What is the best way for investors to decarbonise the global energy system? We argue this outcome is achievable by 2050. But a new ‘venturing’ model is needed, to incubate better technologies. CO2 budgets can also be stretched furthest by re-allocating to gas, lower-carbon oil and lower-carbon industry. But divestment is a grave mistake. These are the conclusions in our new, 18-page report.

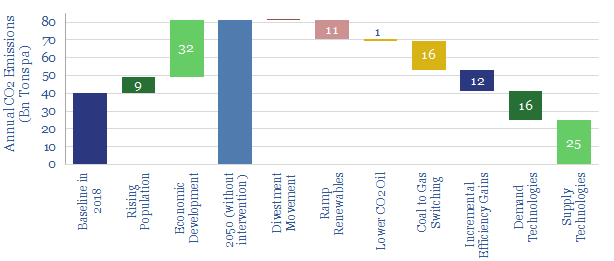

The global energy system could be decarbonised by 2050 (chart above). Yet today’s renewable technologies are only sufficient to meet c15% of the challenge. The largest component, at c50%, requires new energy technologies: both to economize demand and decarbonise supplies, which will most likely remain fossil-dominated to 2100.

Other routes are dangerous. The ‘divestment movement’ seeks to cut off capital for fossil fuels. This does not yield an energy ‘transition’, but a devastating energy ‘shortage’. Scaling up new technologies requires more capital, not less (see pages 2-7 in the PDF).

Is the investment community configured for energy transition? We fear not.

First, the investment process should favour lower-carbon suppliers across every industry, to incentivise efficiency. Within energy, this includes natural gas, low-carbon oil over higher-carbon oil (saving 500MTpa of CO2) and technology-leaders (see pp 8-11).

A new breed of venture funds is most needed, so investors can allocate capital to economically promising technologies. These opportunities are extremely exciting, based on all of our research. For example, we argue leading Energy Majors should offer up co-investments in their venture funds (see pp 12-16).