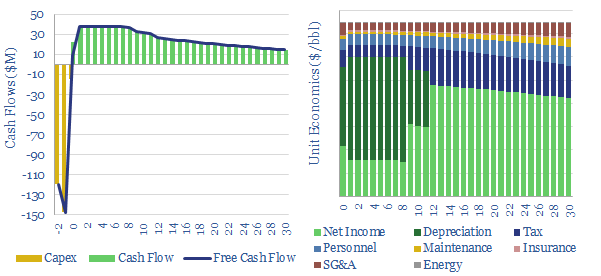

This data-file captures the economics of constructing an oil storage terminal (aka a “tank farm”).

The storage spread for a 10% IRR depends mostly on utilization. A typical facility that empties to c15-20% then refills to 80-85%, once per month, need only add a spread of $1.5/bbl to earn a 10% IRR.

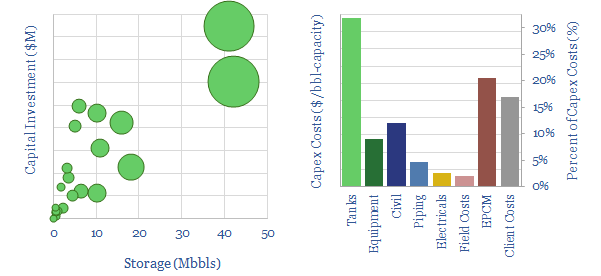

Cost data are taken from 20 prior projects, a granular bottom-up estimate and published disclosures from industry-leader Vopak. And they are around 97% lower, on a per-kWh basis, than the best renewables-battery storage options.

Economics may get more challenging during the energy transition, as it becomes harder to finance new storage terminals off assumptions for lower future utilization or outright phase-outs.