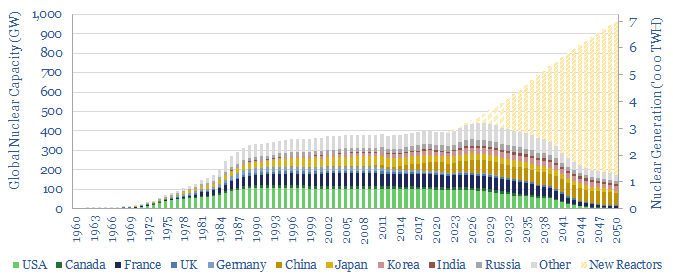

400 GW of nuclear reactors produce 2,800TWH of zero carbon electricity globally each year. But the numbers have been stagnant for two decades. This is now changing. This 14-page note explains our outlook for nuclear in the energy transition. We expect a >3% CAGR through 2030, and hope for a 2.5x ramp through 2050. A ‘nuclear renaissance’ helps the energy transition.

The world generated 2,800 TWH of nuclear electricity in 2021, across 444 operable reactors with 400 GW of total capacity, spread across 33 countries. This is 10% of all global electricity. It is 4% of all useful global energy consumption. However, capacity has been stagnant for 20-years, as the OECD has closed 5 GW pa of reactors (pages 2-3).

History suggests that energy crises underpinned the first large wave of nuclear construction, where new capacity additions peaked in the half-decade from 1984-89. The evidence suggests energy crises in the 2020s will re-awaken this sense of pragmatism (pages 4-6).

Near-term upside, including slower shutdowns, faster construction schedules and the re-start of idled nuclear capacity (especially Japan) are explored on pages 6-7.

There is longer-term upside for nuclear in the energy transition. A good target is to ramp nuclear from 4% to at least 6% of the world’s total useful energy, which in turn requires a 2.5x capacity expansion. The size of the capex cycle is compounded by needing to replace old plants reaching end of life. Spending may ramp by 4x to as much as $150bn pa (pages 8-9).

A renaissance in new nuclear technology will help to meet the call. Out of hundreds of technologies we have reviewed in the energy transition, we have found new nuclear concepts to be some of the least hyped yet “most real” and most natural to de-risk. We note particularly interesting concepts and companies on pages 10-13.

What outlook for uranium? 2-3% demand growth for nuclear already leaves uranium markets deeply under-supplied by late in the 2020s. After re-accelerating our outlook for nuclear in the energy transition, updated numbers, and leading uranium miners are noted on page 14.