-

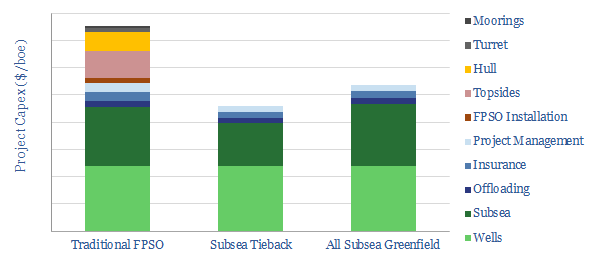

Floating production systems versus subsea tiebacks: the costs?

This model estimates the line-by-line costs of an FPSO project, across c45 distinct cost lines (in $M and $/boe). We estimate c$750M of cost savings for a tieback, and c$500M of cost savings for a fully subsea development, as compared against a traditional project with a traditional production facility.

-

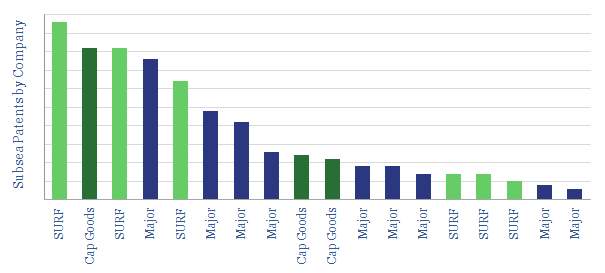

Subsea Services: Patent Leaders?

This data-file captures all the subsea patents from ten of the largest service providers. Priorities have shifted since the oil downturn. The data show who is most innovative and who is best placed, by category. Clear leadership is seen in subsea pumps, wellheads, or umbilicals. Other areas are more competitive.

-

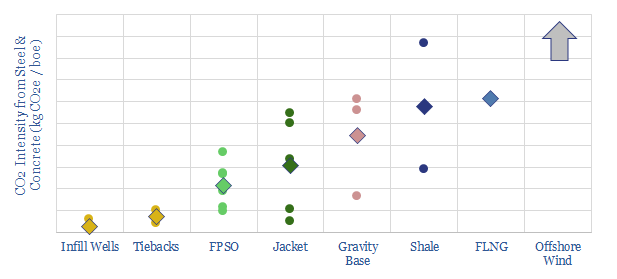

Development Concepts: how much CO2?

We tabulate c25 oil projects, breaking down the total tons of steel and concrete used in their topsides, jackets, hulls, wells, SURF and pipelines. Infill wells, tiebacks and FPSOs make the most CO2-efficient use of construction materials per barrel of production, helping to minimise emissions. Fixed leg platforms are higher CO2, then gravity based structures, then…

-

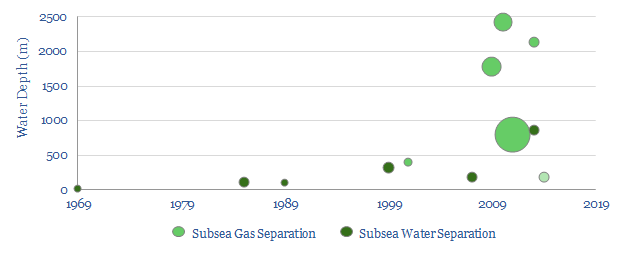

Subsea Separation: the elusive history

This database covers all 14 subsea separation projects across the history of the oil industry, going back to the “dawn of subsea” in 1969. The technology has been elusive, with just a handful of applications, the largest of which is 2.3MW. This could change, with the pre-salt partners pioneering an unprecedented 6MW facility at Mero.

-

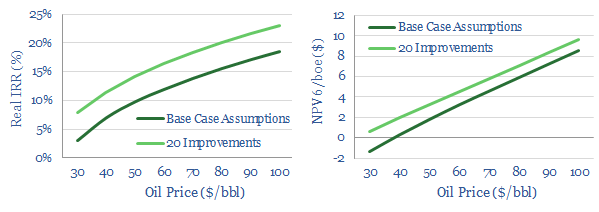

Can technology revive offshore oil?

Can technology revive offshore and deep-water? This note outlines our ‘top twenty’ opportunities. They can double deep-water NPVs, add c4-5% to IRRs and improve oil price break-evens by $15-20/bbl.

-

Offshore Economics: the Impact of Technology

This data-file quantifies the impact that technology can have on offshore economics. A typical offshore oilfield is modelled across 250 lines. The project is then re-modelled capturing our “top twenty” offshore technologies, to quantify the potential improvement: a doubling of NPV6, and a c4-5% improvement in IRR.

-

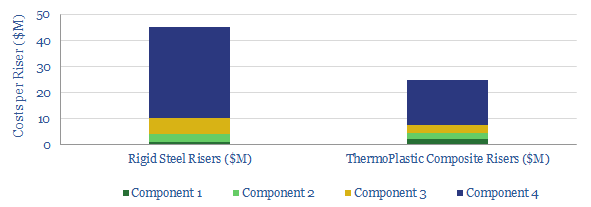

Thermo-Plastic Composite: The Future of Risers?

We estimate thermo-plastic composite riser costs line-by-line. Savings should reach 45%. The file also includes a complete history of TCP installations to-date, as this technology’s adoption continues.

Content by Category

- Batteries (85)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (88)

- Data Models (808)

- Decarbonization (158)

- Demand (106)

- Digital (52)

- Downstream (44)

- Economic Model (196)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (270)

- LNG (48)

- Materials (79)

- Metals (70)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (119)

- Renewables (149)

- Screen (110)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (342)