An exciting aspiration in wind technology is to obviate large, expensive “towers”, and unleash tethered kites into the skies. They can access 2-4x more wind-power at greater altitudes, and at 50-90% lower costs. Intriguingly, we have discovered Exxon and Shell are at the forefront of pursuing this new wind opportunity offshore, based on their patents and filings.

[restrict]

Oil Majors & Wind Energy

If you search the internet for Exxon’s “wind power” business, you are most likely to encounter its range of lubricants for wind-turbines. Its largest public foray so far is a 250MW commitment to offtake wind power into its Permian operations from Orsted’s Sage Draw wind farm.

For Shell, the narrative is around scaling up today’s wind turbines, under its $1-2bn new energies capex commitment. Its most recent bid was for a 2.5GW wind consortium, 8-miles off Atlantic City; off the heels of its 730MW Borssele III-IV project from the Netherlands.

Yet we have found new evidence that both of these Super-Majors are actively looking to a novel offshore wind technology, with potential to unlock larger quantities of energy at materially lower costs.

The theory: aiming higher?

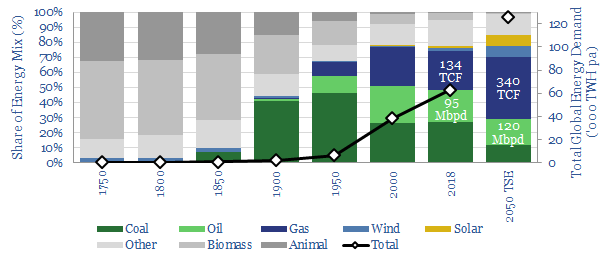

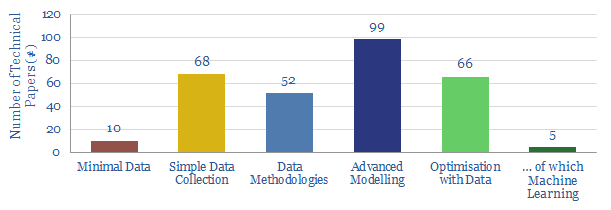

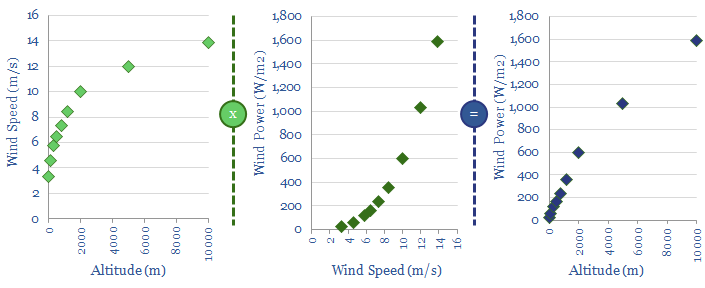

Wind power in the earth’s atmosphere increases with altitude, as shown below. At 300m, it should be possible to access 2x more power than at 80m, based on global average wind speeds, modelled here.

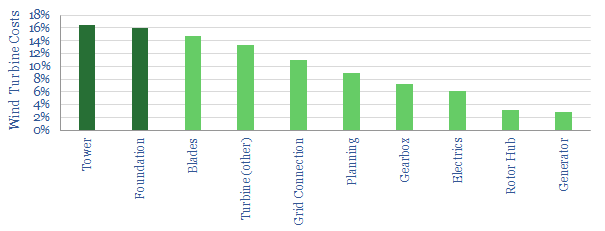

The challenge for conventional wind is how to access these higher wind speeds. The 4,000m foundation and 700T tower already comprise c35% of a typical, 80m wind-turbine’s overall cost.

Hence there is an entire green-tech industry dedicated to “flying wind”. These are airborne drones that submit their power back down to ground level via a tether. The academic literature estimates costs per-kW could be 10-50% the level of conventional wind turbines. “Technology Readiness” ranges from Level 3 to Level 7.

The most famous example would be Makani, which tested a 600kW capacity vehicle in 2017, with the backing of Google (video below). Scroll half-way through the video, to 17-minutes, and you see the tethered craft mid-flight, conducting a looping series of nose-dives: when the vessel surpasses 85mph, according to our calculations, its on-board propellors could be beaming a full 600kW of power back down the tether-cable, towards the base-station. The glider is then carried back up to altitude like a kite, before commencing another dive.

Exxon and Shell are examining what to do with this technology

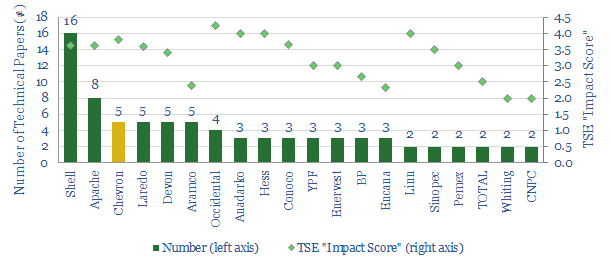

ExxonMobil has filed a series of patents to deploy tethered kites offshore, “opening up a resource system which is four times greater than the electrical generation capacity of the entire United States” (in the patents’ own words).

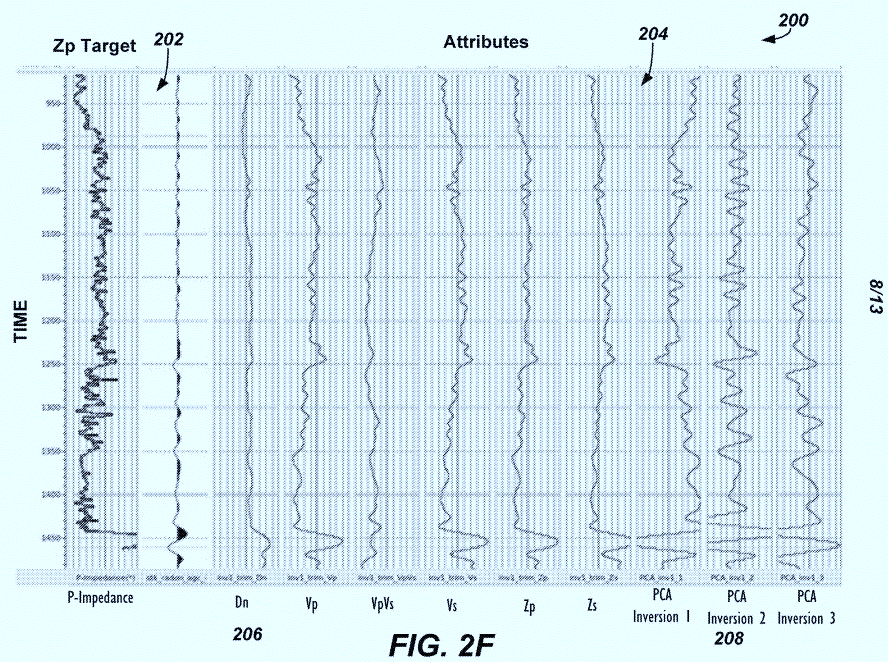

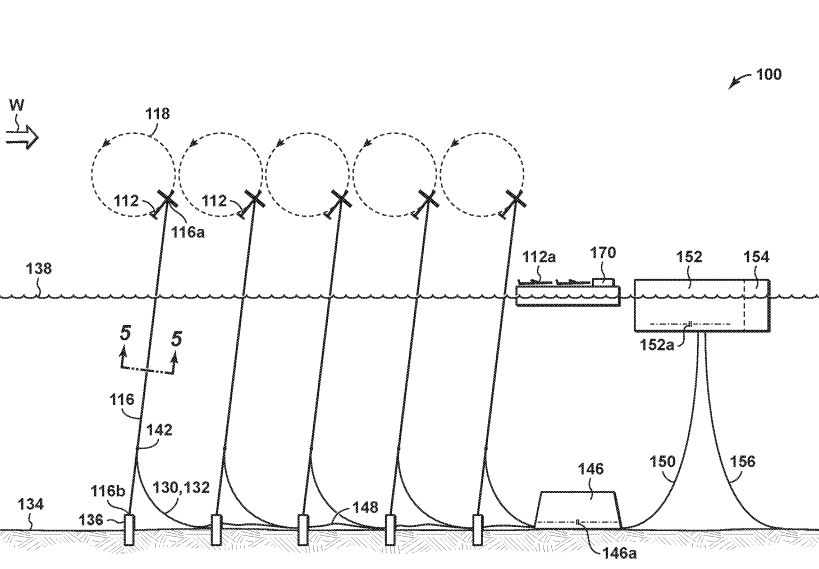

The image below shows Exxon’s concept for an offshore wind farm, with 25 kites (each with 20kW-5MW capacity), arranged in 5 rows of 5. Each row of kites has its own umbilical, electrical module and distribution cable.

The patent includes some comprehensive considerations: the tether system, its connection to a floating structure, the anchor piles, a quick-disconnect system, and offshore maintenance procedures.

Exxon’s floating offshore wind concept?! (150) is a local electrical distribution cable, (146) is an underwater electrical module and (152) is an offshore substation.

Exxon continued refining these patents in 2018, with at least three further filings (in the jurisdictions of Argentina and Taiwan… read into that what you will). We have contacted the company for a comment on any plans to test or pilot the technology, and will update this article with any answers.

Meanwhile, Shell is also stepping up its interest in offshore wind kites. In February-2019, it signed its own partnership with Makani, saying that it “plans to kick-off testing of this new floating offshore system with demonstrations in Norway later this year”. Previously, Shell also invested €6M in Kite Power Systems, another aerial wind concept.

So we have here, an intriguing secret race between two of the largest Oil Majors, at the cutting edge of offshore wind-tech.

Sources & References

Zillman, U., (2015). The Trillion Dollar Drone. Airborne Wind Energy Conference 2015

Hart, C., & Bushby, D. (2017). Airborne Power Generating Crafts Tethered to a Floating Structure. Patent WO2017218118.

Goldstein, L. (2015). Theoretical analysis of an airborne wind energy conversion system with a ground generator and fast motion transfer. Energy Volume 55, 15 June 2013

[/restrict]