What is the marginal cost of offshore oil and gas? To answer this question, offshore oil’s marginal cost is modelled in this data-file, capturing the economics of a small-mid sized oil project, off the coast of Africa, first found in the mid-1980s and vying for development ever since.

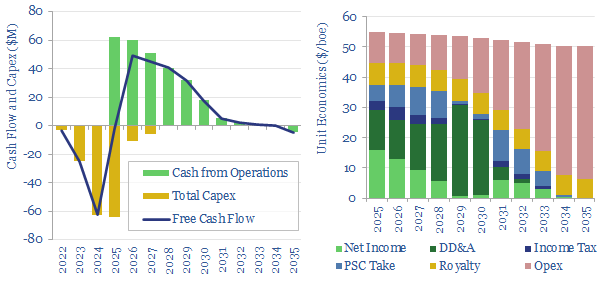

Our base numbers include $15/boe of development costs, $15/boe of opex and 70% of the ‘profits’ accrue to the host government in fiscal tax, spanning royalties, PSC take and income taxes. All of these are good ‘ballpark’ numbers, although a more detailed cost breakdown is in the data-file.

In NPV terms, the project ‘breaks even’ at $35/bbl (0% IRR), covers a 6% WACC at $40/bbl, 10% WACC at $45/bbl, 20% WACC at $60/bbl and 30% WACC at $90/bbl (the increasing sensitivity is a function of the PSC structure).

Note these are life-of-the-project averages. If oil prices spiked to $200/bbl in 2023, it would be irrelevant, given a 2-4 year development time. Project returns will mostly be determined by oil prices in the peak production years of 2025-2028, which ideally could be hedged.

If we were private equity investors, considering funding a project with this risk profile, honestly, we would start getting excited at a 30% IRR, which in turn might require the forward curve to offer up $90/bbl through 2028, for projects like this to definitively move ahead and improve future energy balances.

Details will of course vary, project by project, and some projects may receive helpful tax incentives. You can flex details in this model.

To read more about the marginal cost of offshore oil and gas, please see our article here.