-

Electric trucks: what battery sizes?

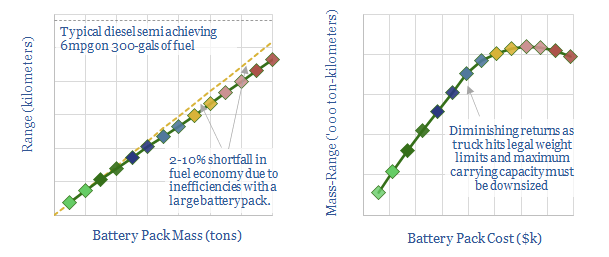

An electric truck would need a 15 ton battery to match the c2,500-mile range of a diesel truck. However, larger batteries above c8-tons detract 10% from fuel economy and may cause trucks to exceed regulatory weight limits, lowering their payload capacities. 4-6 ton batteries with 700-1,000km ranges are optimal.

-

Proton exchange membrane fuel cells: what challenges?

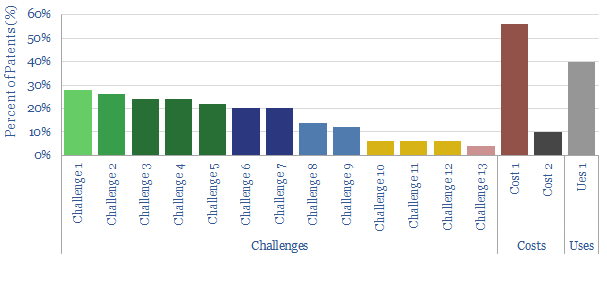

This data-file reviews fifty patents into proton exchange membrane fuel cells, filed by leading companies in the space in 2020, in order to understand the key challenges the industry is striving to overcome. The key focus areas are controlling temperature, humidity and longevity, but unfortunately this will tend to increase costs.

-

Heavy truck costs: diesel, gas, electric or hydrogen?

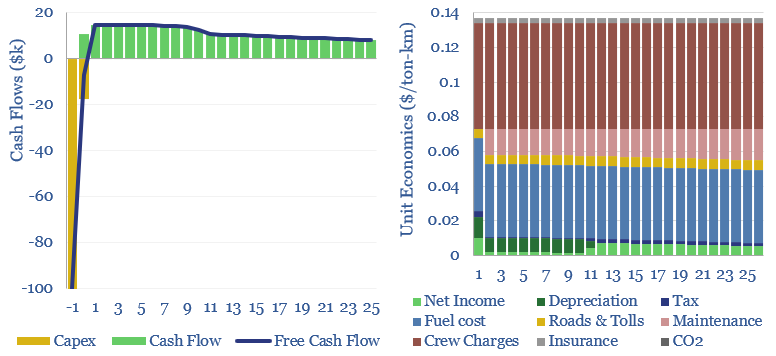

Heavy truck costs are estimated at $0.14 per ton-kilometer, for a truck typically carrying 15 tons of load and traversing over 150,000 miles per annum. Today these trucks consume 10Mbpd of diesel and their costs absorb 4% of post-tax incomes. Electric trucks would be 20-50% most costly, and hydrogen trucks would be 45-75% more, which…

-

Container ships versus trucks and trains

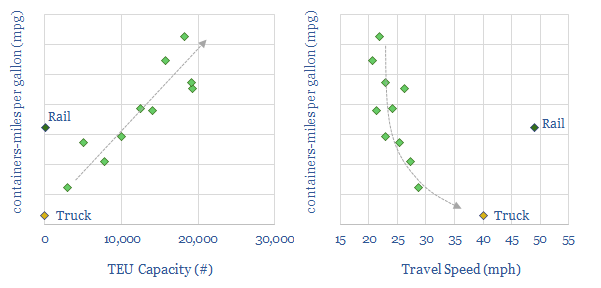

This data-file tabulates the impressive fuel economy of container vessels, as a function of their size and speed. The best examples are 2x more efficient than typical trains and 20x more efficient than typical trucks. Hence, even as the OECD consumes 4kg per person per day of goods shipped from overseas, these container ships account for c0.25%…

-

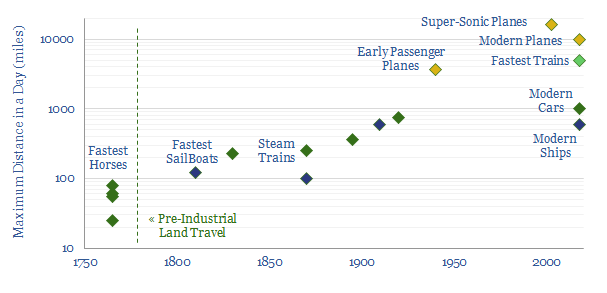

A Short History of Travel Speeds

Top travel speeds have increased c100x since pre-industrial times, however in the past 20-years, the trend has reversed. Average mobility is down c6-7% since 2000. This data-file contains our notes and the data-points we have compiled on travel-times throughout history.

-

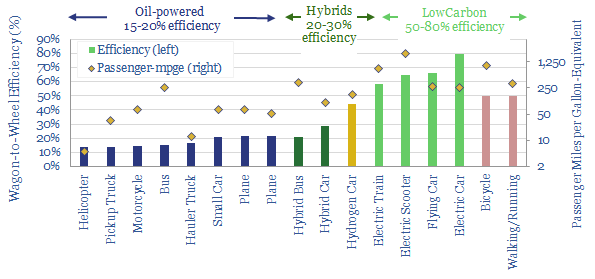

Vehicles: fuel economy and energy efficiency?

We have quantified the energy efficiency of 14 different transportation technologies, using real-world data and mechanics equations. Electrification raises auto efficiency 4x, from c15-20% to c60-80%. Novel electric technologies are also unlocking unprecedented fuel economies per passenger mile.

-

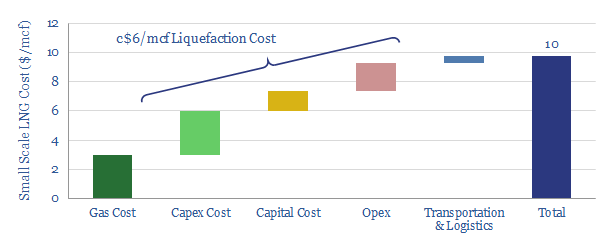

LNG in transport: scaling up by scaling down?

Next-generation technology in small-scale LNG has potential to reshape the global shipping-fuels industry. Especially after IMO 2020 sulphur regulations, LNG should compete with diesel. This note outlines the technologies, economics and opportunities for LNG as a transport fuel.

-

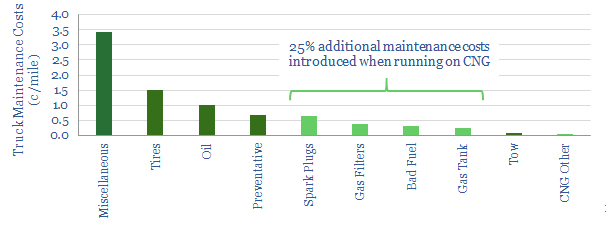

Maintenance costs for gas-powered trucks?

Maintenance costs are tabulated by category, for a fleet of compressed natural gas (CNG) trucks, travelling 16M miles across the United States.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (822)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (200)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (275)

- LNG (48)

- Materials (81)

- Metals (74)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (124)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (347)