CO2-EOR is the most attractive option for large-scale CO2 disposal. Unlike CCS, which costs over $70/ton, additional oil revenues can cover the costs of sequestration. And the resultant oil is 50% lower carbon than usual, on a par with many biofuels; or in the best cases, carbon-neutral. The technology is fully mature and the ultimate potential exceeds 2GTpa. This 23-page report outlines the opportunity.

The rationale for CO2-EOR is to cover the costs of CO2 disposal by producing incremental oil. Whereas CCS is pure cost. These costs are broken down and discussed on pages 2-5.

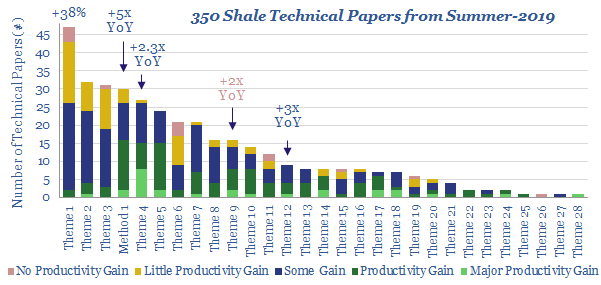

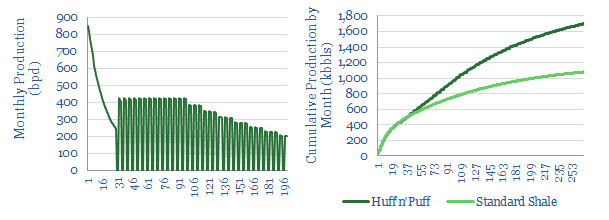

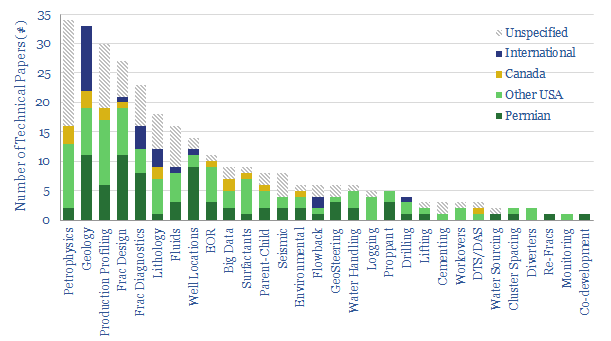

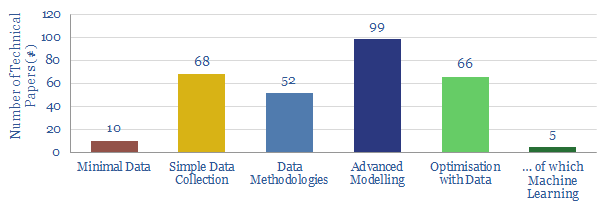

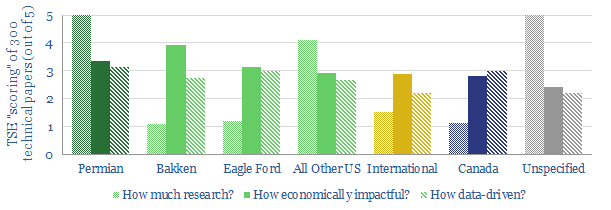

An overview of the CO2-EOR industry to-date is presented on pages 6-7, drawing on data-points from technical papers.

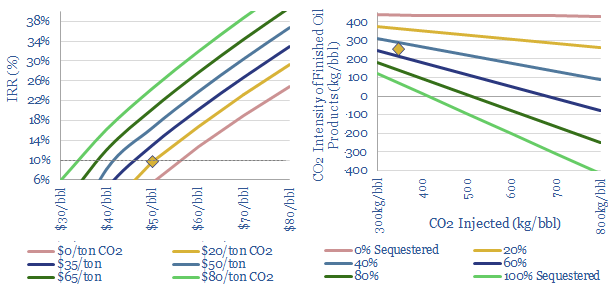

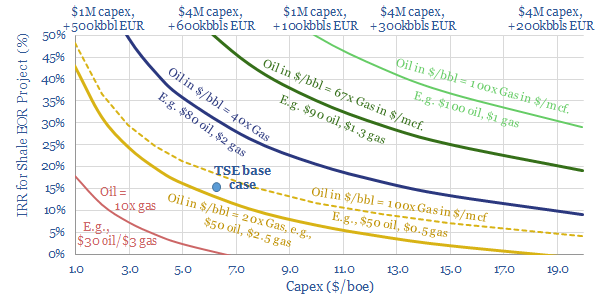

Our economic model for CO2-EOR is outlined on pages 8-10, including a full breakdown of capex, opex, and sensitivities to oil prices and CO2 prices. Economics are generally attractive, but will vary case-by-case.

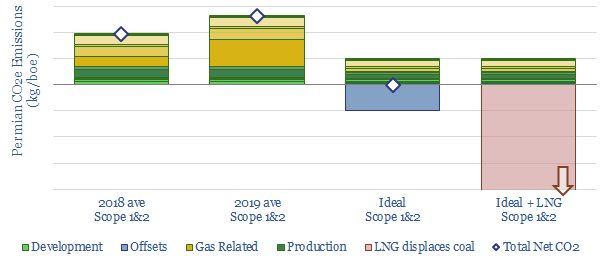

What carbon intensity for CO2-EOR oil? We answer this question on pages 11-12, including a debate on the carbon-accounting and a contrast with 20 other fuels.

The ultimate market size for CO2-EOR exceeds 2GTpa, of which half is in the United States. These numbers are outlined on pages 13-15.

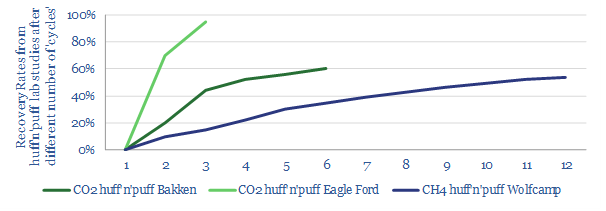

Technical risks are low, as c170 past CO2-EOR projects have already taken place around the industry, but it is still important to track CO2 migration through mature reservoirs and guard against CO2 leakages, as discussed on pages 16-17.

How to source CO2? We find large scale and concentrated exhaust streams are important for economics, as quantified on pages 18-21.

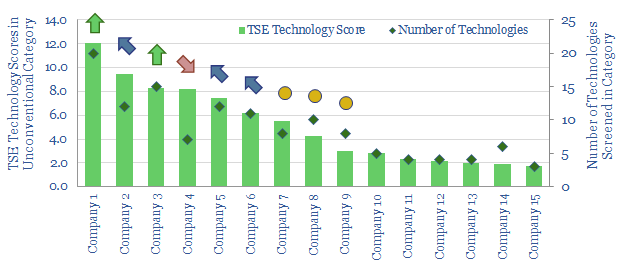

Which companies are exposed to CO2-EOR? We profile two industry leaders on page 22.

What implications for reaching net zero? We have doubled our assessment of CO2-EOR’s potential in this report, helping to reduce the costs in our models of global decarbonization.