-

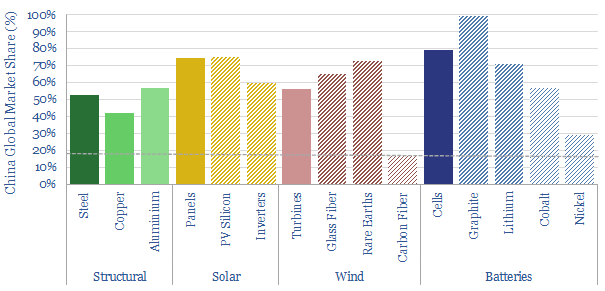

East to West: re-shoring the energy transition?

China is 18% of the world’s people and GDP. But it makes c50% of the world’s metals, 60% of its wind turbines, 70% of its solar panels and 80% of its lithium ion batteries. Re-shoring is likely to be a growing motivation after events of 2022. This 14-page note explores resultant opportunities.

-

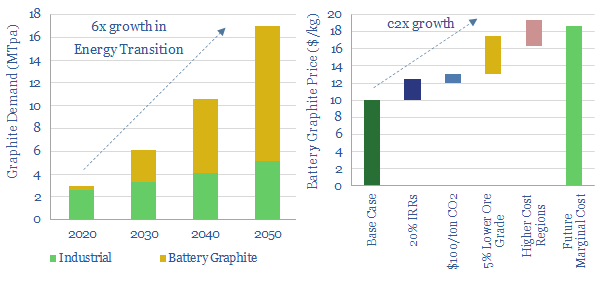

Graphite: upgrade to premium?

Global graphite volumes grow 6x in the energy transition, mostly driven by electric vehicles. We see the industry moving away from China’s near-exclusive control. The future favors a handful of Western producers, integrated from mine to anode, with CO2 intensity below 10kg/kg. This 10-page note outlines the opportunity.

-

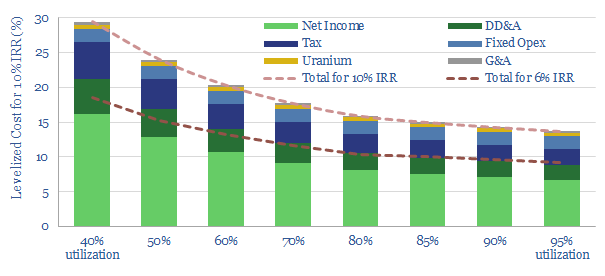

Back-stopping renewables: the nuclear option?

Nuclear power can backstop much volatility in renewables-heavy grids, for costs of 15-25c/kWh. This is at least 70% less costly than large batteries or green hydrogen, but could see less wind and solar developed overall. Our 13-page note reviews the opportunity.

-

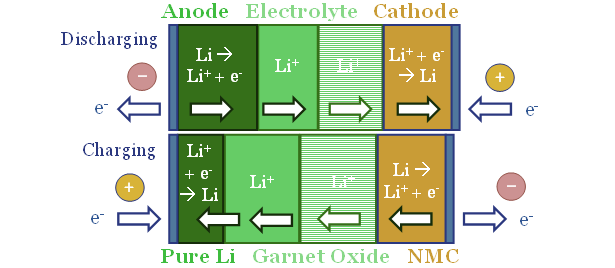

Solid state batteries: will they change the world?

Solid state batteries promise 2x higher energy density than lithium ion, with 3x faster charging and lower risk of fires. They could re-shape global energy, especially heavy trucks. But the industry has been marooned by uncontrollable cell degradation. QuantumScape’s disclosures claim it is light years ahead. But costs may remain high.

-

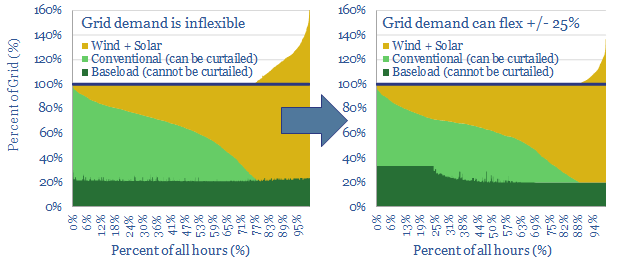

Shifting demand: can renewables reach 50% of grids?

25% of the power grid could realistically become ‘flexible’, shifting its demand across days, even weeks. This is the lowest cost and most thermodynamically efficient route to fit more wind and solar into power grids. We are upgrading our renewables ceilings from 40% to 50%. This 22-page note outlines the opportunity.

-

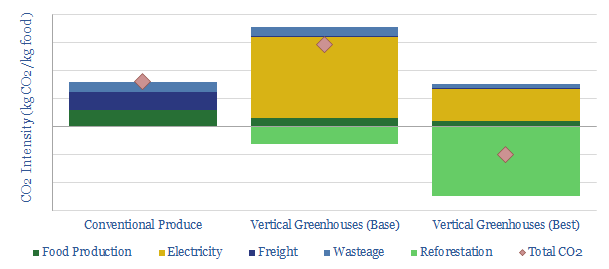

Vertical greenhouses: what future in the transition?

Vertical greenhouses achieve 10-400x greater yields per acre than field-growing, stacking layers of plants indoors, and illuminating each layer with LEDs. Economics are exciting. CO2 intensity varies. But it can be carbon-negative if powered by renewables. This 17-page case study outlines the opportunity.

-

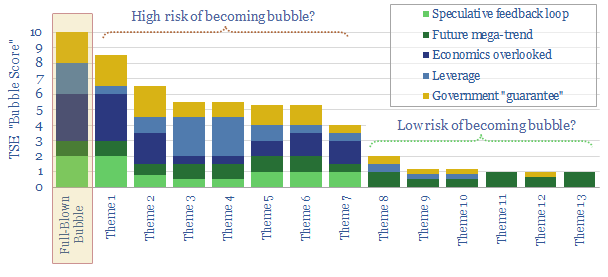

Energy transition: is it becoming a bubble?

Investment bubbles in history typically take 4-years to build and 2-years to burst, as asset prices rise c815% then collapse by 75%. There is now a frightening resemblance between energy transition technologies and prior investment bubbles. This 19-page note aims to pinpoint the risks and help you defray them.

-

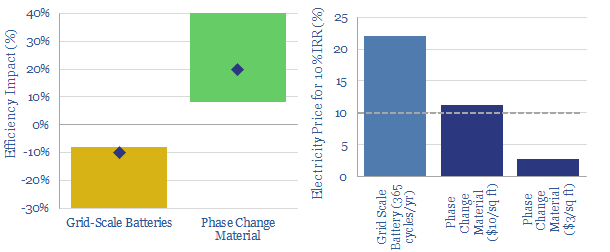

Backstopping renewables: cold storage beats battery storage?

Phase change materials could be a game-changer for energy storage. They can earn double digit IRRs unlocking c20% efficiency gains in freezers and refrigerators, which make up 9% of US electricity. This is superior to batteries which add costs and incur 8-30% efficiency losses. We review 5,800 patents and identify leading companies.

-

Ten Themes for Energy in the 2020s

We presented our ‘Top Ten Themes for Energy in the 2020s’ to an audience at Yale SOM, in February-2020. The audio recording is available below. The slides are available to TSE clients.

-

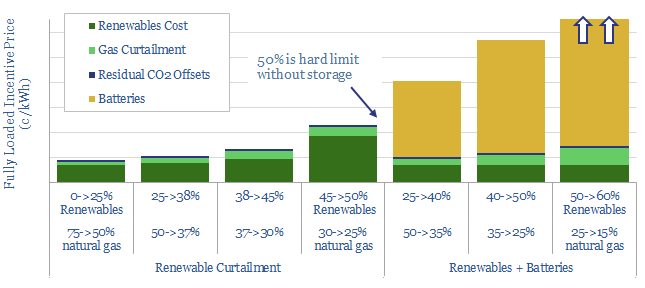

Decarbonized power: how much wind and solar fit the optimal grid?

What is the optimal mix of wind and solar in a low-cost, zero-carbon power grid? We find renewables cannot surpass 45-50% due to curtailment, which trebles prices. Batteries help little, under grid conditions. Decarbonized gas is the best backstop. A grid of 50% decarbonized gas, 25% renewables and 25% nuclear has the lowest incentive price,…

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (90)

- Data Models (816)

- Decarbonization (159)

- Demand (108)

- Digital (56)

- Downstream (44)

- Economic Model (197)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (273)

- LNG (48)

- Materials (79)

- Metals (71)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (345)