-

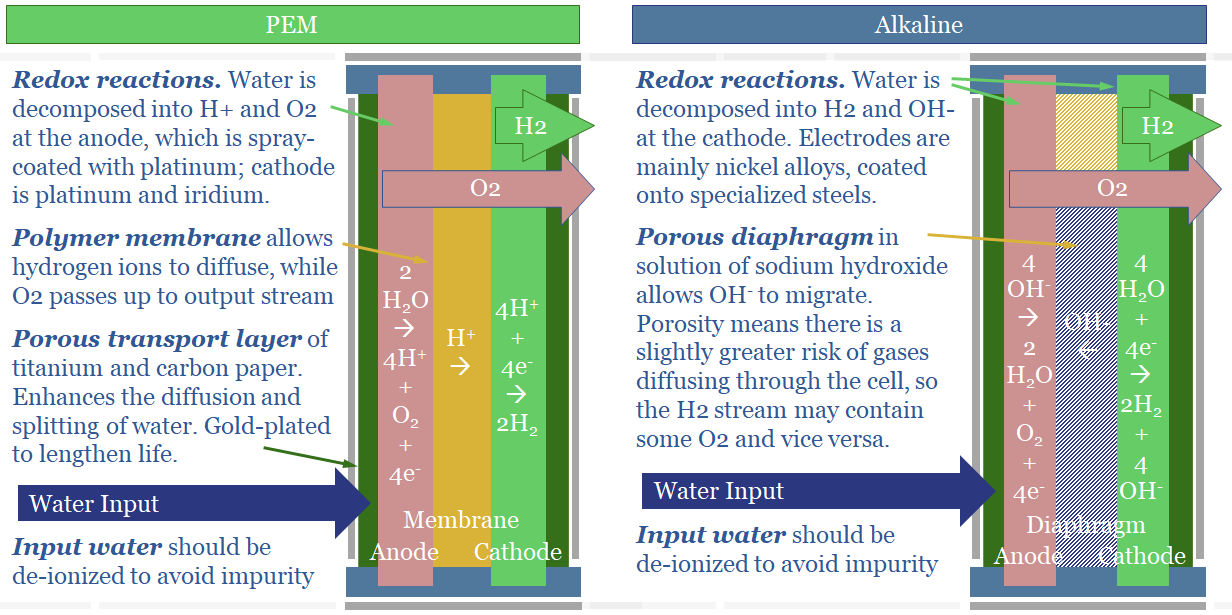

Green hydrogen: alkaline versus PEM electrolysers?

This note spells out the top ten differences between alkaline and PEM electrolysers. The lowest cost green hydrogen will likely come from alkaline electrolysers in nuclear/hydro-heavy grids. If hydrogen is to back up wind/solar, it would likely require PEMs.

-

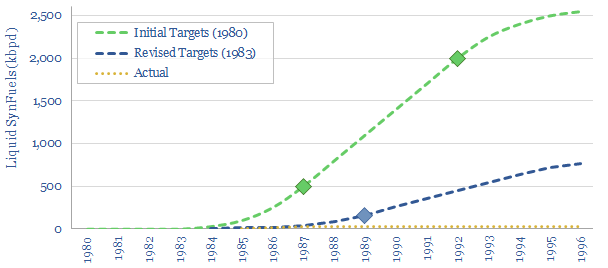

Energy policy: unleashing new technologies?

Does policy de-risk new technology? This 10-page note is a case study. The Synthetic Fuels Corporation was created by the US Government in 1980. It was promised $88bn. But it missed its target to unleash 2Mbpd of next-generation fuels by 1992. There were four challenges. Are they worth remembering in new energies today?

-

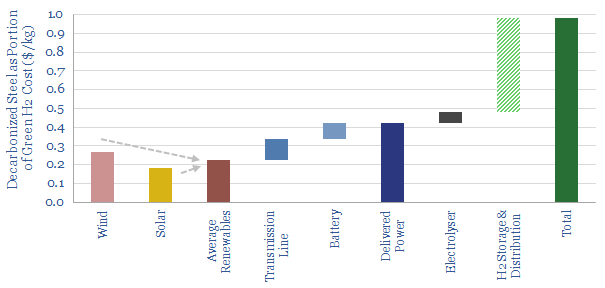

Green steel: circular reference?

Steel explains almost c10% of global CO2. Hence 2021 has seen the world’s first green steel, made using green hydrogen. Yet inflation worries us. At $7.5/kg H2, green steel would cost 2x conventional steel. In turn, doubling the global steel price would re-inflate green H2 costs. This note explores inflationary feedback loops and other options…

-

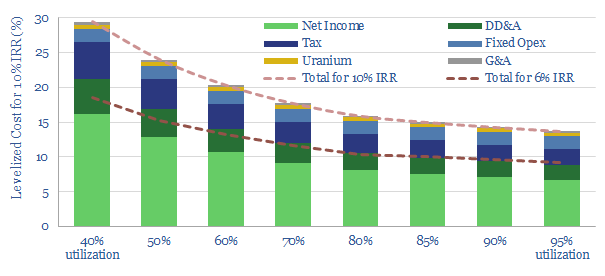

Back-stopping renewables: the nuclear option?

Nuclear power can backstop much volatility in renewables-heavy grids, for costs of 15-25c/kWh. This is at least 70% less costly than large batteries or green hydrogen, but could see less wind and solar developed overall. Our 13-page note reviews the opportunity.

-

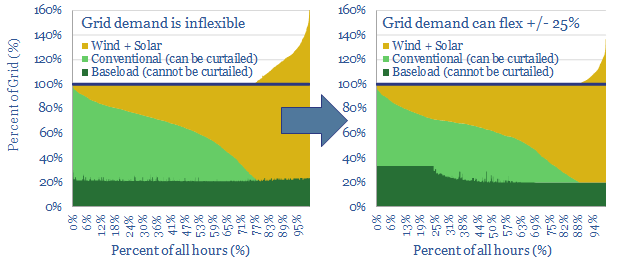

Shifting demand: can renewables reach 50% of grids?

25% of the power grid could realistically become ‘flexible’, shifting its demand across days, even weeks. This is the lowest cost and most thermodynamically efficient route to fit more wind and solar into power grids. We are upgrading our renewables ceilings from 40% to 50%. This 22-page note outlines the opportunity.

-

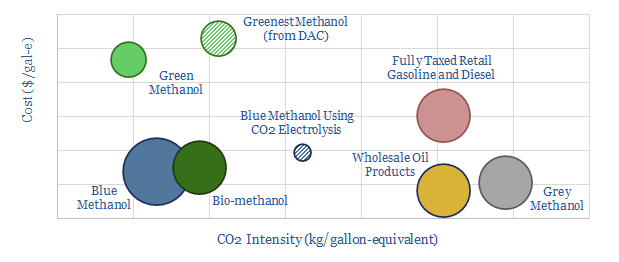

Methanol: the next hydrogen?

Methanol is becoming more exciting than hydrogen as a clean fuel to help decarbonize transport. Specifically, blue methanol and bio-methanol are 65-75% less CO2-intensive than oil products, while they already earn 10% IRRs at c$3/gallon prices. Unlike hydrogen, it is simple to transport and integrate methanol with pre-existing vehicles.

-

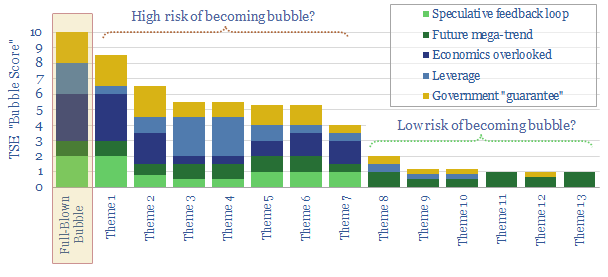

Energy transition: is it becoming a bubble?

Investment bubbles in history typically take 4-years to build and 2-years to burst, as asset prices rise c815% then collapse by 75%. There is now a frightening resemblance between energy transition technologies and prior investment bubbles. This 19-page note aims to pinpoint the risks and help you defray them.

-

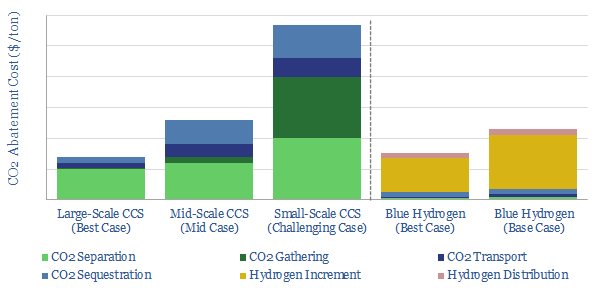

Deep blue: cracking the code of carbon capture?

Carbon capture is cursed by colossal costs at small scale. But blue hydrogen may be its saviour. Crucial economies of scale are guaranteed by deploying both technologies together. The combination is a dream scenario for gas producers. This 22-page note outlines the opportunity and costs.

-

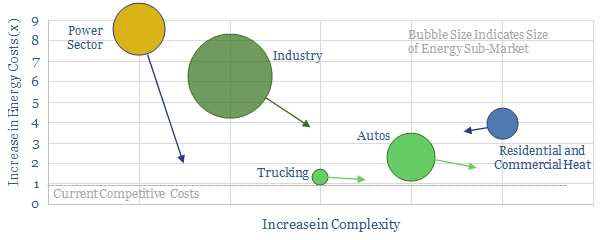

The green hydrogen economy: a summary?

We have looked extensively for economic hydrogen opportunities to advance the energy transition. Pessimistically stated, we fear that the ‘green hydrogen economy’ may fail to be green, fail to deliver hydrogen, and fail to be economical. This short note summarizes our work.

-

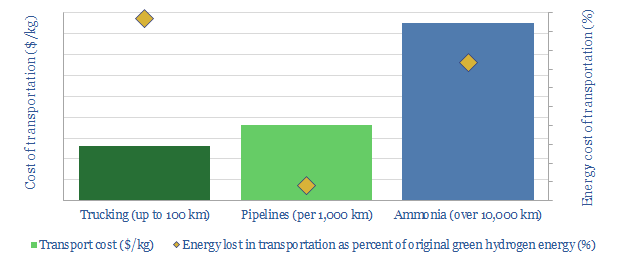

Hydrogen: lost in transportation?

Transporting hydrogen will be more challenging than any other energy commodity ever commercialised. This 19-page note reviews the costs and complexities of cryogenic trucks, pipelines and chemical carriers (e.g., ammonia). Midstream costs will be 2-10x higher than natural gas, while up to 50% of hydrogen’s embedded energy may be lost in transit.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (91)

- Data Models (821)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (200)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (275)

- LNG (48)

- Materials (81)

- Metals (74)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (347)