-

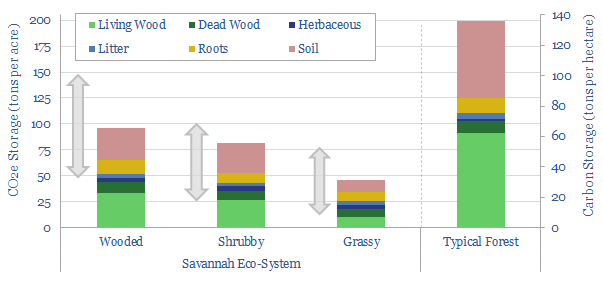

Savanna carbon: great plains?

Savannas are an open mix of trees, brush and grasses. They comprise up to 20% of the world’s land, 30% of its CO2 fixation, and their active management could abate 1GTpa of CO2 at low cost. This 17-page research note was inspired by exploring some wild savannas and thus draws on photos and observation.

-

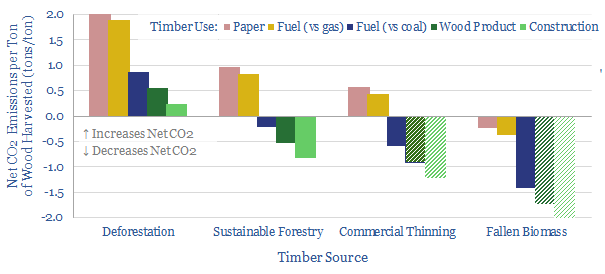

Wood use: what CO2 credentials?

The carbon credentials of wood are not black-and-white. They depend on context. So this 13-page note draws out the numbers and five key conclusions. They highlight climate negatives for deforestation, climate positives for using waste wood and wood materials (with some debate around paper), and very strong climate positives for natural gas.

-

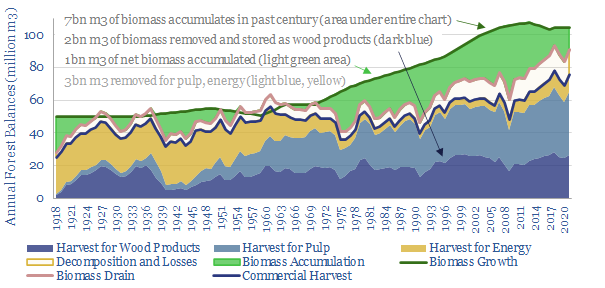

Finnish forests: a two billion ton CO2 case-study?

Can forests absorb CO2 at multi-GTpa scale? This 19-page note is a case study from Finland, where detailed data goes back a century. 70% of the country is forest. It is managed sustainably, equitably, economically. And forests have sequestered 2GT of CO2 in the past century, offsetting two-thirds of the country’s fossil emissions.

-

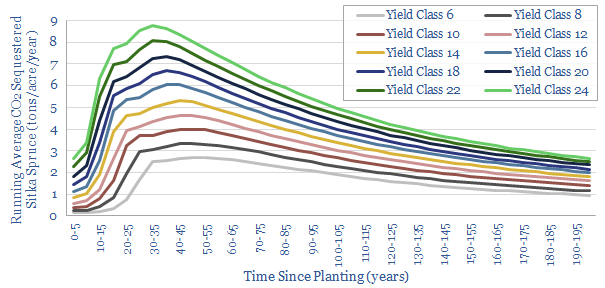

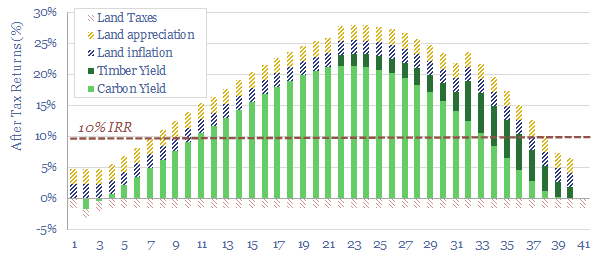

Sitka spruce: our top ten facts?

Sitka spruce is a fast-growing conifer, which now dominates UK forestry, and sequesters net CO2 up to 2x faster than mixed broadleaves. It can absorb 6-10 tons of CO2 per acre per year, at Yield Classes 16-30+, on 40 year rotations. This short note lays out our top ten conclusions, including benefits, drawbacks and implications.

-

Nature based CO2 removals: theory of evolution?

Learning curves and cost deflation are widely assumed in new energies but overlooked for nature-based CO2 removals. Support for NBS has already stepped up sharply in 2021. This 15-page note finds the CO2 uptake of well-run reforestation projects could double again.

-

Reforestation: a real-life roadmap?

This 12-page note sets out an early-stage ambition for Thunder Said Energy to reforest former farmland in Estonia, producing high-quality CO2 credits in a biodiverse forest. The primary purpose would be to stress-test nature-based carbon removals in our roadmap to net zero, and understand the bottlenecks.

-

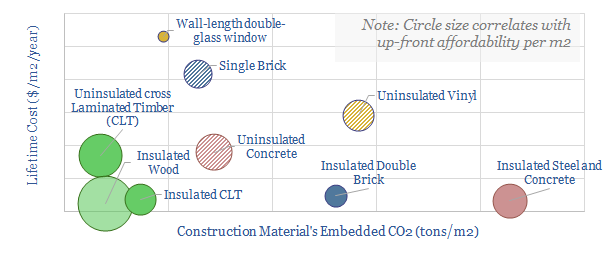

Carbon negative construction: the case for mass timber?

Construction accounts for 10% of global CO2, mainly due to cement and steel. But mass timber could become a dominant new material for the 21st century, lowering emissions 15-80% at no incremental cost. Debatably mass timber is carbon negative if combined with sustainable forestry. We outline the opportunity.

-

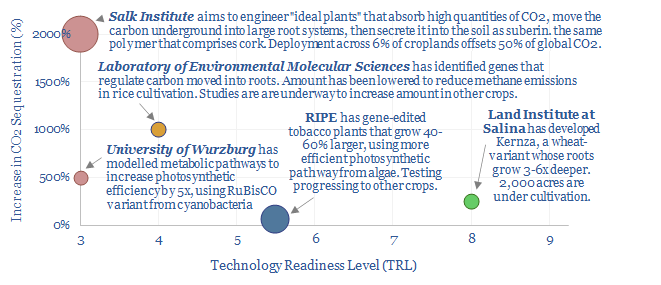

Bio-engineer plants to absorb more CO2?

Our roadmap towards ‘net zero’ requires 20-30GTpa of carbon offsets using nature based solutions, including reforestation and soil carbon. This short note considers whether the task could be facilitated by bio-engineering plants to sequester more CO2. We find exciting ambitions, and promising pilots, but the space is not yet investable.

-

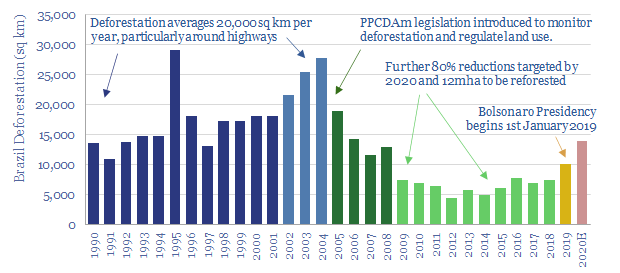

The Amazon tipping point theory?

Another 2-10% deforestation could make the Amazon rainforest too dry to sustain itself. 80GT of Carbon could thus be released, inflating atmospheric CO2 above 450ppm. This matters as Amazon deforestation rates have already doubled under Jair Bolsonaro’s presidency. We explore policy implications.

-

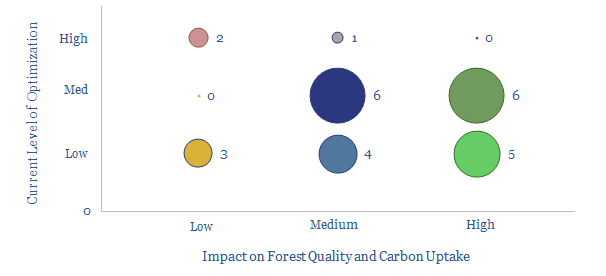

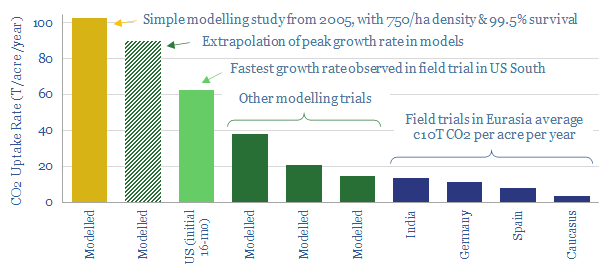

Paulownia tomentosa: the miracle tree?

The ‘Empress Tree’ has been highlighted as a miracle solution to climate change, with potential to absorb 10x more CO2 than other tree species; while its strong, light-weight timber is prized as the “aluminium of woods”. This note investigates the potential. There is clear room to optimise nature based solutions. But there may be downside…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (131)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (356)