This database of global LNG contracts tabulates the details for 450 LNG offtake contracts where disclosures have been released into the public domain, tracking buyers, sellers, facilities, contract durations and destination flexibility. The total market has grown by 3x in the past 20-years to 401MTpa in 2023, while the spot and short-term market has increased by 10x to 150MTpa.

This database tabulates details for 450 LNG offtake contracts where details are available in the public domain, tracking buyers, sellers, facilities, contract durations and destination flexibility. We think this gives a pretty good coverage of the market, although there may also be some non-public contracts, which are not captured in our database.

Underlying details in the database are drawn from company reports and disclosures from GIIGNL, which is an LNG industry body, founded in 1971, with 95 member companies in 29 markets.

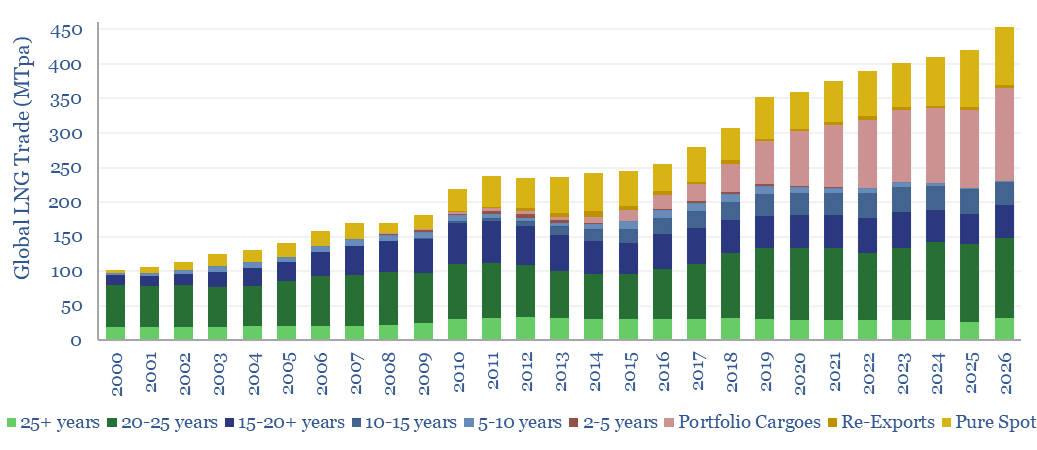

Back in 2000, the LNG market was just 100MTpa, c90% of the market was traded on long-term contracts (defined as having 10-years’ duration or more), and the weighted average cargo was on a 22-year contract.

By 2023, the global LNG market has surpassed 400MTpa, and only 55% of the market is traded on long-term contracts, while 35% was traded purely on spot. The weighted average cargo is on a 10-year contract.

Market depth has increased. Customers increasingly prefer flexibility, which the industry has reached the scale to support. It does not connote waning interest in security of supply: indeed medium-long term global LNG contracts have increased their average duration from 14-years in 2015 to 19-years in 2023.

Flexibility will continue rising through 2026, when half of a 500MTpa global LNG market could be traded spot, up from 35-40% in 2024.

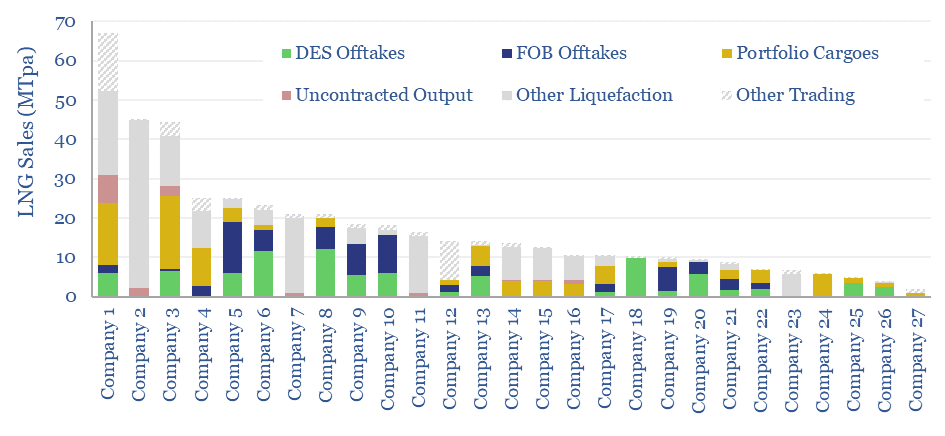

25 major LNG companies offtook, marketed and sold 65% of the world’s LNG, as tabulated in the LNGContracts tab of this data-file. Our breakdown of global LNG sales by company, in MTPa is previewed below.

Shell and TOTAL were most active, both absorbing around 15-20MTpa of LNG as portfolio cargoes, which can be directed anywhere, followed to a lesser extent by BP, while other Major Energy companies have been less active in spot LNG, limiting their exposure to upstream and liquefaction.

We see increasing value in flexibility as a backstop to renewables, amidst our outlook for LNG in the energy transition.