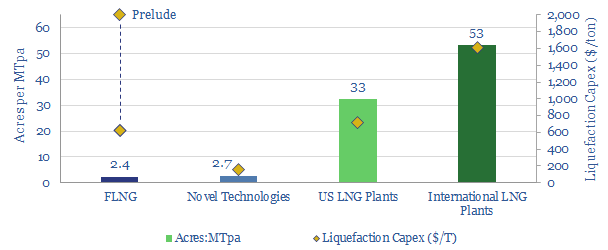

LNG plant footprints: compaction costs?

This data file tabulates the acreage footprints of c20 recent LNG projects. FLNG is 20x more compact than a comparable onshore plant, which may elevate costs. To benefit from compactness, we see more potential in novel “liquefaction” technologies.

-

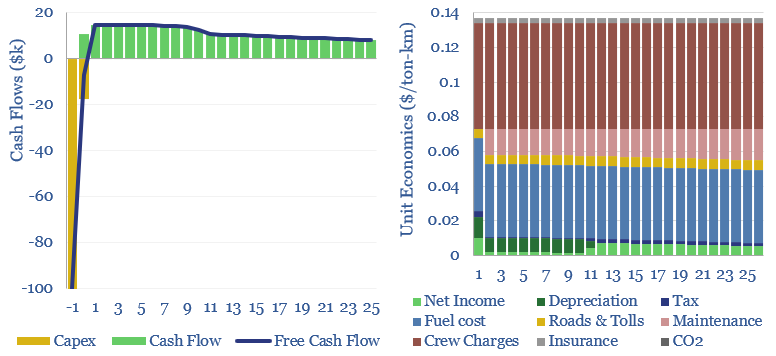

Heavy truck costs: diesel, gas, electric or hydrogen?

Heavy truck costs are estimated at $0.14 per ton-kilometer, for a truck typically carrying 15 tons of load and traversing over 150,000 miles per annum. Today these trucks consume 10Mbpd of diesel and their costs absorb 4% of post-tax incomes. Electric trucks would be 20-50% most costly, and hydrogen trucks would be 45-75% more, which…

-

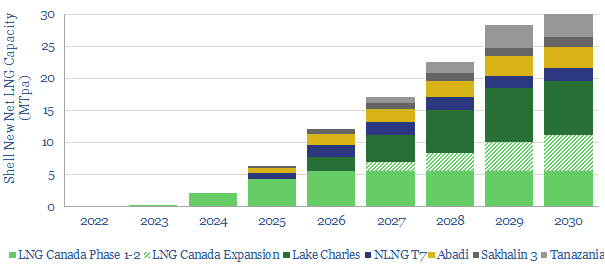

Shell: the future of LNG plants?

Shell is revolutionizing LNG project design, based on reviewing 40 of the company’s gas-focused patents from 2019. The innovations can lower LNG facilities’ capex by 70% and opex by 50%; conferring a $4bn NPV and 4% IRR advantage over industry standard greenfields. Smaller-scale LNG, modular LNG and highly digitized facilities are particularly abetted. This note…

-

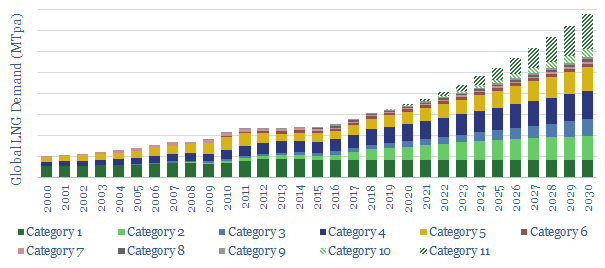

Long-Term LNG Demand: technology-led?

This is a simple model of long-term LNG demand, extrapolating out sensible estimates for the world’s leading LNG-consumers. On top of this, we overlay the upside from two nascent technology areas, which could add 200MTpa of potential upside to the market. Backup workings are included.

-

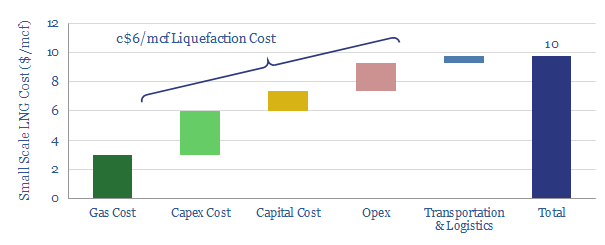

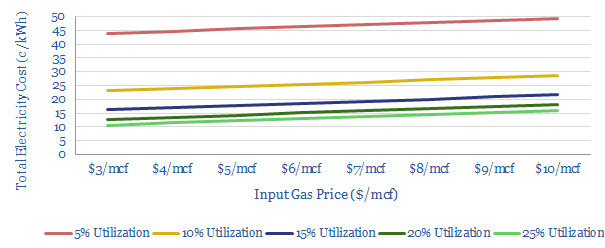

Small-Scale LNG liquefaction Costs: New Opportunities?

Small-scale LNG technologies can be economic at $10/mcf, generating 15% pre-tax IRRs, off $3/mcf input gas. This data-file tabulates the line-by-line costs of typical small-scale LNG technologies (SMRs, N2 expansion). Against this baseline, we model a more cutting-edge technology, which preserves strong economics at c25x smaller scale.

-

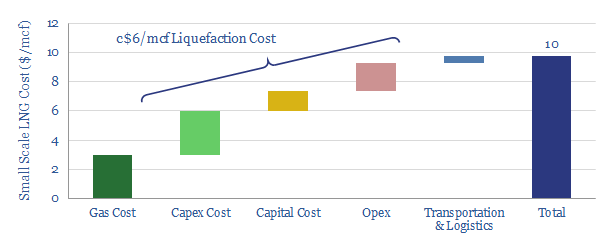

LNG in transport: scaling up by scaling down?

Next-generation technology in small-scale LNG has potential to reshape the global shipping-fuels industry. Especially after IMO 2020 sulphur regulations, LNG should compete with diesel. This note outlines the technologies, economics and opportunities for LNG as a transport fuel.

-

LNG as a Shipping Fuel: the Economics

This data-file provides line-by-line cost estimates for LNG as a shipping fuel, for trucked LNG, small-scale LNG and bunkered LNG. After IMO 2020 regulations buoy diesel pricing, it should be economical to fuel newbuild ships with small-scale LNG; and in the US it should be economical to convert pre-existing ships to LNG.

-

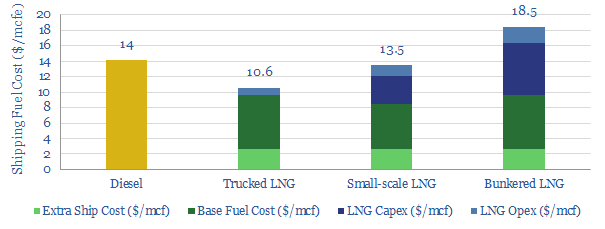

Fast-charge the electric vehicles with gas?

There is upside for natural gas, as EV penetration rises: we model that gas turbines can economically power fast-chargers for 13c/kWh. Carbon emissions are lowered by c70% compared with oil. And the grid is spared from power demand surges. Download our data-file to stress-test the sensitivities.

-

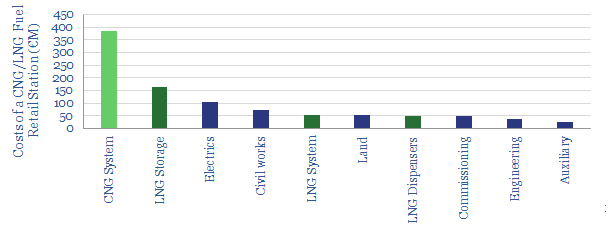

Costs of an LNG fuelling station

We have tabulated the costs of constructing an LNG-fuelling station across 55 cost lines, totalling €1M/site. c$10/mcf may be added to the cost of gas as a fuel.

-

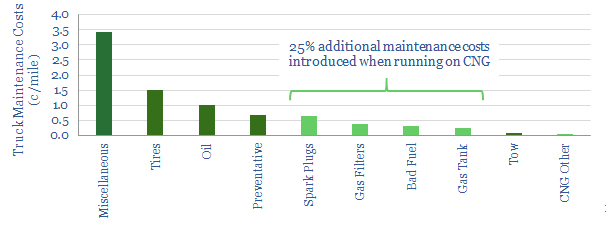

Maintenance costs for gas-powered trucks?

Maintenance costs are tabulated by category, for a fleet of compressed natural gas (CNG) trucks, travelling 16M miles across the United States.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (822)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (200)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (275)

- LNG (48)

- Materials (81)

- Metals (74)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (124)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (347)