This 14-page note lays out our top ten predictions for global energy in 2023. Brace yourself for volatility, a possible recession due to energy shortages, and deepening bottlenecks on accelerating new energies? However, the biggest change for 2023 is that an energy super-cycle is now gradually coming into view.

Energy markets are uncertain. Everyone is guessing. But our own best guesses for 2023 are outlined in this note.

Global energy demand (forecasts on page 2) and disrupted global energy supplies (page 3) continue to be mis-matched. Thus the first law of thermodynamics creates a need to ‘destroy aggregate demand’, or in other words, there are risks of a commodity-led recession.

The most favored policy response will still be to ramp wind and solar ever faster (forecasts on page 4). This creates bottlenecks. In 2023, it will be crucial to distinguish between ‘soft bottlenecks’, ‘hard bottlenecks’ and ‘inverse bottlenecks’. This means some materials prices will spike, while others collapse (pages 5-8).

In conventional energy, we expect growing controversies for how to deploy record free cash flow. Especially for shale (page 9). Should it be for ever-greater shareholder returns, funding more growth to alleviate energy shortages, decarbonization, or eaten up by re-inflation in the energy services industry?

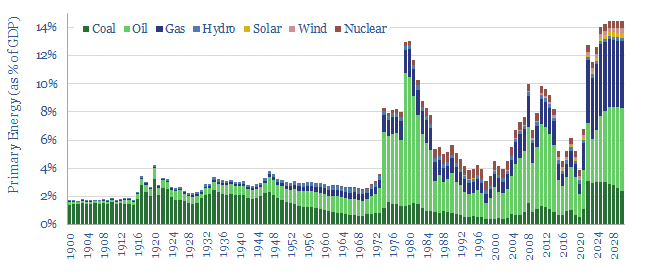

Another energy super-cycle is on the horizon (page 10), especially for low-carbon natural gas (page 11). But for investors, timing considerations are very important (page 12).

Three bright spots will stand out in 2023, and against this macro background, as summarized on pages 13-14. They include energy efficiency, nature and CCUS.

Our ten predictions for global energy in 2023 are presented in the full note. Here is to an interesting year ahead, and to the investments and innovations that yield a better-supplied and cleaner energy system, as the world progresses towards net zero.