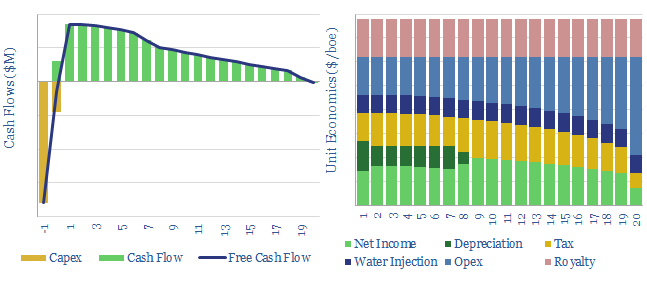

This model captures the energy economics of a conventional waterflooding project in the oil industry, in order to maintain reservoir pressure and productivity at maturing oilfields.

Our base case calculations suggest strong economics, with 30% IRRs at $40/bbl oil on a project costing $2.5/boe in capex and $1/bbl of incremental opex.

Please download the data-file to stress-test parameters such as commodity prices, water injection rates, reservoir pressure, electricity prices and other economic assumptions.