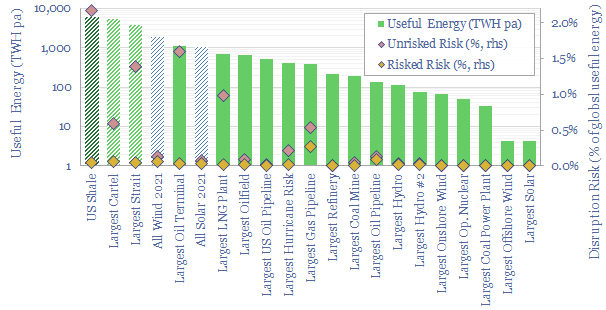

World’s largest energy assets by type. The size and risk of global energy assets are assessed in this data-file, which focuses in upon the largest energy assets in the world, the energy derived from them (in TWH) and their resultant risk profiles. Our workings and conclusions are presented in the data-file.

For example, the analysis includes a description and a risk assessment for each of: the world’s largest oil terminal (1,100TWH pa of useful energy supplied to the world), the world’s largest LNG plant (700TWH pa), oilfield (650TWH pa), oil pipeline (500TWH pa), gas pipeline (400 TWH pa), refinery (200TWH pa), coal mine (200TWH pa), hydro plant (100 TWH pa), nuclear plant (50TWH pa), offshore wind farm (4TWH pa) or solar asset (4TWH pa).

The main risks for large assets are one-offs, such as outages, political disputes and outright sabotage. But the energy industry is also shifting to smaller assets (renewables, shale), where the main risks are systemic ones that impact all assets, such as particularly non-windy years or possible kamikaze policies such as fracking bans. Climate change likely also creates higher risks to energy security due to drier weather and hurricanes.

Overall, the analysis suggests it is not unrealistic to fear that global energy supplies could come in 2% lower than base case models, which are linked here.

Further discussion on the world’s largest energy assets, and our conclusion on a particularly large and important gas, oil, shale, nuclear, wind and solar assets are linked here.