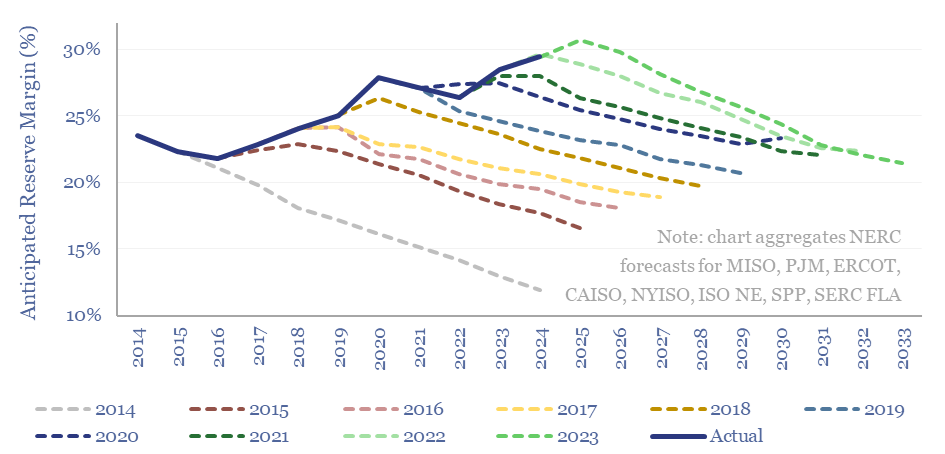

This 17-page note outlines how capacity markets work, in order to stabilize global power grids. We argue reserve margins in the US grid are not as healthy as they look (in the chart above). Data-centers are like wolves at the door. Capacity prices must rise. This boosts gas plants, grid-scale batteries and non-regulated utilities?

US grid resiliency is supported by c100 Reliability Standards written by NERC, enforced by FERC, and applicable to c100 balancing authorities, c325 transmission operators and c1,000 generation facilities in the US. Each violation can incur penalties up to $1M per day.

A key NERC Standard is to expect no more than 1 major grid outage per 10-year period, which in turn requires keeping reserve margins above 15%. Often quite far above. The evolution of these regulations is explained from first principles on pages 2-3.

The real challenge for resilient power grids is how to unlock sufficient long-term investment, aka the ‘missing money problem’. Different markets have capacity incentives in place, e.g., energy-only, centralized capacity markets, decentralized capacity markets. An overview of how capacity markets work is given on pages 4-5.

There might not seem to be any reason to worry about reserve margins given the title chart above. Yet we are worried (page 6) that demand will surprise to the upside (page 7), anticipated resources may underestimate renewables’ volatility (page 8), planning has become politicized (page 9) and some regions will deteriorate sharply (page 10).

What happens when reserve margins unexpectedly deteriorate? As a playbook, to inform our outlook, we provide some case studies from past data at ERCOT and CAISO on pages 11-13.

A key question in 2024 electricity markets is whether AI data centers could improve their time to market (see our AI video overview) amidst power grid bottlenecks by signing contracts to directly absorb large quantities of pre-existing power plants (e.g. per Amazon-Talen). If you think about how capacity markets work (pages 2-13), then data-centers are like a wolf at the door, for the reasons on page 14-15.

Capacity prices therefore need to increase, in order to safeguard today’s capacity chickens from the wolf at the door. We have attempted to quantify the necessary increases. This will flow through to the cash margins of gas turbines, nuclear facilities, grid-scale batteries, demand shifting contracts and non-regulated utilities, per pages 16-17.