-

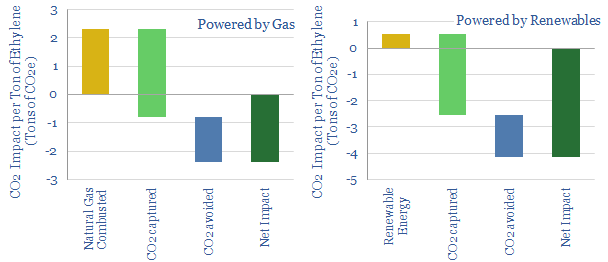

Carbon-negative plastics: a breakthrough?

This short note describes a potential, albeit early-stage, breakthrough converting waste CO2 into polyethylene, based on a recent TOTAL patent. We estimate the process could sequester 0.8T of net CO2 per ton of polyethylene. This matters as the world consumes c140MTpa of PE, 30% of the global plastics market, whose cracking and polymerisation emits 1.6T…

-

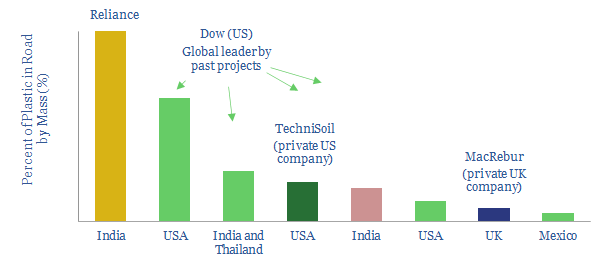

Turn the Plastic into Roads?

The opportunity is emerging to absorb mixed plastic waste, displacing bitumen from road asphalts. We find strong economics, with net margins of $200/ton of plastic, deflating the materials costs of roads by c4%. The challenge is scaling the opportunity. Leading companies and projects are profiled in our 6-page note.

-

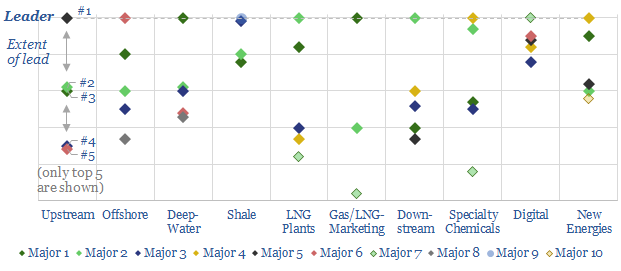

Patent Leaders in Energy

Technology leadership is crucial in energy. It drives costs, returns and future resiliency. Hence, we have reviewed 3,000 recent patent filings, across the 25 largest energy companies. Our 34-page report outlines the “Top 10 Technology Leaders” in energy, ranging across each sub-sector.

-

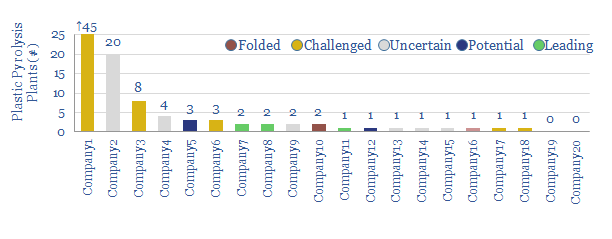

Turn the Plastic Back into Oil

Due to the limitations of mechanical recycling, 85% of the world’s plastic is incinerated, dumped into landfill, or worst of all, ends up in the oceans. An alternative, plastic pyrolysis, is on the cusp of commercialisation. We have assessed twenty technology solutions. Excitingly, this nascent opportunity can turn plastic back into oil, generate >30% IRRs…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)