Large LNG projects make large headlines. But we are excited by the ascent of smaller-scale LNG. At <1MTpa each, these facilities can be harder to track, which is the objective of this data-file.

There is currently c13MTpa of small-scale LNG liquefaction capacity online, across 70 facilities, of which c50 are in China and c10 in the US. A further c12MTpa pipeline is in progress, for a 100% increase.

We estimate small-scale LNG supplied c0.2MTpa of shipping fuel in 2017, compared to c260MT of total liquid shipping fuels. Dedicated LNG shipping fuels capacity should rise 20x, to 4MTpa by the end of 2021; and total shipping fuels could reach 40MTpa by 2040.

Exciting projects are currently ramping up: in Russia, Novatek’s Vyotsk (1.1MTpa) and Gazprom’s Portovaya are both devoted to Baltic shipping fuels (1.5MTpa) and sourced from the same input gas as Nord Stream; followed in the US Gulf, by Florida’s Eagle LNG (0.9MTpa) and in Louisiana.

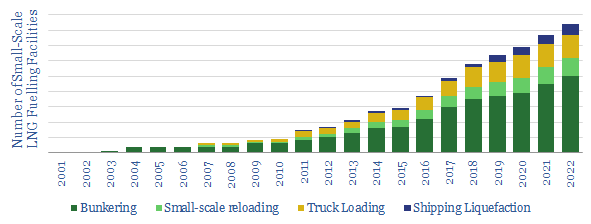

Small-scale LNG growth is particularly exciting around European markets, where by 2022 there will be 5x more port-side facilities than a decade prior.

For all the underlying data, please download this data-file. For our research on this theme, please see the note, ‘LNG in transport: scaling up by scaling down’.