This 13-page note considers five options to cure emerging energy shortages in the gas and power sectors of countries working hard to decarbonize. Unfortunately, the options are mostly absurd. They point to inflation, industrial leakage and slipping global climate goals. But there may be a few glimmers of opportunity in LNG, nuclear and efficiency technologies.

How did we get here? Our latest models for gas, LNG and power shortages in Europe are laid out on pages 2-4, to illustrate the scale of looming under-supply.

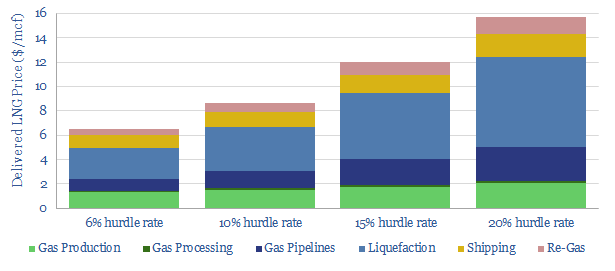

The first option to cure long-term under-supply is to incentivize more gas projects. Unfortunately, energy transition has become irrational and adversarial. Hence we worry hurdle rates for these big, capital intensive projects are around 15-20% and this could make the marginal cost of LNG around $12-16/mcf (pages 5-7).

The second option is to use more coal and fuel oil to lower the need for gas, especially in the most price-sensitive emerging market geographies. But this is not good for decarbonization. “Switching economics” are laid out on pages 8-11.

The third option is to ‘leak’ industrial activity away from the West, so our energy demand decreases. We model what a long-term doubling of gas and power would do to the cost curves of ten major industries, finding inflation of c30% on average (page 12).

The fourth option is to step up efficiency gains: a very broad area. This would include cancelling nuclear scale-backs, backtracking on ridiculous green hydrogen, and an accelerated cycle of capital investments to promote more efficient energy use. This is the best option. But it only has a limited impact. And we only scratch the surface on page 13.

The fifth option is a 100% renewable powered energy system, which avoids any need for gas in the mix, by 2025-30. Unfortunately, this is a fantasy, for practical, economical and timeframe reasons. We have not re-hashed all of our prior analysis in this note, but for further details, please see here, here, here, here, here, here, here and here.