Shale EOR: the economics

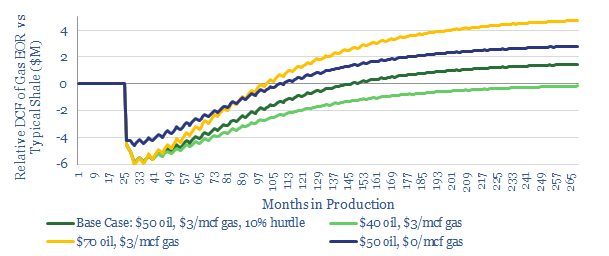

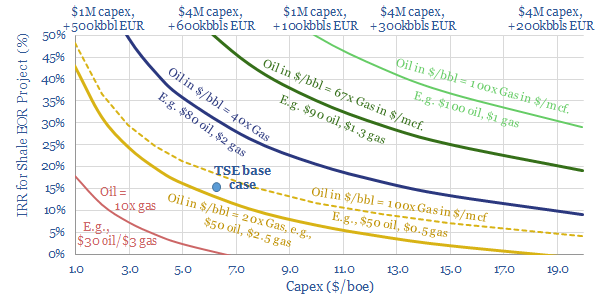

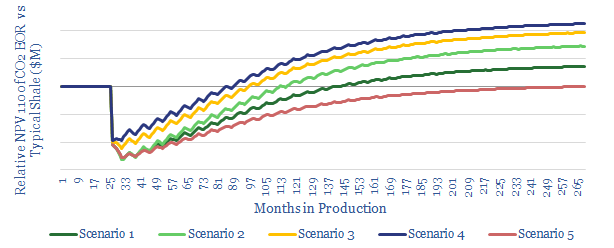

This model assesses the economics of a shale-EOR huff’n’puff project. NPVs and IRRs can be stress-tested as a function of oil prices, gas prices, production-profiles, EUR uplifts and capex costs….

This model assesses the economics of a shale-EOR huff’n’puff project. NPVs and IRRs can be stress-tested as a function of oil prices, gas prices, production-profiles, EUR uplifts and capex costs….

Is Shale-EOR the next wave of unconventional upside? The topic jumped into the ‘Top 10’ most researched shale themes last year. Stranded in-basin gas will improve the economics. Production per…

Will Shale-EOR add another leg of unconventional upside? The topic jumped into the ‘Top 10’ most researched shale themes last year, hence we have reviewed the opportunity in depth. Stranded…

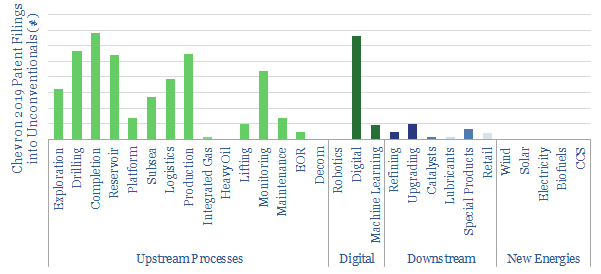

SuperMajors’ shale developments are assumed to differ from E&Ps’ mainly in their scale and access to capital. Access to superior technologies is rarely discussed. But new evidence is emerging. This…

We have modelled the economics of CO2-EOR in shale, after interest in this topic spiked 2.3x YoY in the 2019 technical literature. Our deep-dive research into the topic is linked…

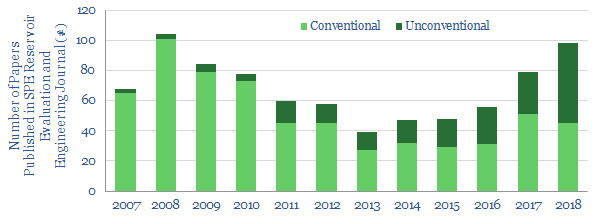

This data-file estimates the number of SPE papers that have been published about conventional and unconventional reservoir engineering in the SPE Reservoir Evaluation and Engineering Technical journal, each year since…

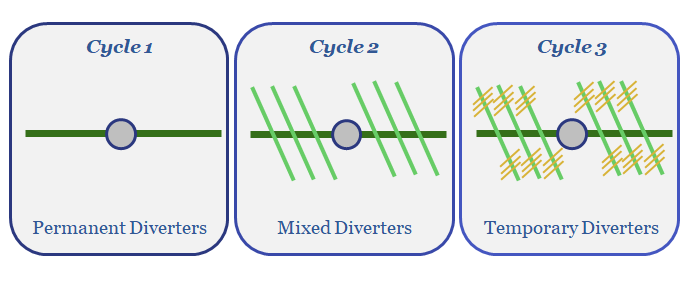

The key challenge for the US shale industry is to continue improving productivity per well, as illustrated repeatedly in our research. Hence, this short note reviews an advance in fracturing…