-

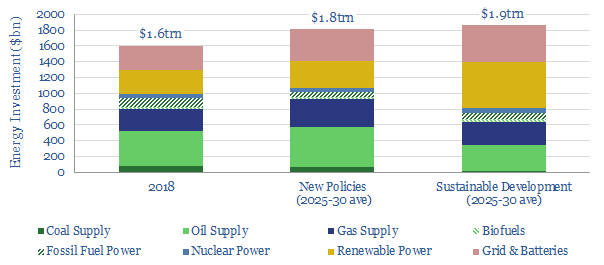

Is the world investing enough in energy?

The IEA has cautioned that global energy investment may be falling short. Spending of $1.6trn in 2018 may need to rise $220-270bn pa by 2025-30. We argue the best way to attract this capital is through the opportunities in better energy technology.

-

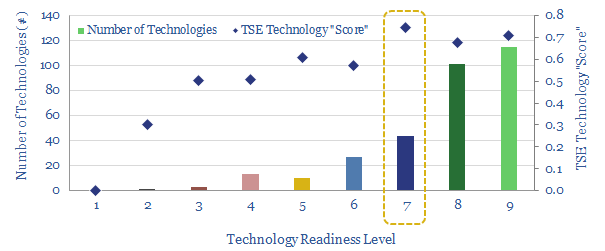

TRLs: When does technology get exciting?

We categorised 300 of the Oil Majors’ technologies according to their technical maturity. The most exciting are those on the cusp of commercialisation, not simply the most mature. We found Majors that work on earlier-stage technologies also had better overall technologies. Value can be maximised by a rich funnel of opportunities.

-

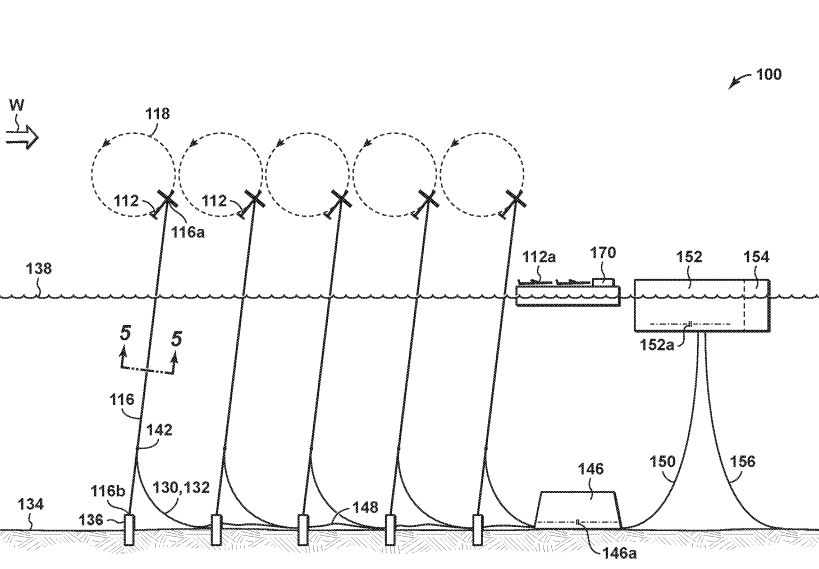

Two Majors’ Secret Race for the Future of Offshore Wind?

Tethered kites access 2-4x more wind-power at 50-90% lower costs than turbines. Intriguingly, Exxon and Shell are now at the forefront of the new opportunity.

-

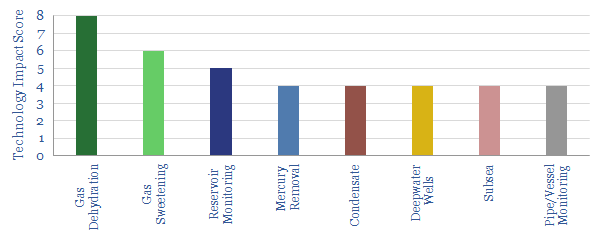

Mozambique LNG: Can Chevron create more value?

It would be unwise to under-estimate the complexity of creating a new LNG province, with a 50MTpa prize ultimately on the table in Mozambique. Hence we have tabulated our ‘top ten’ examples of Chevron’s LNG-relevant technologies, from reviewing over 200 of the company’s patents so far.

-

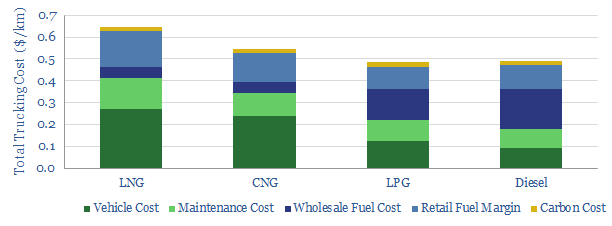

Is gas a competitive truck-fuel?

We have assessed whether gas is a competitive trucking fuel, comparing LNG and CNG head-to-head against diesel, across 35 different metrics (from the environmental to the economic). Total costs per km are still 10-30% higher for natural gas, even based on $3/mcf Henry Hub, which is 5x cheaper than US diesel.

-

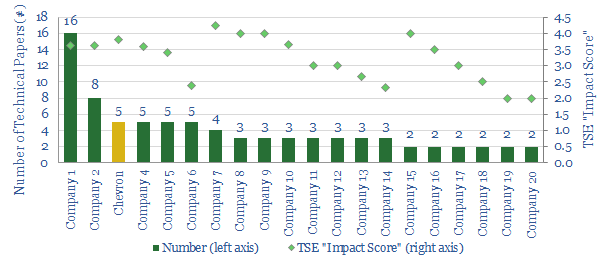

Who else wants more shale?

The Majors’ deepening interest in shale was illustrated by Chevron’s $50bn acquisition of Anadarko. To see who else wants more shale, we have counted the number of shale research-studies, by company, in our databases from 2018.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)