Search results for: “volatility volatile”

-

Grid volatility: are batteries finally in the money?

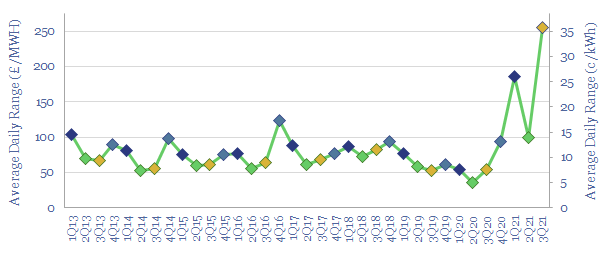

UK power price volatility has exploded in 2021. The average daily range has risen 4x from 2019-20, to 35c/kWh in 3Q21. At this level, grid-scale batteries are strongly ‘in the money’. So will the high volatility persist? This is the question in today’s 6-page note.

-

Prevailing wind: new opportunities in grid volatility?

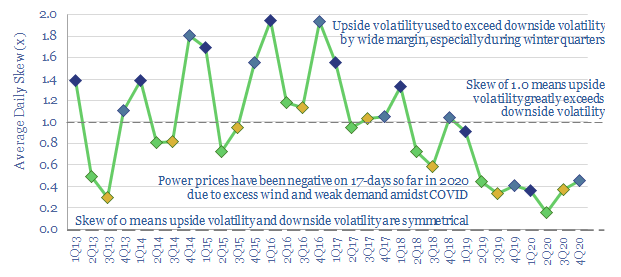

UK wind power has almost trebled since 2016. But its output is volatile, now varying between 0-50% of the total grid. Hence this 14-page note assesses the volatility, using granular, hour-by-hour data from 2020, to outline which backup opportunities are best-placed.

-

Smooth operators: who benefits from volatile power grids?

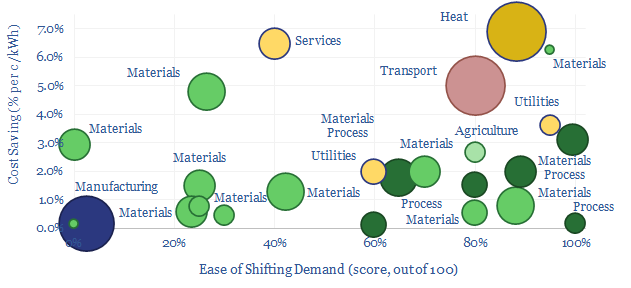

Some industries can absorb low-cost electricity when renewables are over-generating and avoid high-cost electricity when they are under-generating. The net result can lower electricity costs by 2-3c/kWh and uplift ROCEs by 5-15% in increasingly renewables-heavy grids. This 14-page note ranges over 10,000 demand shifting opportunities, to identify who can benefit most.

-

Energy market volatility: climate change?

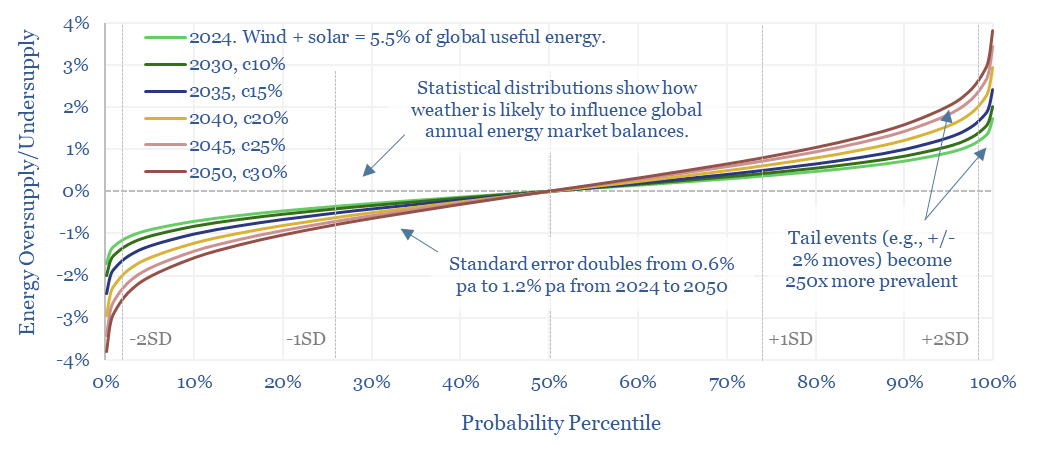

This 14-page note predicts a staggering increase in global energy market volatility, which doubles by 2050, while extreme events that sway energy balances by +/- 2% will become 250x more frequent. A key reason is that the annual output from wind, solar and hydro all vary by +/- 3-5% each year, while wind and solar…

-

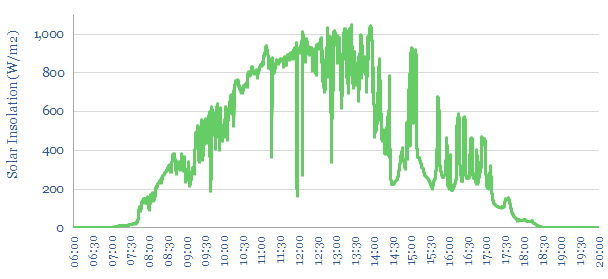

Solar volatility: tell me lies, tell me sweet little lies?

This 20-page note quantifies the statistical distribution of short-term volatility at solar power plants. Solar output typically flickers downwards by over 10%, around 100 times per day. Can industrial processes truly be ‘powered by solar’? What opportunities will arise to buffer the volatility?

-

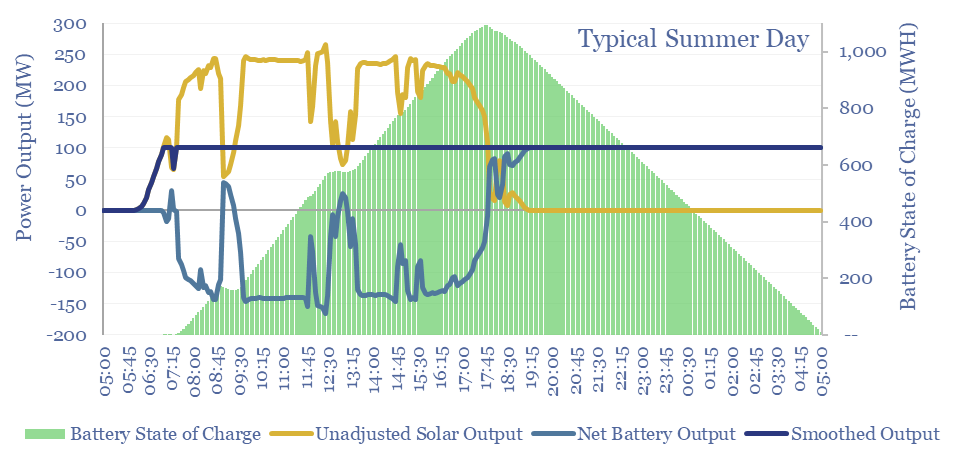

Solar+battery co-deployments: output profiles?

Solar+battery co-deployments allow a large and volatile solar asset to produce a moderate-sized and non-volatile power output, during 40-50% of all the hours throughout a calendar year. The smooth output is easier to integrate with power grids, including with a smaller grid connection. The battery will realistically cycle 100-300 times per year.

-

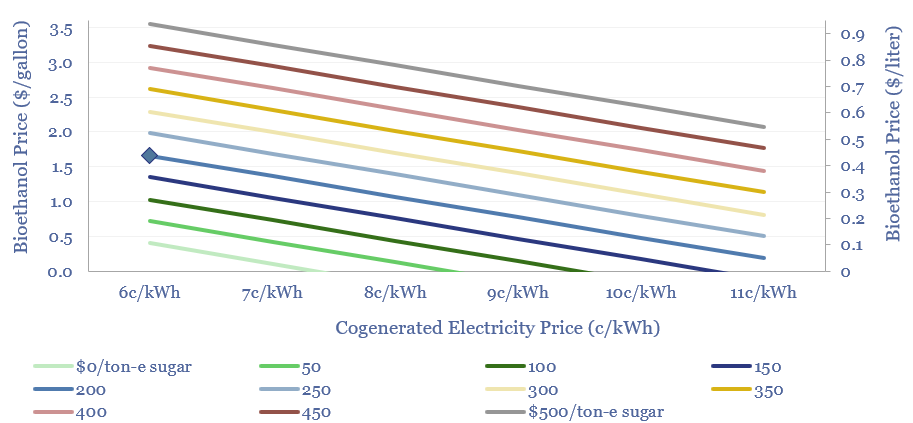

Sugar to ethanol: value in volatility?

Sugar cane is an amazing energy crop, yielding 70 tons per hectare per year, of which 10-15% is sugar and 20-25% is bagasse. Crushing facilities create value from sugar, sugar-to-ethanol and cogenerated power. This 11-page note argues that more volatile electricity prices could halve ethanol costs or raise cash margins by 2-4x.

-

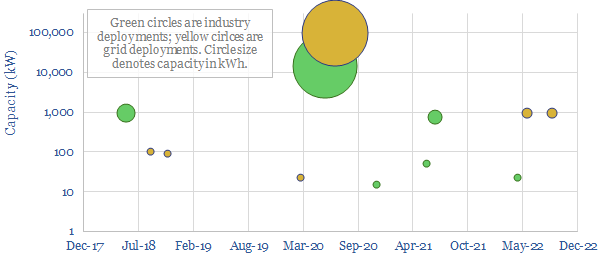

Supercapacitors: case studies for renewable-heavy grids?

Supercapacitors are well suited to smoothing short-term volatility in increasingly renewables-heavy grids. Typical systems are 10kW-10MW, 1M chage-discharge cycles, 5-30 seconds storage and $30/kW costs. Expect the market to surprise to the upside, especially in combination with other power-electronics. Who benefits?

-

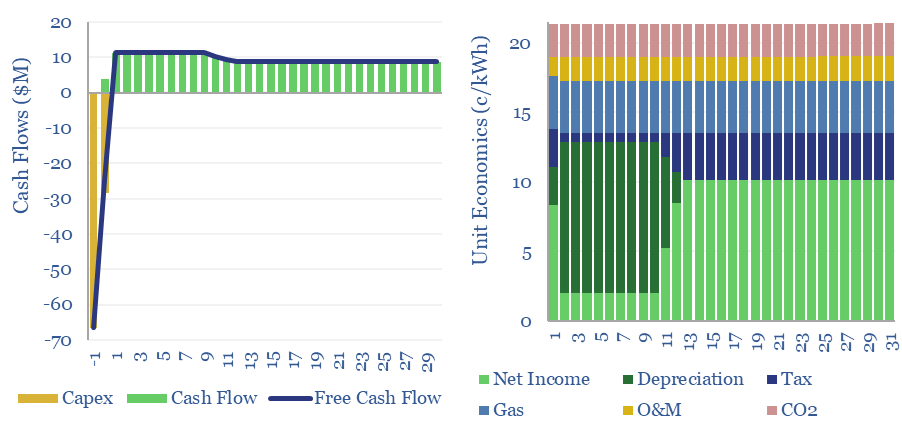

Gas peaker plants: the economics?

Gas peaker plants run at low utilizations of 2-20%, during times of peak demand in power grids. A typical peaker costing $950/kW and running at 10% utilization has a levelized cost of electricity around 20c/kWh, to generate a 10% IRR with 0.5 kg/kWh of CO2 intensity. This data-file shows the economic sensitivities to volatility and…

-

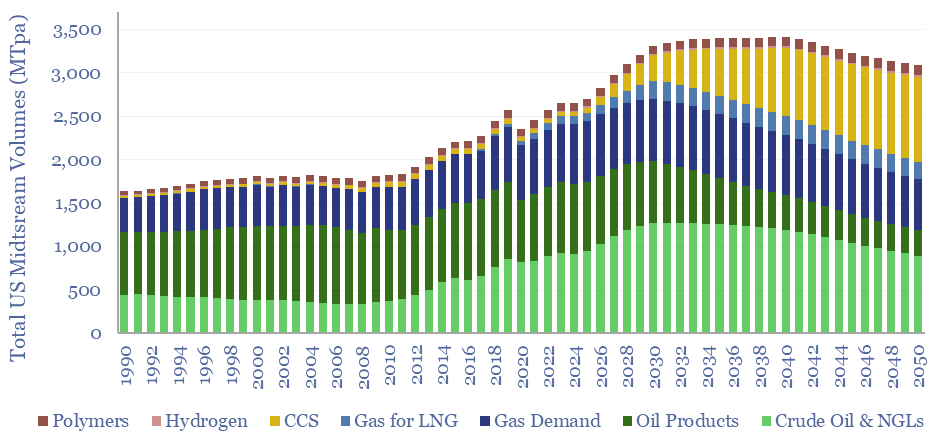

Midstream opportunities in the energy transition?

The midstream industry moves molecules, especially energy-molecules, and especially in pipelines. Despite the mega-trend of electrification, there are still strong midstream opportunities in the energy transition, backstopping volatility and moving new molecules. This short note captures our top ten conclusions. (1) Our overall outlook on the US midstream industry sees the total tonnage of molecules…

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (90)

- Data Models (816)

- Decarbonization (159)

- Demand (108)

- Digital (56)

- Downstream (44)

- Economic Model (197)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (273)

- LNG (48)

- Materials (79)

- Metals (71)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (345)