We have all heard the criticism that shale oil is “too light”, so its ascent will create a surplus of natural gas liquids and a shortage of heavier distillates. Less discussed is the opportunity in this imbalance. Hence this note highlights one such opportunity, based on an intriguing patent from Chevron, which could convert ethylene into diesel and jet fuel, to maximise value as its shale business ramps up.

[restrict]

Are ethylene, polyethylene and diesel markets broken?

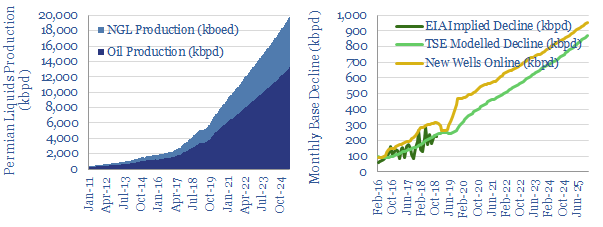

US ethane production reached a new peak of 1.9Mbpd in 1Q19, having doubled since 2014. Two thirds of that ascent can be attributed to the Permian, where output rose 4x over the same time-frame and 10-15% of production is ethane. So far, the latest rises in ethane are being absorbed by new steam crackers on the US Gulf Coast. In 2018, Chevron and Exxon both started new facilities, which will each take in 90kbpd of ethane, to produce ethylene and polyethylene.

A glut of ethylene and polyethylene has resulted. S&P Platts noted in June-2019 how Gulf Coast ethylene prices had fallen to an all-time low of 12c/lb, which is down -80% from 2012-14 average levels of 60c/lb. As a consequence, polyethylene prices are also -20% since early 2018. Hence ICIS notes the risk of a “trade war” as the world must absorb growing US polyethylene supplies. Other commentators are even more cautious, arguing the ramp up of US crackers and chemicals plants will coincide with a structural decline in plastics demand. All of this would block the outlet for shale’s light components and hinder its ascent (chart below, our model downloadable here).

Fears over a diesel shortage persist on the other side of the oil product market. Shale’s light oil composition has been blamed. One European Major recently told us this is why it remains negative on the shale sector, as it cannot run shale oil effectively through its refineries, which are geared to cracking and coking heavy oils. IMO 2020 sulphur regulation compounds the fear of a diesel shortage, pulling in c2-4Mbpd of diesel into the shipping fuels market, as demand for high-sulphur fuel oil collapses.

An opportunity is thus created for an integrated oil company, if it can transform the surplus of ethane ($0.10/lb), ethylene ($0.13/lb) or other light fractions into diesel ($0.33/lb).

Seizing the opportunity: from ethylene to diesel?

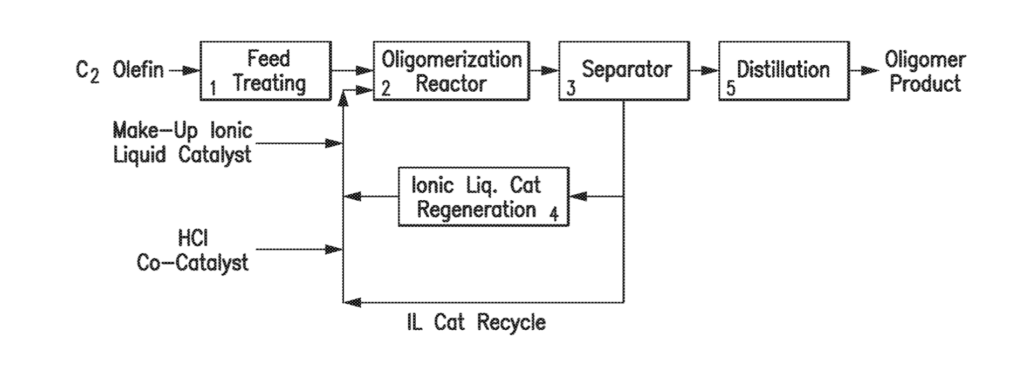

What is fascinating from our review of 3,000 of the Oil Majors’ patents is that many companies are progressing technologies to seize these emerging opportunities, i.e., to convert the abundant by-products of shale into under-supplied products. For the challenge described above, we recently reviewed a Chevron patent, which can oligomerize ethylene into diesel and jet fuel. The process schematic is shown below.

Similar technologies already exist to convert ethylene into dimers, trimers and oligomers, rather than straight polyethylene. For instance, Shell’s SHOP process uses Nickel catalyst to produce alpha-olefins. Others include the Ineos process, Gulf process (ChevronPhillips), Sabic Linde α-Sablin or the IFP-Axens AlphaSelect process.

Where Chevron has an edge is in ionic liquids catalysts, which have been used elsewhere in its refining operations to achieve higher yields of very high octane alkylates for the gasoline pool. Chevron’s ISOALKY technology won Platts’ 2017 “Breakthrough Solution Award” and has been installed in a c$90M retrofit to Chevron’s Salt Lake City refinery. The first Chevron patents for alkylation of ethylene using ionic liquid catalysts go back to 2006.

The key improvements in Chevron’s latest patent filings allow ethylene to be converted into distillates. Advantages are that the ethylene only needs to be in the molar majority (>50%) for the reaction to progress, excess isoparrafin does not need to be deliberately fed and recycled, and the process can tolerate mild impurities (0-10ppm sulfur, 0-10ppm oxygenate, 0-100ppm dienes and residual trace metals, which would poison metallocene catalysts). The patent uses a HCl co-catalyst.

The commercial rationale is justified thus: “There is a need for a process that can be applied to a mixed hydrocarbon stream containing ethylene to oligomerize ethylene into a high value hydrocarbon product using ionic liquid catalysts to obtain jet and diesel fuel and satisfy increasing market demand… By converting ethylene to jet fuel and diesel blending stock, a significant value uplifting is achieved”.

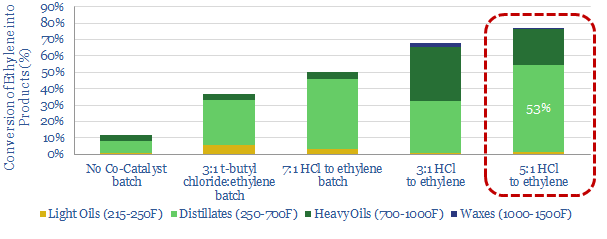

The technology has been demonstrated. For example, the patent describes a continuous test-run which achieved 77% yields of product, of which c69% are distillate-range (chart below). Fuel properties are described to be excellent: 48-57 cetane number, -76F freeze point/cloud point and negligible sulphur content.

It may be interesting to explore with the company whether Chevron plans to deploy this technology, integrating around its shale portfolio.

An important principle is also illustrated for the ascent of shale: Technical solutions are under development to absorb shale’s light product slate, without permanently distorting downstream markets.

[/restrict]

Conclusions and Further Work?

Shale’s light product slate may create opportunities for integrated companies. Chevron’s ethylene-to-diesel patents are one example. But we have also seen a surprising uptick among other Oil Majors in patent filings for GTL, for oxidative coupling of methane and for a process to convert C3-4s into gasoline and diesel range molecules.

Our positive outlook on shale is best illustrated by our deep-dive note, Winner Takes All, but also be recent work focusing on the emerging opportunities with Fibre-Optic Sensing and Shale-EOR.

Can we help? If you would like to register any interest in the topics above, to guide our further work, then please don’t hesitate to contact us.