Solar costs have deflated by an incredible 90% in the past decade to 4-7c/kWh. Some commentators now hope for 2c/kWh by 2050. Further innovations are doubtless. But there are four challenges, which could stifle future deflation or even re-inflate solar. Most debilitating would be a re-doubling of CO2-intensive PV-silicon. Our 15-page report explores re-inflation risks for solar developers.

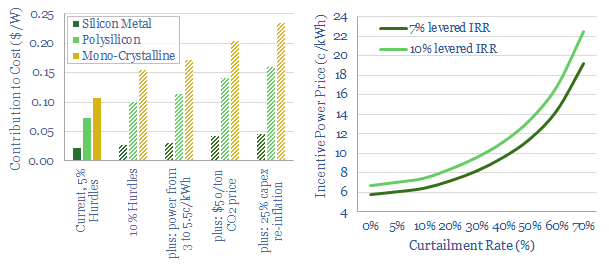

Our current solar models are laid out on page 2, breaking down the capex costs of a new utility solar installation (in $/W) and the resultant levelized power prices required for various IRRs (in c/kWh).

But can solar costs deflate to 2c/kWh in the future? This is the base case assumption now factored into the IEA’s ‘roadmap to net zero’, which has solar generating 33% of all global electricity by 2050. If correct, this could unleash a very different roadmap to net zero than our own.

We outline four reasons we cannot see solar deflating to 2c/kWh on pages 6-15. The first three revolve around curtailment, geographic down-spacing and interest rates.

Photovoltaic silicon is the key focus on pages 10-15. This currently makes up one-third of a solar panel’s cost, and is one of the most CO2 intensive materials on the whole planet. Models must join up. Thus if the production of PV silicon itself needed to be decarbonized, then prices would easily rise by 2x, or more. The full analysis is broken out in the note.