This 13-page note aims to quantify the upside case for CCS in the United States, using economics, top-down and bottom-up calculations. Our conclusion is that a clear, $100/ton incentive could help CCS scale by c25x, accelerating over 500MTpa of projects in the next decade, which could prevent almost 10% of the US’s current CO2 emissions. Our numbers include blue hydrogen and next-gen CCS.

Current CCS incentives are not sufficient for hard-to-abate sectors in the US, within the <$50/ton confines of the 45Q tax credit (page 2).

Although CCS technology is mature, c$100/ton incentives are needed to kick-start the industry. The economics are built-up on pages 3-7.

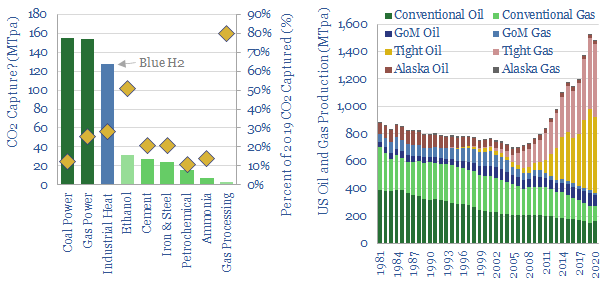

Top-down market-sizing is based on the oil and gas industry, which has extracted 900MTpa of hydrocarbons from sub-surface reservoirs, on average in the past 40-years. We discuss possible future CCS volumes relative to this baseline on page 8.

Bottom-up market sizing looks industry-by-industry, to break down possible capture volumes. We discuss each industry in turn – coal power, gas power, ethanol, steel, cement, et al., – on pages 9-12.

Blue hydrogen remains particularly exciting, for the decarbonization of smaller industrial facilities that may need to share infrastructure (page 13).