Steel explains almost c10% of global CO2. Hence 2021 has seen the world’s first ‘green steel’ made using green hydrogen. Yet inflation worries us. At $7.5/kg H2, green steel would cost 2x conventional steel. In turn, doubling the global steel price would re-inflate green H2 costs by $0.5/kg. This 16-page note explores inflationary feedback loops and other options for steel-makers.

Global steel production runs at 2GTpa, comprising one of the ‘top ten’ materials made by mankind. 70% of production is from blast furnaces and basic oxygen furnaces emitting 2.4 tons of CO2 per ton of steel output. Pages 2-4 provide an overview of the industry, its production processes and their CO2 emissions.

Green hydrogen is generating excitement as an abatement option. We review pilot projects and optimistic projections from technical papers on pages 5-6.

What about the costs? We have modeled the economics of a full-scale switch to green hydrogen in a Direct Reduced Iron + Electric Arc Furnace plant configuration. We would see costs doubling, but c85-90% of the CO2 can be removed (page 7).

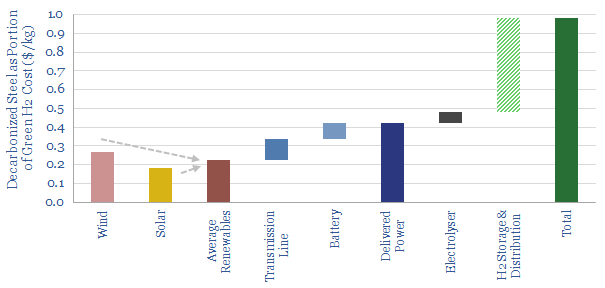

Inflationary feedback loops have been a recurring topic in our recent research, and steel makes an interesting case study. Steel is used in wind, solar, power distribution, batteries, hydrogen electrolysers and hydrogen storage infrastructure. So what happens to the price of green hydrogen if all of these value chain components switch to 2x more expensive green steel? We run through the results on pages 8-11, then discuss how these inflationary feedback loops might actually play on pages 12-13.

Technical challenges for the adoption of green hydrogen in the steel industry are discussed on page 14. We are skeptical of the cost-deflation promised in other studies.

Our conclusions are that there may be some niche uses for green steel, but we prefer other options for mass-scale decarbonization of the steel industry, on pages 15-16.