Search results for: “shale”

-

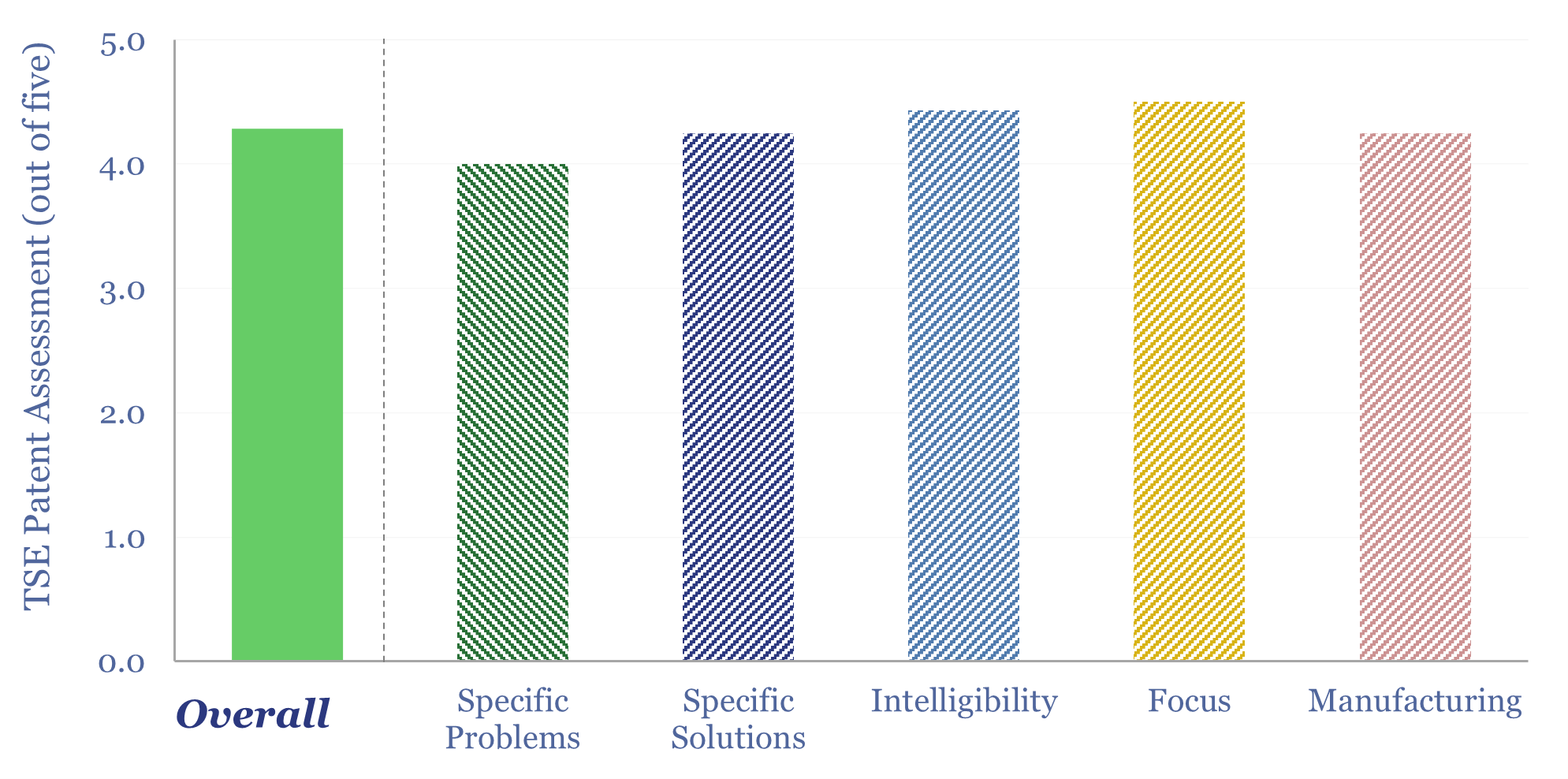

VoltaGrid: mobile micro-grid technology?

VoltaGrid has become the largest provider of mobile, natural gas reciprocating engines in the US, reaching GW-scale in 2025, in order to rapidly energize data centers, e-frac operations in shale, and other micro-grids in mining and industry amidst power grid bottlenecks. This data-file reviewed VoltaGrid’s mobile micro-grid technology and patents.

-

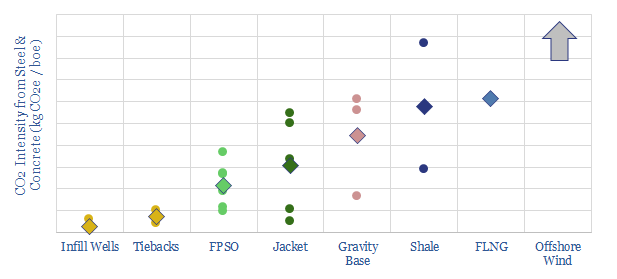

Development Concepts: how much CO2?

We tabulate c25 oil projects, breaking down the total tons of steel and concrete used in their topsides, jackets, hulls, wells, SURF and pipelines. Infill wells, tiebacks and FPSOs make the most CO2-efficient use of construction materials per barrel of production, helping to minimise emissions. Fixed leg platforms are higher CO2, then gravity based structures, then…

-

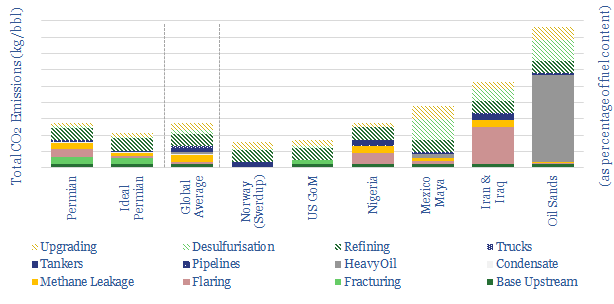

Oil industry CO2 per barrel?

We have constructed a simple model to estimate full-cycle CO2 emissions of an oil resource, as a function of its flaring, methane leakage, gravity, sulphur content, production processes and transportation to market. A c10x energy return on energy investment is estimated. Relative advantages are seen for well-managed resources offshore and in shale; relative disadvantages are…

-

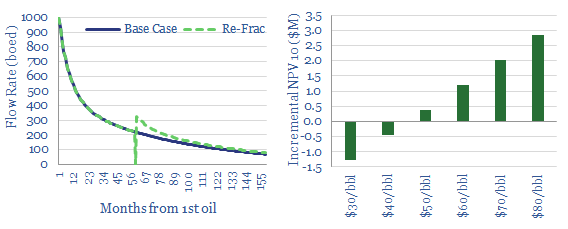

Re-Frac Economics. How much uplift?

Re-fracturing Permian and Eagle Ford shale wells holds potential at higher oil prices. Our base case assumes $0.5M NPV/well uplifts, and $45/bbl breakevens. Higher prices and process-enhancements can unlock $2-3M of NPV10/well. Oxy and Devon lead the technical literature.

-

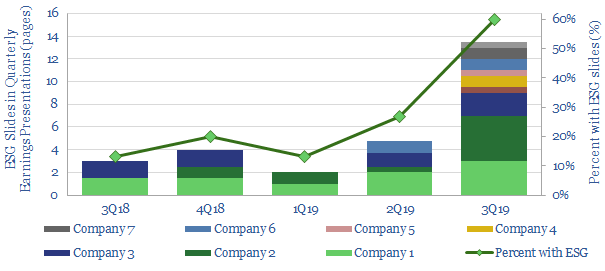

US E&Ps turn to ESG?

Of the largest 15 shale E&Ps, the proportion with ESG slides in their quarterly presentations has exploded by 4.5x in the trailing twelve months, from 13% in 3Q18 to 60% in 3Q19. The progress is tracked in this short data-file.

-

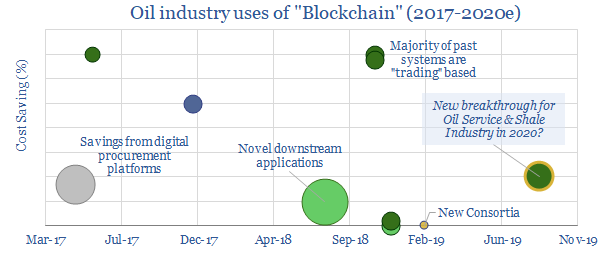

Blockchain in the Oil & Gas Supply Chain

This datafile tabulates ten examples of deploying Blockchain in the oil and gas industry since 2017; including companies and cost savings. Most prior examples are in trading. For 2020, we are particularly excited by the broadening of Blockchain technologies into the procurement industry, which can deflate shale costs.

-

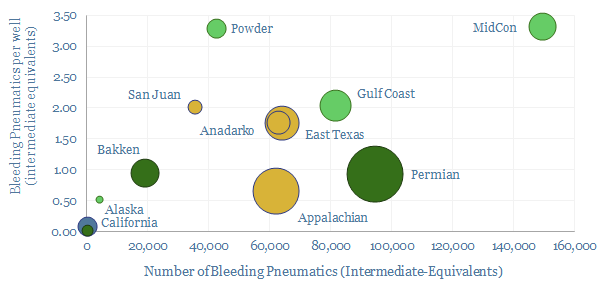

Methane emissions from pneumatic devices: by operator, by basin?

Methane leaks from 1M pneumatic devices across the US onshore oil and gas industry comprise 50% of all US upstream methane leaks and 20% of upstream CO2. This file aggregates the data. Rankings reveal operators with a pressing priority to replace >100,000 medium and high bleed devices, and other best-in-class companies.

-

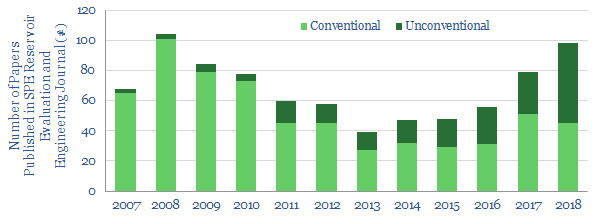

SPE Papers about Conventional vs Unconventional Reservoirs

This data-file estimates the number of SPE papers that have been published about conventional and unconventional reservoir engineering in the SPE Reservoir Evaluation and Engineering Technical journal, each year since 2007. 2018 was the first year where unconventional papers eclipsed conventional.

-

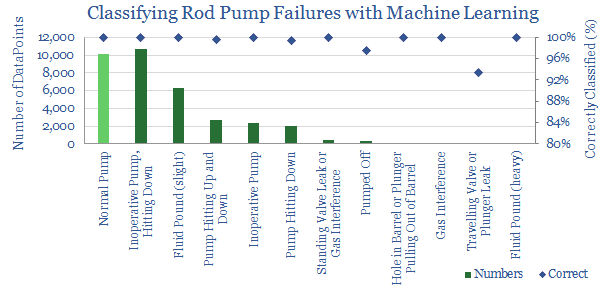

Machine Learning to Optimise Rod Pumps

This data-file summarises progress using machine learning to maximise production from mature wells, by detecting errors and optimising production. There is potential to lower global decline rates by c100kbpd per annum for over a decade, and increase each well’s NPV by $0.1M.

-

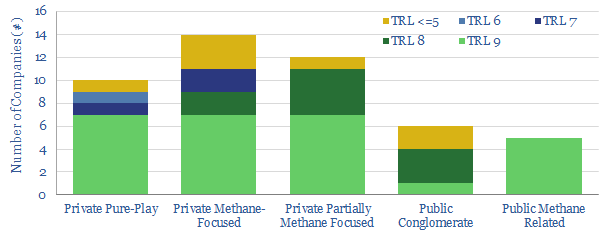

Screen of companies detecting methane leaks?

This data-file screens the methods available to monitor for methane emissions. Notes and metrics are tabulated. Emerging methods, such as drones and trucks are also scored, based on technical trials. The best drones can now detect almost all methane leaks >90% faster than traditional methods. c34 companies at the cutting edge are screened.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)