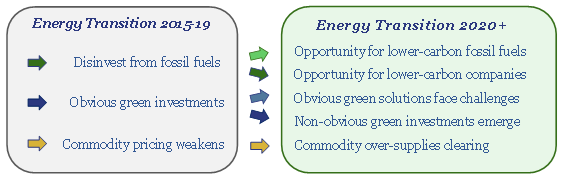

Energy transition is maturing as an investment theme. ‘Obvious’ portfolio tilts are beginning to look over-crowded. Non-obvious ones are over-looked. This 26-page note outlines the ‘top ten’ themes that excite us most in 2020, among commodities, drivers of the energy transition, market perceptions and corporate strategies.

Theme #1 is that investors are seeking non-obvious ways to drive the energy transition, as obvious opportunities start to look over-concentrated.

Theme #2 presents an example of an ‘obvious’ renewable energy theme, which is on the cusp of slowing down.

Theme #3 outlines the maturation of the ESG movement, as new sectors and new opportunities come into its purview.

Theme #4 explains how leading oil companies are likely to present their low carbon credentials in order to re-attract capital and potentially re-rate.

Theme #5 is our outlook for the US shale industry in 2020, following on from Themes 2-4.

Theme #6 is our outlook for the downstream industry as IMO 2020 finally arrives, with a focus on second-order consequences and opportunities.

Theme #7 finds a new up-cycle beginning to form in the global gas industry (LNG), a theme that increasingly excites us, to drive the energy transition.

Theme #8 is our oil outlook, where we expect markets may be re-shaped (perhaps even surprised) by the shedding of “unwanted” and high-carbon barrels.

Theme #9 outlines which companies we expect to lead the industry with growth and acqusitions.

Theme #10 argues the case for new, technology-focused investments.