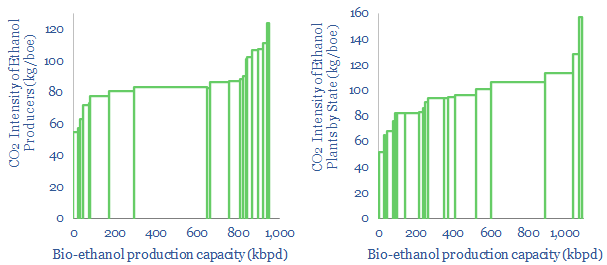

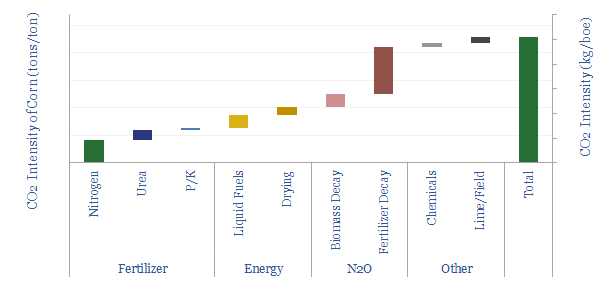

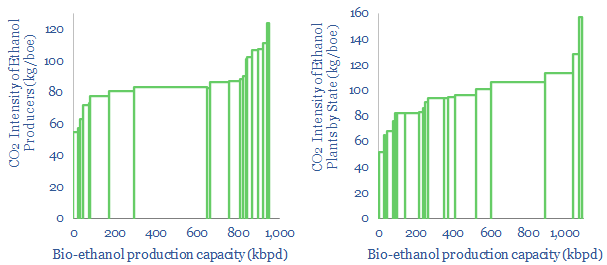

This data-file tabulates the CO2 emissions from US ethanol plants, which produce around 1Mbpd of liquid fuels, giving an average CO2 intensity of ethanol of 85kg/boe. $599.00 – Purchase Checkout Added to…

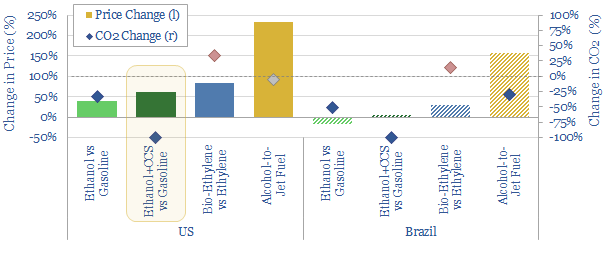

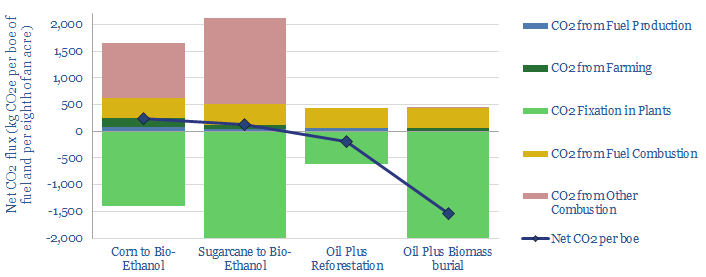

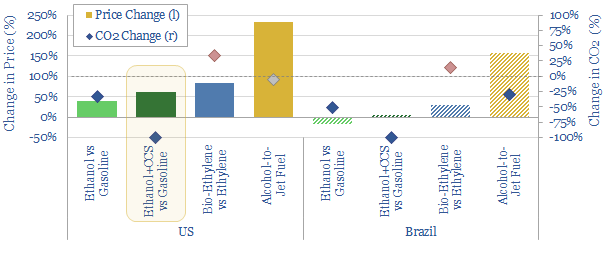

…our recent research. Hence how could new technologies fix the economics and carbon credentials of corn-based ethanol? Our constructive outlook on ethanol + CCS is presented on pages 4-6. Ethanol…

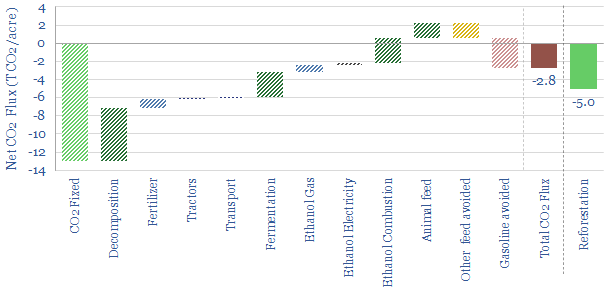

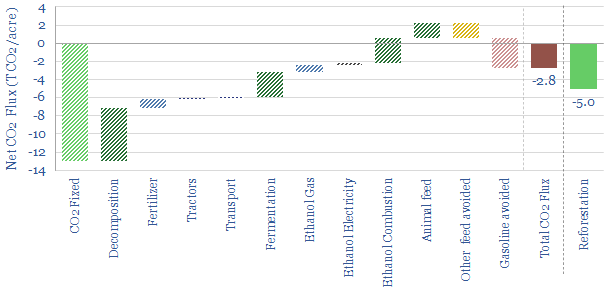

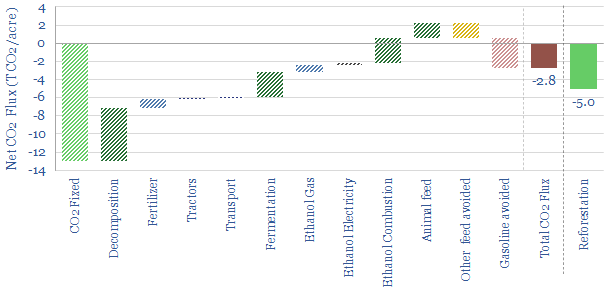

30M acres of US croplands are used to grow corn for ethanol. Each acre prevents 2-3 tons of CO2 emissions per annum, for a CO2 abatement cost of $200/ton. However,…

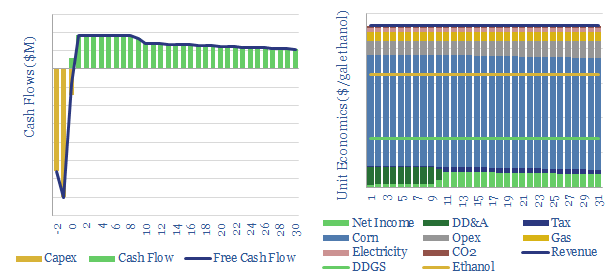

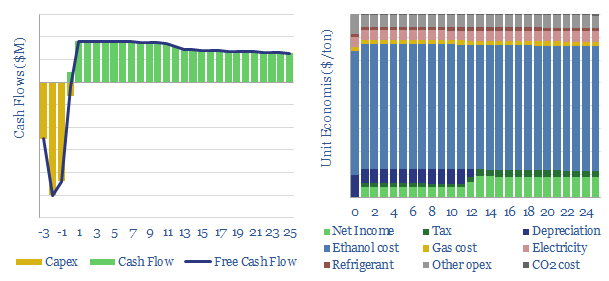

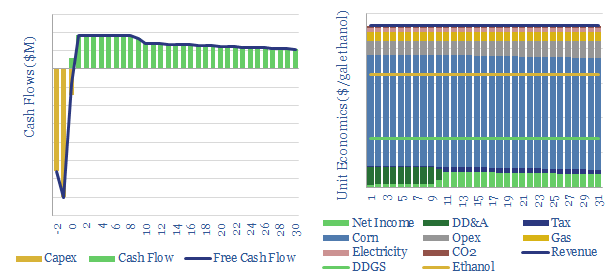

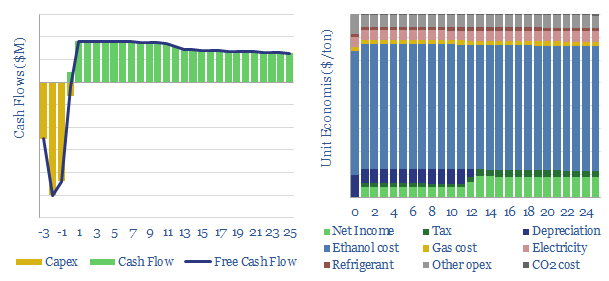

…suggest a price of $1.6/gallon of ethanol is needed for a 10% IRR on a new greenfield plant, equivalent to $2.4/gallon gasoline. This is higher than 2020 ethanol pricing, which…

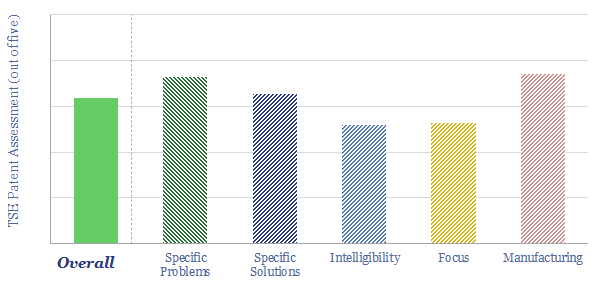

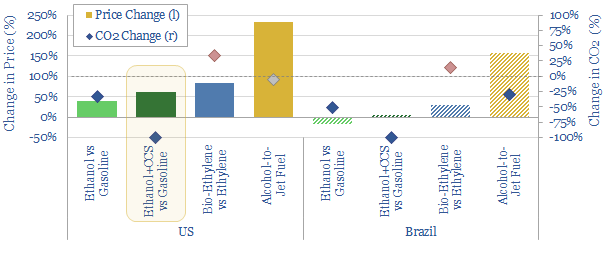

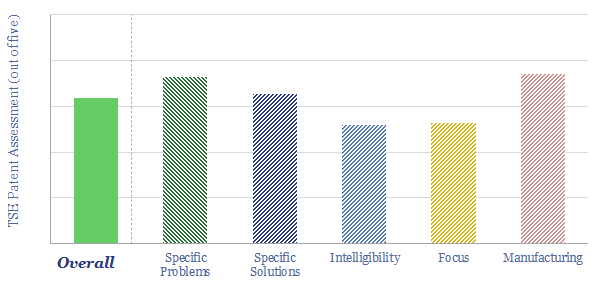

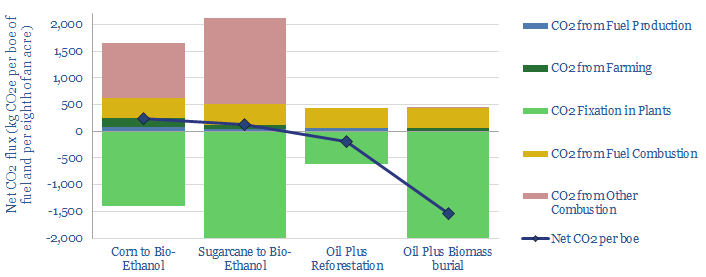

Could new technologies reinvigorate corn-based ethanol? This 12-page note assesses three options. We are constructive on combining CCS or CO2-EOR with an ethanol plant, which yields a carbon-negative fuel. But…

This data-file captures the economics of producing bio-ethylene by dehydration of ethanol, backed up by half-a-dozen technical papers. $499.00 – Purchase Checkout Added to cart We estimate an ethylene price of $1,600/Tpa…

30M acres of US croplands are used to grow corn for ethanol. Each acre prevents 2-3 tons of CO2 emissions per annum, for a CO2 abatement cost of $200/ton. However,…

…bio-ethanol plants and bio-methane plants, then recirculating the stillage. Some nice flow diagrams are copied in our data-file. But most interestingly, halving the heat use on a bio-ethanol facility, and…

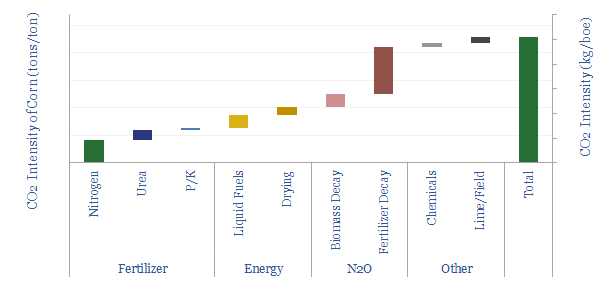

…look-through CO2 footprint for corn ethanol, including data from actual bio-ethanol plants and our corn ethanol economic model. We think the Scope 1-3 CO2 of corn ethanol is 240kg/boe, or…

…This report was originally published in 2020. We have also deepened our analysis of the corn ethanol industry, CO2 of corn production, alternative uses for bio-ethanol and an outlook for…