Drilling wells and lifting fluids to the surface are core skills in the oil and gas industry. Hence could geothermal be a natural fit in the energy transition? This 17-page note finds next-generation geothermal economics can be very competitive, both for power and heat. Pilot projects are accelerating and new companies are forming. But the greatest challenge is execution, which may give a natural advantage to incumbent oil and gas companies.

The development of the geothermal industry to-date is summarized on pages 2-4. We also explain the rationale for geothermal in the energy transition.

The costs of geothermal projects can be disaggregated across wells (page 5), pumping (page 6-7) and power turbines (pages 8-9). We draw out rules of thumb, to help you understand the energy economics.

The greatest challenge is geological complexity, as argued on page 10. It is crucial to find the best rocks and mitigate execution risks.

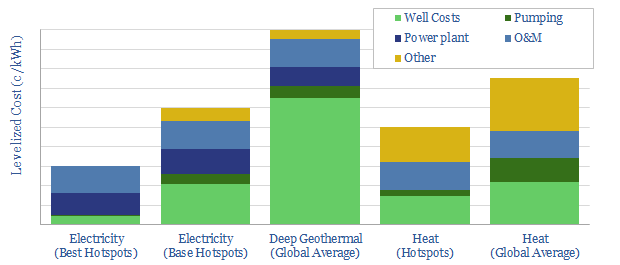

Base case economics? Our estimates of marginal costs are presented for traditional geothermal power (page 11), next-generation deep geothermal electricity (page 12) and using geothermal heat directly (page 13).

Leading companies are profiled on pages 14-16, after tabulating 8,000 patents. We also reviewed incumbent suppliers, novel pilots, and earlier-stage companies.

We conclude that geothermal energy is a natural fit for incumbent oil and gas companies to diversify into renewables, and arguably a much better fit than wind and solar (page 17).