Could PGMs experience another up-cycle through 2030, on more muted EV sales growth in 2025-30, and rising catalyst loadings per ICE vehicle? This 16-page note explores global supply chains for platinum and palladium, the long-term demand drivers for PGMs in energy transition, and profiles leading PGM producers.

Our electric vehicle outlook has been revised down twice in 2024, due to market saturation, and our updated outlook for EV costs. A year ago, we hoped that EV sales would quadruple, from 14M BEV and PHEV sales in 2023, to 65M units in 2030. We now expect closer to 40M EV sales in 2030. Key observations are re-capped on pages 2-3.

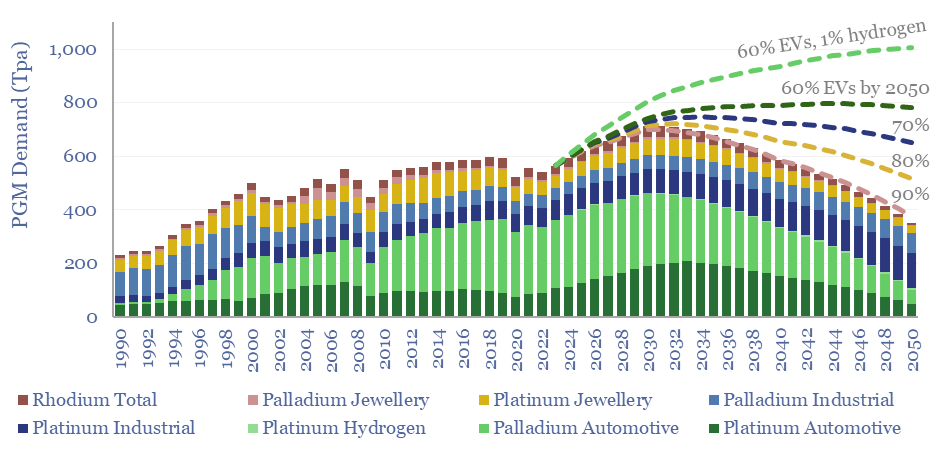

65% of global PGMs are used in the catalytic converters that give today’s ICE vehicles 20-100x lower emissions of CO, NOx, unburned hydrocarbons and particulates compared with 50-years ago. Hence could fewer EVs and more ICEs change the outlook for PGMs in energy transition?

PGMs comprise six silver-white metals, which co-occur in nature and have remarkable catalytic properties: platinum, palladium, rhodium, ruthenium, iridium and osmium. To help understand the industry, this report outlines PGM supply-demand (page 4), pricing (page 5) and use in vehicle catalysts (pages 6-7).

PGM use per ICE vehicle is expected to rise, for three key reasons, which are outlined on pages 8-9. They are linked to the changing vehicle mix, emerging world air standards and increasing deployment of hybrids and turbocharged engines within ICE passenger vehicles.

Hydrogen vehicles do not play a large role in our roadmap to net zero, but present an interesting ‘what if’. Each hydrogen truck contains 4x more PGMs than a typical diesel truck (pages 10-11).

Forecasts and sensitivities for global PGMs in energy transition could see another upcycle through 2030, while the long-term outlook depends upon the ultimate share of EVs and hydrogen vehicles in the 2030-50 fuel mix, as quantified on pages 12-13.

Leading producers of PGMs are profiled on pages 14-16. Eight companies control 90% of global mining, refining and recycling. Mostly mid-caps. Many are trading at 2-15-year lows, due to weak market expectations for PGMs and weak recent PGM pricing, while those that have pivoted towards battery metals have recently profit-warned.

Conclusions in the report are strongly linked to our recent outlook for EV adoption in 2025-30, which is also shown below.