Electrification is the most overlooked, most misunderstood opportunity in the energy transition. Hence this 10-page note aims to explain the upside, simply and clearly, for electrification in the energy transition. Electricity rises from 40% of total useful energy today to 60% by 2050. Within the next decade, this adds $2trn to the enterprise value of capital goods companies in power grids and power electronics.

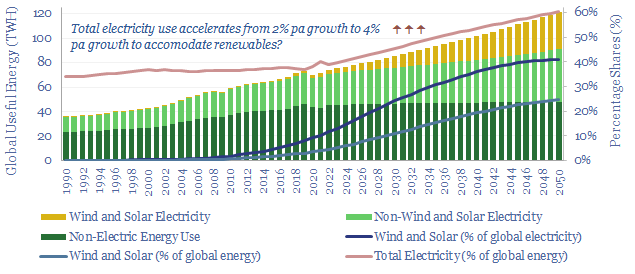

Electrification in the energy system. In the past five-years, 38% of global useful energy has been consumed as electricity. Our forecasts for 70,000 TWH of total global electricity demand are explained on pages 2-3.

The single biggest reason for accelerating electrification is to expand renewables as much as possible, while also keep renewables as a right-sized share of the total power grid. After four years of research, our simplest, clearest explanation of this effect, along with our ‘top three charts’ are presented on pages 4-5.

What about energy storage? Can batteries and hydrogen solve the various volatility issues, and increase the percentage share of renewables. Again, summarizing four years of research, our conclusions and key numbers are summarized on page 6.

The best solution to backstop renewables is via electrification. Expand the grid. Hence renewables will not reach ‘problematic’ or ‘impassable’ shares of the total. We summarize how this will actually happen, and ‘how it works’, with examples, on pages 7-8.

Who benefits? Electrification requires expanding power grids and power electronics. The extent of this upside is truly overlooked, due to its complexity. We quantify the upside, and why it is overlooked on pages 9-10.

(There is also upside for nuclear, gas and CHPs, which will provide most of the remaining shares of an increasingly large grid).

1,100 companies have crossed our screens since starting Thunder Said Energy, including dozens in power grids and power electronic capital goods. Although four listed companies seem to come up again and again, with leading positions in some of the different market segments that excite us most (page 11).