-

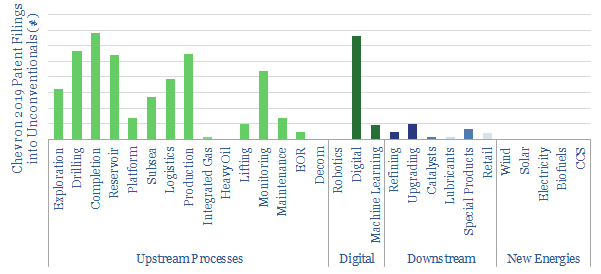

Chevron: SuperMajor Shale in 2020?

SuperMajors’ shale developments are assumed to differ from E&Ps’ mainly in their scale and access to capital. Superior technologies are rarely discussed. But new evidence is emerging. This 11-page note assesses 40 of Chevron’s shale patents from 2019, showing a vast array of data-driven technologies, to optimize every aspect of shale.

-

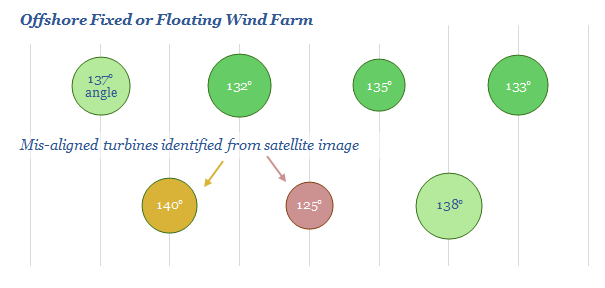

Offshore Wind: Tracking Turbines with Satellites and Machine Learning?

Equinor has patented a machine learning method to optimise offshore wind farms using satellite imagery or pictures from drones. We estimate a 0.5% IRR uplift on offshore wind projects. As Oil Majors move into renewables, it is important to be leaders not followers.

-

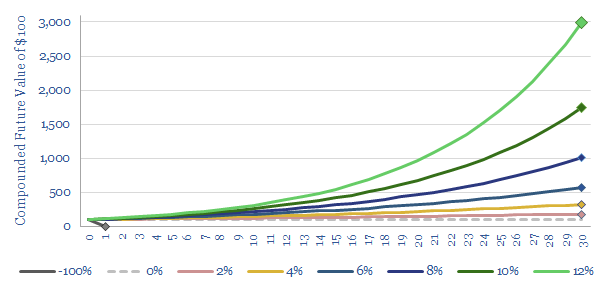

The Most Powerful Force in the Universe?

Investors may suffer if they do not consider the energy transition. But they may suffer much more if they consider it, and get the answer wrong. The best way to drive the energy transition will be to maximise carbon-adjusted investment returns.

-

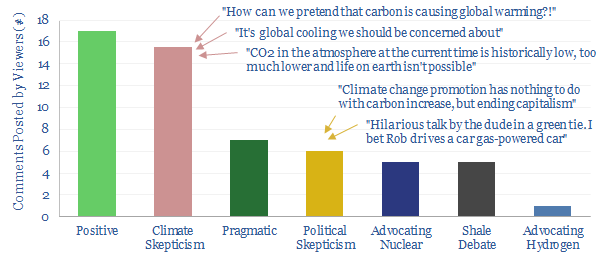

Energy Transition: Polarized Perspectives?

Last year, we appeared on RealVision, advocating economic opportunities that can decarbonize the energy system. The “comments” surprised us, suggesting the topic of energy transition is extremely polarized. Historically, such ideological polarization has not ended well. This re-affirms the need for energy technologies.

-

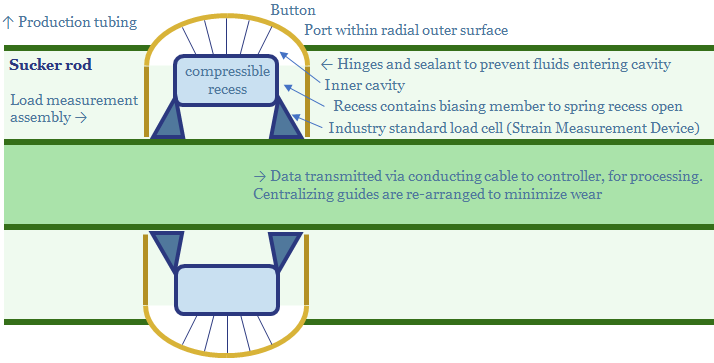

EOG’s Digitization: Pumped-Up?

EOG patented a new digital technology in 2019: a load assembly which can be built into its rod pumps: to raise efficiency, lower costs and lower energy consumption. This 8-page note reviews the patent, illustrating how EOG is working to further digitize its processes, maximise productivity and minimise CO2 intensity.

-

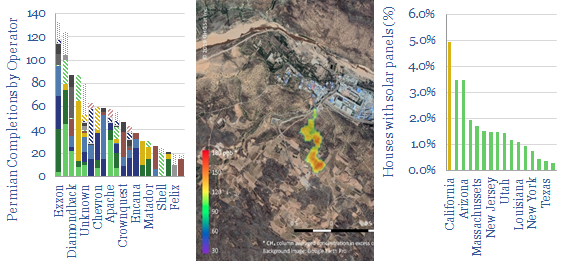

Satellites: the spy who loved methane?

Satellite analysis is gaining momentum, and features in three of our recent research reports. A step-change in resolution is helping to mitigate methane. It is possible to track Permian completions from space. We also suspect renewable growth may slow. More satellite images should reshape commercial research as costs deflate.

-

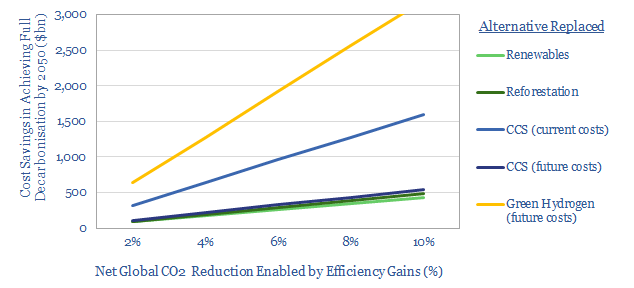

CO2-Labelling for an Energy Transition?

CO2-labelling is the most important policy to accelerate the energy transition: making products’ CO2-intensities visible, so they can sway purchasing decisions. Expect 4-8% savings across global energy, which will lower the net costs of decarbonisation by $200-400bn pa. Digital technologies also support wider eco-labelling compared. Leading companies are preparing their businesses.

-

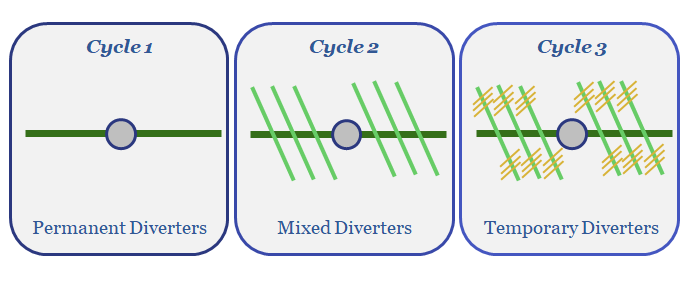

New Diverter Regimes for Dendritic Frac Geometries?

The key challenge for the US shale industry is to continue improving productivity per well. The process is increasingly being driven by Oil Majors and using data. This is illustrated by BP’s latest fracturing fluid patents, which optimise successive diverter compositions to create dendritic fracture geometries, to enhance stimulated rock volumes.

-

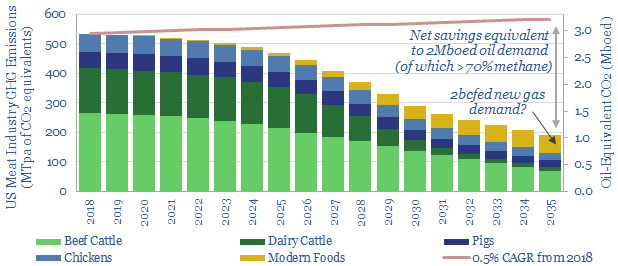

Disrupting Agriculture: Energy Opportunities?

Precision-engineered proteins are on the cusp of disrupting the agriculture industry. The science is improving rapidly, to create meat-substitutes with vastly superior nutrition, taste and costs. We explore the energy consequences of “replacing cows”, with potential for 2bcfd upside to US gas demand, to offset the CO2 of all US oil demand, increase US biofuels…

-

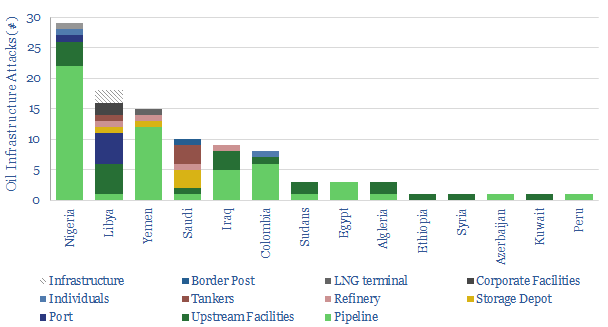

Drone Attacks on Energy Assets?

A devastating new wave of drone technologies could place the world’s largest and most vulnerable energy infrastructure into the firing line of aggressors. This short note reviews the ten facets of drone swarms that make them so dangerous. Hence we are increasingly concerned over supply disruptions in the 2020s.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)