Search results for: “LNG”

-

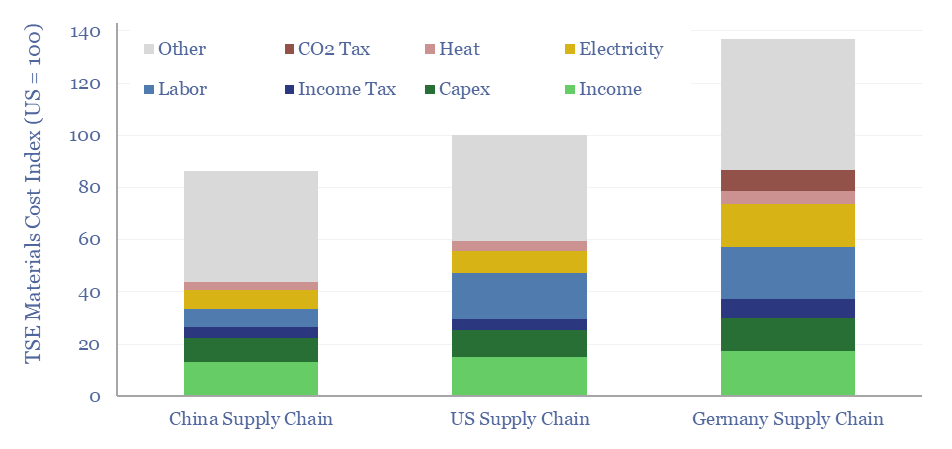

Material and manufacturing costs by region: China vs US vs Europe?

Material and manufacturing costs by region are compared in this data-file for China vs the US vs Europe. Generally, compared with the US, materials costs are 10% lower in China, and 40% higher in Germany, although it depends upon the specific value chain. A dozen different examples are contrasted in this data-file, especially for solar…

-

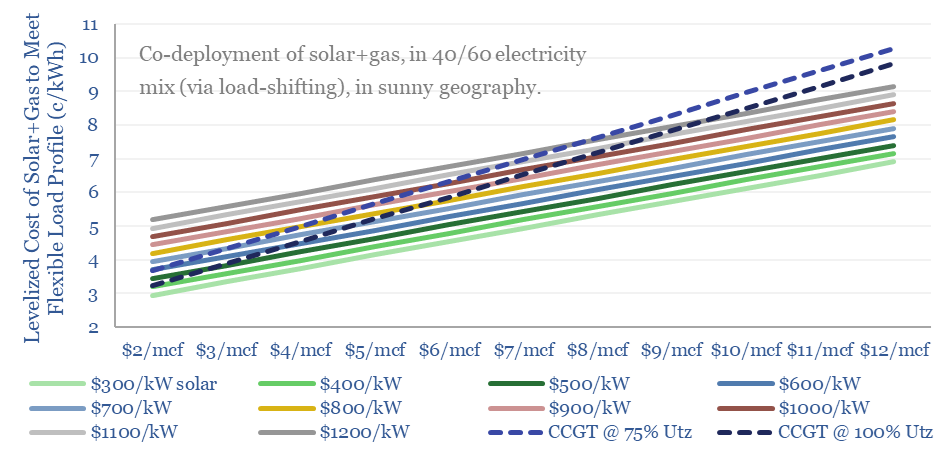

Load bearing: will solar+gas be cheaper than gas alone?

The costs to power a real-world load – e.g., a data center – with solar+gas will very often be more expensive than via a standalone gas CCGT in the US today. But not internationally? Or in the future? This 9-page note shows how solar deflation and load shifting can boost solar to >40% of future…

-

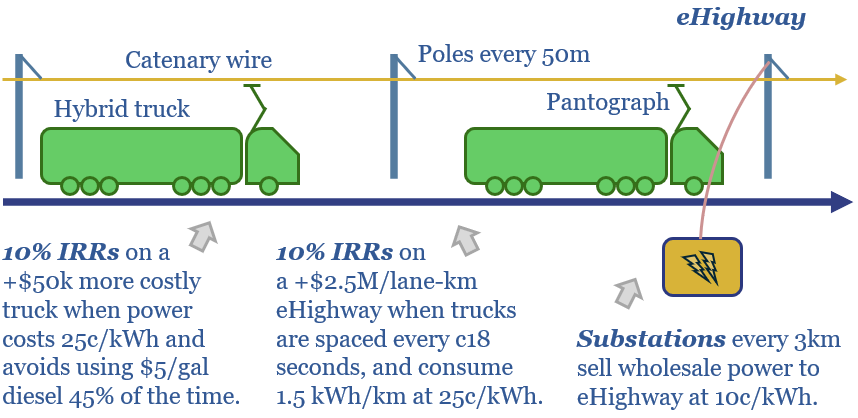

eHighways: trucking by wire?

eHighways electrify heavy trucks via overhead catenary wires. They have been de-risked by half-a-dozen real-world pilots. High-utilization routes can support 10% IRRs on both road infrastructure and hybrid trucks. This 15-page report finds benefits in logistics networks and for integrating renewables?

-

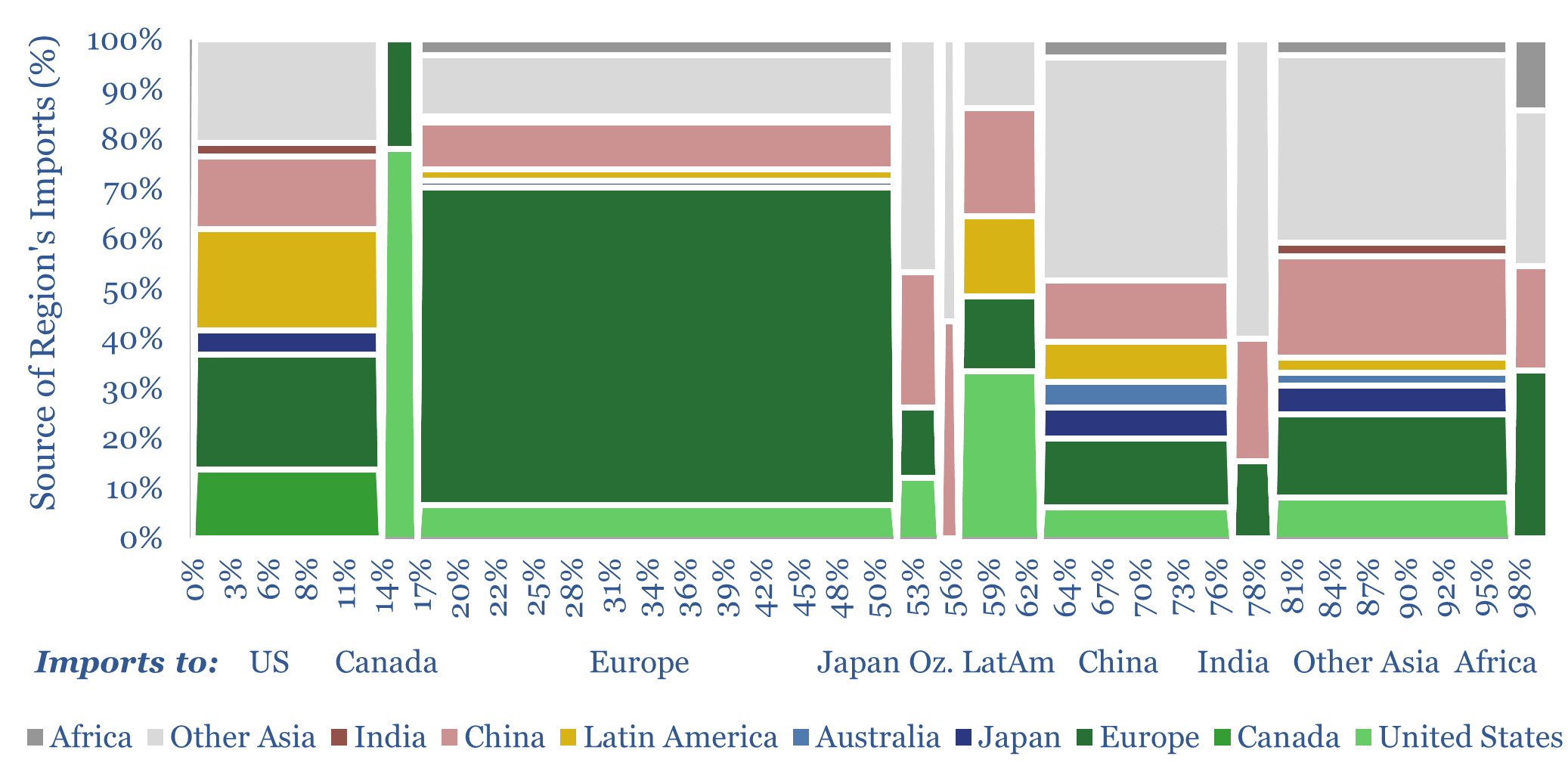

Global trade: imports and exports, by product, by region?

Global trade is set to hit a new peak of $33trn in 2024 (30% of global GDP), of which 70-80% is for goods and 20-30% is for services. This data-file disaggregates global trade by product by region, across c20 categories of energy, materials and capital goods, which we follow in our research, and which are…

-

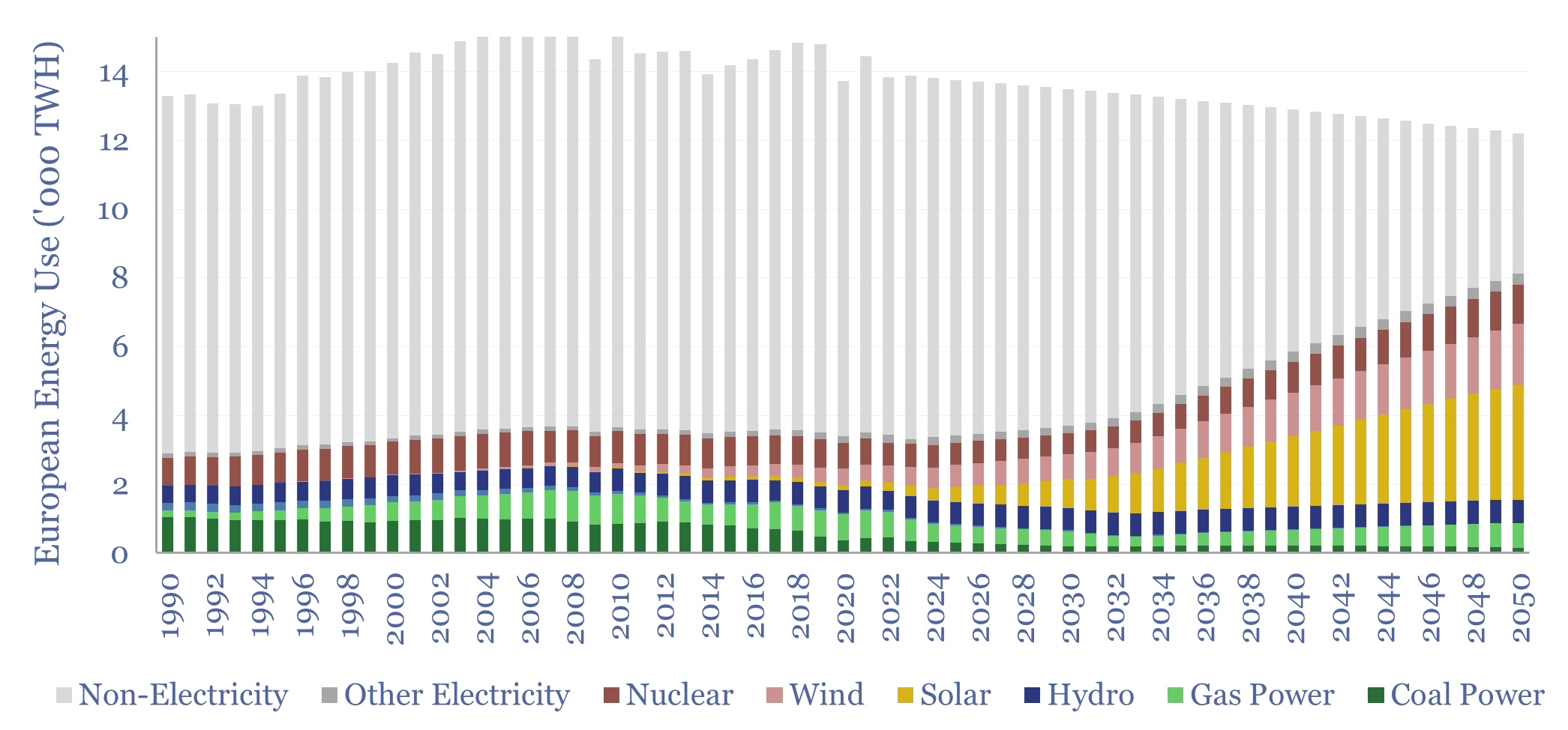

European energy: the burial of the dead?

Europe’s energy ambitions are now intractable: It is just not feasible to satisfy former climate goals, new geopolitical realities, and also power future AI data centers. Hence this 18-page report evaluates Europe’s energy options; predicts how policies are going to change; and re-forecasts Europe’s gas and power balances, both to 2030 and to 2050.

-

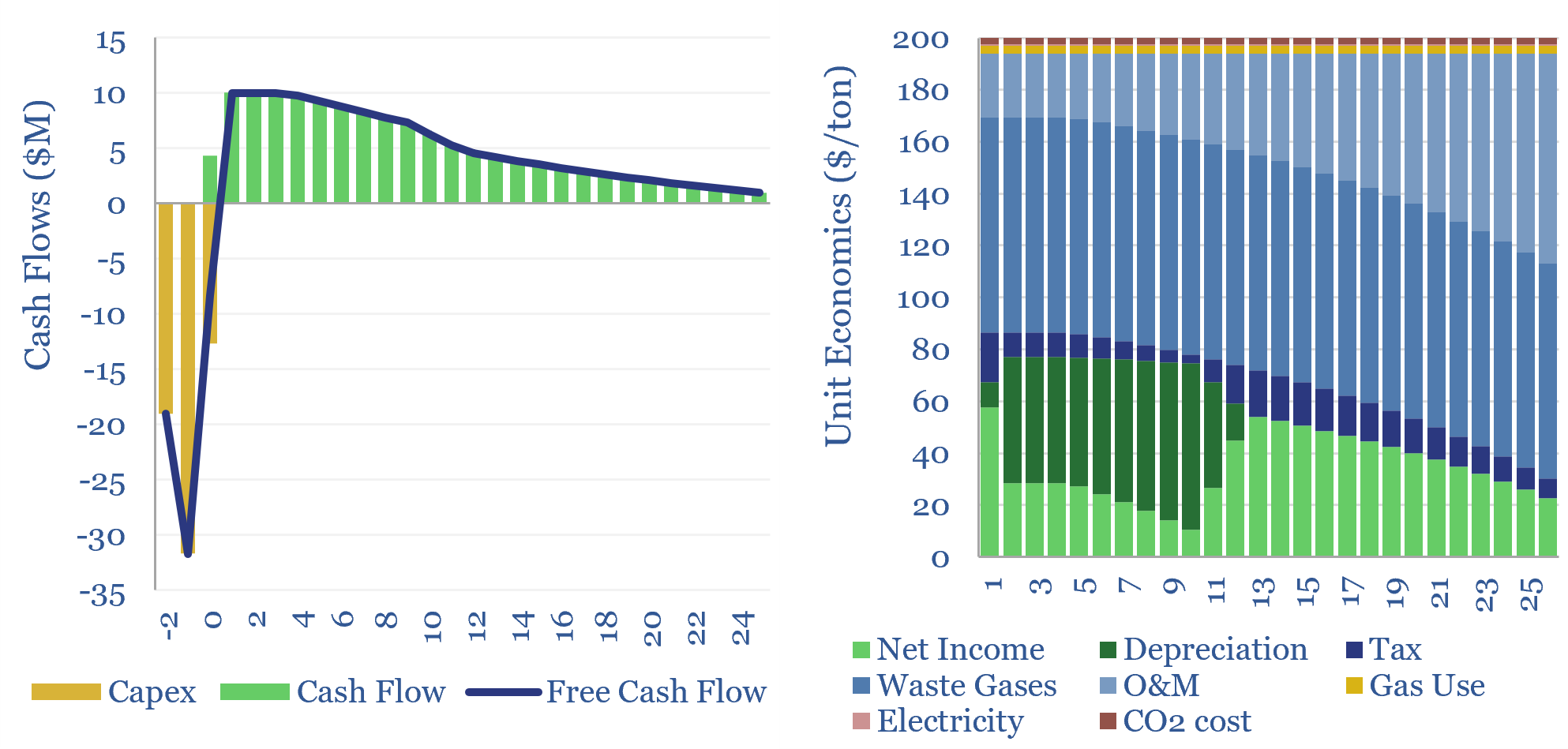

Helium production: the economics?

This economic model captures the production costs of helium, which is cryogenically extracted from low concentrations in natural gas. $200/mcf helium prices can support 10% IRRs on a resource with 2% helium content. $400-1,000/mcf spot prices can unlock 50-100% IRRs and trigger a capex boom. Economics can be stress-tested in this data-file.

-

Why the Thunder Said?

This 8-page report outlines the ‘four goals’ of Thunder Said Energy; and how we hope we can help your process…

-

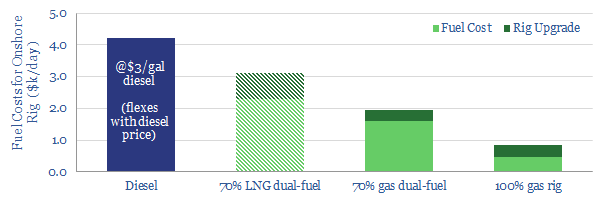

Should a shale rig switch to gas-fuel?

Should a shale rig switch to gas-fuel? We estimate that a dual-fuel shale rig, running on in-basin natural gas would save $2,300/day (or c$30k/well), compared to a typical diesel rig. This is after a >20% IRR on the rig’s upgrade costs. The economics make sense. However, converting the entire Permian rig count to run on…

-

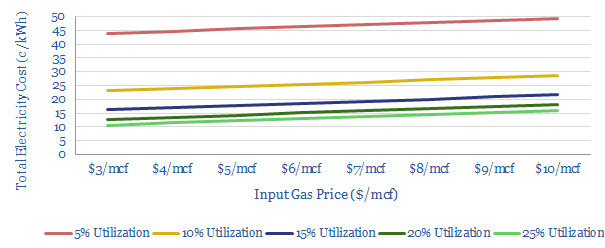

Fast-charge the electric vehicles with gas?

There is upside for natural gas, as EV penetration rises: we model that gas turbines can economically power fast-chargers for 13c/kWh. Carbon emissions are lowered by c70% compared with oil. And the grid is spared from power demand surges. Download our data-file to stress-test the sensitivities.

-

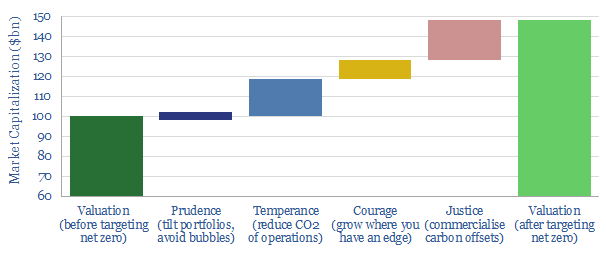

Net zero Oil Majors: four cardinal virtues?

Attaining ‘Net Zero’ can uplift an Energy Major’s valuation by c50%. This means emitting no net CO2, either from the company’s operations or from the use of its products. This 19-page report shows how a Major can best achieve ‘net zero’ by exhibiting four cardinal virtues. Decarbonization is not a threat but an opportunity.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (839)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)