If global energy supplies run short, then someone has to curtail demand. Europe is in the firing line, with 7% of the world’s people, using 17% of its energy, of which 65% is imported. So this 13-page note searches for the ‘least bad’ options to cut demand. We do not think the lights will go out. But energy shortages in Europe may cause more energy intensive industries to shutter and never return.

Our outlook for global energy markets is that the world is already 2% under-supplied in 2022, while the under-supply looks likely to continue deepening, each year, out to 2030. Our assumptions, and possible resolutions, are explained on pages 2-4.

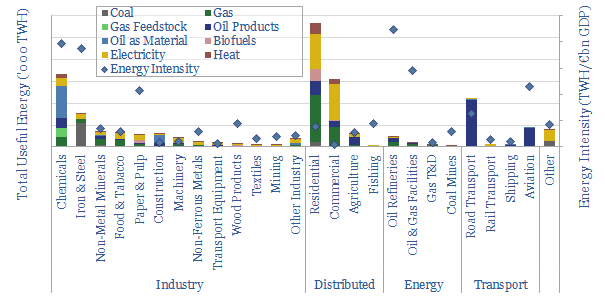

Europe’s energy use will likely need to be curtailed, if energy supplies run short. Hence we have disaggregated Europe’s energy demand across 25 different end-uses, versus their contribution to European GDP and payrolls, on pages 5-7.

Where could we cut demand? We explore each option in turn, on pages 8-11, including granular data across 125 different economic models. This shows which industries are most at risk of deeper and deeper curtailments.

The best constructive solutions would be pragmatic policies, a re-prioritization of gas, and a massive step-up in efficiency improvements. The best options across all of our research are summarized on pages 12-13.

Subsequent research on energy shortages in Europe is linked here, and research on how the energy crisis could devastate low-income countries is linked here.