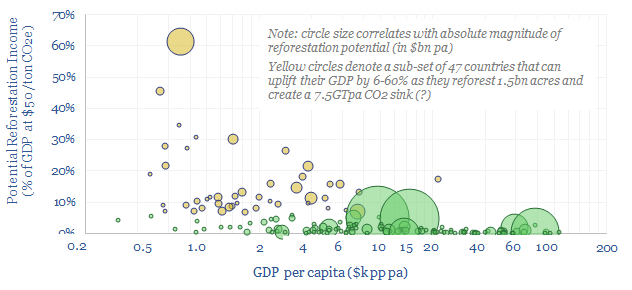

CO2 removal credits could add 6-60% to the GDP of 47 emerging countries as they reforest 1.5bn acres and create a 7.5GTpa CO2 sink, while the resultant cash flows could double these countries’ investment rates. Reinvesting in wind, solar, electrification avoids higher carbon fuels and deforestation for firewood. Reinvesting in timber value chains maximizes CO2 permanence and value. This 13-page note explores ‘reforest and reinvest’ as a promising framework for clean economic development in the energy transition.

An important objective in the energy transition is to accommodate clean economic development for 4bn people on Planet Earth, with incomes around $2k pp pa, who currently use 90% less energy per capita than the ‘top 1bn’ in the developed world (page 2).

However clean economic development requires investment, especially for clean infrastructure. Without financing this infrastructure, there are risks that development will be slower and more skewed to particularly high-carbon energy sources; such as cheap coal and even worse, firewood from deforestation (page 3).

But what if emerging countries could reforest half of the areas that have historically been deforested, selling the resultant CO2 credits at $50/ton, and reinvesting a large portion of the income? (page 4).

We think there are 47 countries where this model could uplift GDP by 6-60% and ‘double’ potential annual investment rates in the country. Examples, numbers and case studies are presented on pages 5-7.

Where to reinvest the cash flows from selling nature-based CO2 removals? We think that 2-10x multipliers can be achieved. In other words, if the sales proceeds from 1 ton of CO2 removals are reinvested in emerging world countries, they can abate 2-10 tons of future CO2, while promoting clean economic development, and progressively increasing the ‘quality’ of nature based CO2 removals (pages 8-9).

Integration into timber value chains is explored as a method to maximize value and ensure that sustainably harvested timber sees its carbon locked up for the long-term in higher-value construction materials, which are 20-60x more valuable than raw stumpage (pages 10-11).

Wind, solar and electrification can also be financed to lower countries’ reliance upon coal and deforestation wood. This option has a strong multiplier effect (numbers in the note) and also enhances the quality of reforestation in the country (page 12).

Implications for the energy transition? Emerging world reforestation may increasingly gather momentum as a clean economic development model. We think this presents opportunities for companies that align themselves with the ‘reforest and reinvest’ model, while it will contribute to pushing high cost options off of the CO2 abatement cost curve.