Wind and solar have so far leaned upon conventional power grids. But larger deployments will increasingly need to produce their own reactive power; controllably, dynamically. Demand for STATCOMs & SVCs may thus rise 30x, to over $25-50bn pa. This 20-page note outlines upside for STATCOMs and who benefits?

This 20-page research note is about controlling reactive power in increasingly renewable-heavy grids. We believe this theme is going to become increasingly important, but it has been overlooked, for two reasons, laid out on pages 2-3.

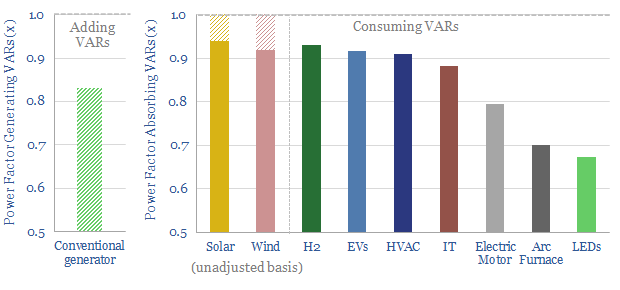

What is reactive power? After reviewing hundreds of technical papers and patents, our ‘best explanation’ is set out on pages 4-7, to explain concepts such as real power, reactive power, power factor, power triangles, phase angle and VARs.

Lean on me. Wind and solar assets inherently produce no reactive power and may even have consumed it. This was fine in the early days, as renewables assets could rely on the large and controllable output of reactive power from spinning generators. But regulations are tightening. And if renewables are to dominate future grids, replacing spinning generators, then they will increasingly need to produce their own reactive power (page 8).

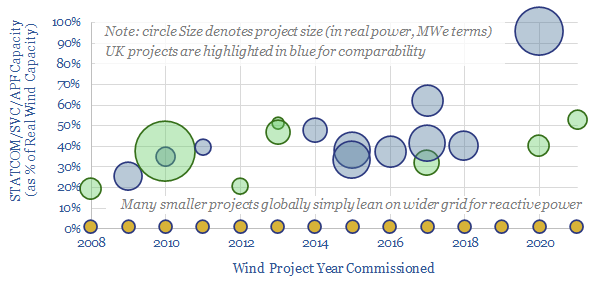

FACTS = Flexible AC Transmission Systems. We review different options for renewables to control reactive power on pages 9-14. The discussion covers switched capacitor banks, synchronous condensers, upsized inverters, Static VAR Compensators (SVCs) and Static Synchronous Compensators (STATCOMs). In each case, we review the costs ($/kVAR), advantages and challenges for each technology. We think STATCOMs are taking the lead to back up large wind projects.

Market sizing for STATCOMs and SVCs market suggests that a 30x ramp-up is not mathematically inconceivable. If wind capacity additions ramp from 100 GW pa to 300-500 GW pa, and we install 0.5 MVAR/MW of STATCOMs/SVCs at an average of $160/kVAR, then this would become a $25-50bn pa market. Huge numbers. Worked examples and quotes from technical papers are also given (page 15-16).

Who benefits? Leading companies in STATCOMs and SVCs are profiled on pages 17-20, after reviewing 2,500 patents. The market is incredibly concentrated, with two leading large-caps, and a handful of smaller and interesting semi-pure plays. Our screen is linked here.

To read more about the upside for STATCOMs & SVCs, please see our article here.