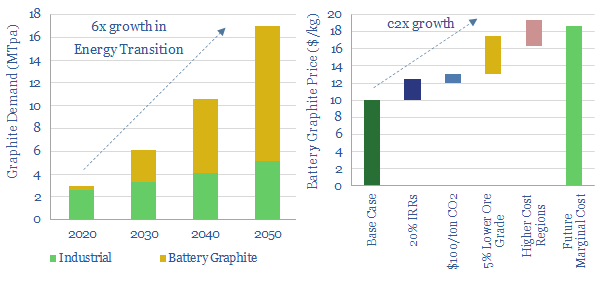

Global graphite volumes grow 6x in the energy transition, mostly driven by electric vehicles, while marginal pricing also doubles. We see the industry moving away from China’s near-exclusive control. The future favors a handful of Western producers, integrated from mine to anode, with CO2 intensity below 10kg/kg. This 10-page note on graphite opportunity in energy transition concisely outlines the opportunity.

What is graphite and why does it matter? We outline some history, some chemistry, some market-sizing and the main sources of industrial demand growth on pages 2-3.

The supply chain is explained on page 4-5. Specifically, how is battery-grade graphite made via mined graphite (natural route) and petcoke/coal (synthetic route), and what are the respective CO2 intensities?

Our base case economic model requires $10/kg for a greenfield production facility to earn a 10% IRR. We outline what drives these numbers on pages 6-7.

Surprise bottlenecks? We cannot help wondering whether there is a surprise bottleneck waiting in battery-grade graphite. The rationale is laid out on page 8.

Western companies are described on pages 9-10, including summary profiles of the four leading listed companies, ramping up Western graphite facilities in 2022-25.

To read more about our outlook on graphite opportunity in energy transition, please see our article here.