A typical Oil Major can uplift its valuation by 50% through targeting net zero CO2. This requires demonstrating four cardinal virtues, as outlined in our recent research note (below). However, a recurrent question is “how much will it cost?”. This short note presents an answer, concluding that the costs are likely to be worthwhile.

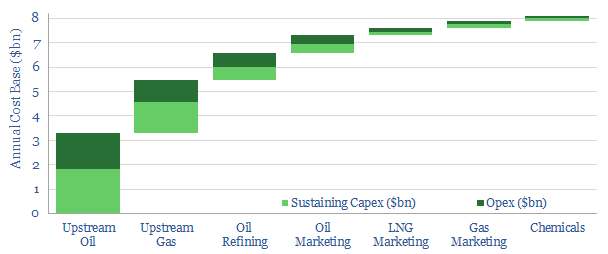

Our starting point is to model a typical Oil Major with 1Mboed of upstream production, 1Mbpd of refining and marketing, a gas marketing business and 5MTpa of annual chemicals production. We estimate this Oil Major would have around 30MTpa of Scope 1&2 emissions, 200MTpa of Scope 3 Emissions, over $4bn pa of sustaining capex and almost c$4bn pa of opex. To rebase these numbers for a Major that produces, say, 2.5Mboed, simply multiply all of the above figures by 2.5x, and you have an approximation.

The costs of lowering Scope 1&2 emissions are calculated using granular examples in our recent research note below. We estimate that the first c10% of CO2 reductions unlock net economic benefits prior to a CO2 price, with average capex costs of $150/Tpa. The next 10% require a $1-100/ton CO2 price and cost $850/Tpa. Another c5% emissions reductions are possible, but require higher CO2 prices and cost $2,250/Tpa.

An additional method to lower Scope 1&2 CO2 emissions is to power c10% of operations with renewables. This will also cost $850/Tpa of CO2 that is saved, based on our economic models of wind and solar projects (below).

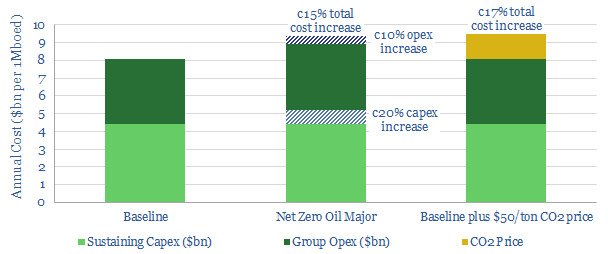

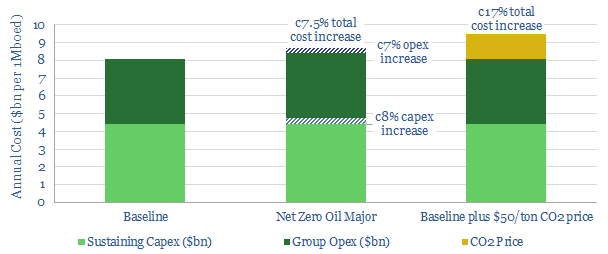

Thus a typical Oil Major can eliminate 35% of its Scope 1&2 CO2 emissions through funding efficiency technologies and renewables. The average cost of these CO2 reductions is $850/Tpa. Spread out over a period of 10-years, this would increase the Major’s annual sustaining capex by c20%, we calculate.

The remaining 65% of CO2 emissions would need to be offset using nature based solutions, which screen among the lowest cost and most scalable decarbonization opportunities on the planet. The note below provides a short summary of several hundred pages of our research on the topic.

We estimate an incremental c10% would be added to group opex, through funding nature based solutions to reach net zero, at a conservative cost of $25/ton per carbon credit.

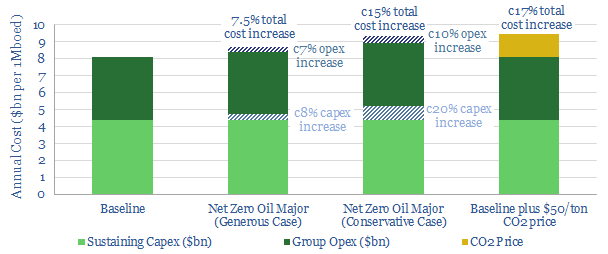

Overall costs are thus seen to be 15% higher for a Major that transitions to net zero, using the combination of options described above (chart below). This is equivalent to $1.2bn pa of incremental annual costs for a typical 1Mboed integrated oil company.

For contrast, if $50/ton global CO2 prices are introduced, and a Major chooses not to decarbonize, we estimate that the same company would incur a 17% annual cost increase. In other words, if you think $50/ton global CO2 prices are likely to come into force within the next decade, it would be lower cost to shift a business towards net zero pre-emptively.

It could be a lot lower cost. For example, the cost increase could be reduced to 7.5% per annum, if (a) the company did not fund the final, 5% most expensive CO2 reductions (b) spaced its spending over 15-years rather than 10-years and (c) could source nature based offsets at the bottom end of our modelled range of $13/ton rather than $25/ton (chart below).

Although costs are increasing by 7.5-15%, as a Major transitions to Net Zero Scope 1&2, this can be more than offset by the virtues identified in our original work: tilting businesses towards value-accretive areas, benefitting from 2pp lower capital costs in financial markets, targeting efficiency gains that uplift economics and commercializing CO2 offsets at an additional margin (to cut Scope 3 emissions).

A more extreme re-shaping of Oil Majors sees them incubating vast new businesses, seeding nature based solutions to climate change, then selling these CO2 credits alongside their fuels, for an additional margin. Assuming that land for reforestation is leased (not purchased outright), then a 1Mboed Oil Major might need to dedicate $400M of new capex and $4bn pa of opex to nature based solutions, representing 10% uplifts to group capex and 100% uplifts to group opex. Although this new activity would be rewarded by 5-10% unlevered IRRs at $15-35/ton commercial CO2 prices.

We conclude that a typical Oil Major can uplift its valuation by 50% through targeting net zero. This requires incurring 7.5-15% higher costs in early years. But the costs will break even, assuming $50/ton long-term CO2 prices, amidst the energy transition.