Reaching ‘net zero’ is impossible without nature based carbon removals. Hence this 17-page note argues corporations will increasingly create internal groups to procure carbon offsets, re-shaping the energy transition. We make three arguments, twenty predictions and draw a historical analogy from labor reforms in 1850-1950. Is this the future of ESG?

We draw a distinction between carbon reduction technologies and carbon removal technologies on page 2-4. It is not possible to get to ‘net zero’ via reduction technologies alone. Allocations are needed to carbon negative removal technologies too. Especially nature-based solutions.

What model will be best for corporations to procure nature-based carbon removals? On pages 4-5, we propose internal groups will be created to ensure these projects are real, reliable, additional, permanent and meet other organizational goals.

Our first line of evidence comes from assessing the increasing trend towards nature based solutions at 35 large organizations, profiled on page 6.

Our second line of evidence is a specific example in a hard to abate sector. Without nature-based solutions, abatement costs 100-200x more and even then, only 40% of CO2 can actually be abated (page 7).

Our third line of evidence is a specific example, a company targeting ‘net zero’ which has created exactly the kind of internal carbon offsetting division that we envisage. It states a goal to “help establish this market by sparking a paradigm shift as soon as possible”.

Other beneficiaries of the theme could be organizations that vet economical carbon removal solutions and sell this service onwards, or Energy Majors that commercialize ‘zero carbon energy’ by combining nature based solutions with their fuels (pages 9-10).

A historical analogy is given on pages 11-14. Correcting the 19th century’s imbalance between labour and capital did not come via dismantling capitalism, but via a series of mundane internal reforms from corporations, from safety measures to defined benefit pension funds.

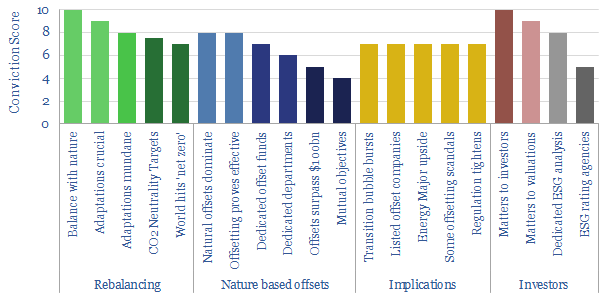

Implications for the energy transition are given on pages 15-17, including twenty predictions for the future of ESG.