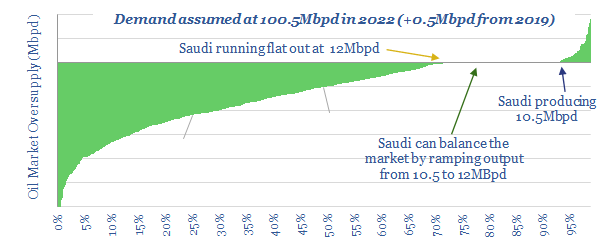

2022 oil markets now look 2Mbpd under-supplied, portending another industry up-cycle. 1.5bn bbls of excess inventories from the COVID crisis have likely been drained by early-2021, allowing OPEC to ramp back fully from production cuts by mid-2021. Yet this year’s disruption to shale and across the wider industry will drain a further 2.5bn bbls from inventories by mid-2023. It takes until 2024 for oil markets to re-balance. Inventories remain historically low until late in the decade.

This 4-page note makes the case for the next oil industry up-cycle, with a one-page summary of our thesis, plus three pages of charts covering market balances, demand, shale, other supply, inventories and our Monte Carlo analysis. The underlying models are available here for TSE clients.