-

Mozambique LNG: Can Chevron create more value?

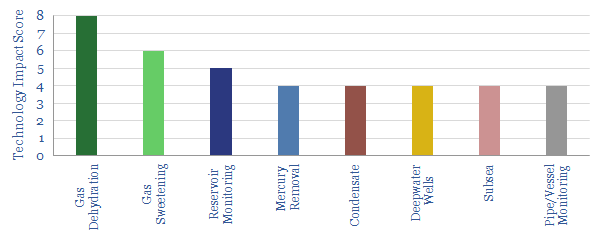

It would be unwise to under-estimate the complexity of creating a new LNG province, with a 50MTpa prize ultimately on the table in Mozambique. Hence we have tabulated our ‘top ten’ examples of Chevron’s LNG-relevant technologies, from reviewing over 200 of the company’s patents so far.

-

EOG’s Completions: Plugged-In?

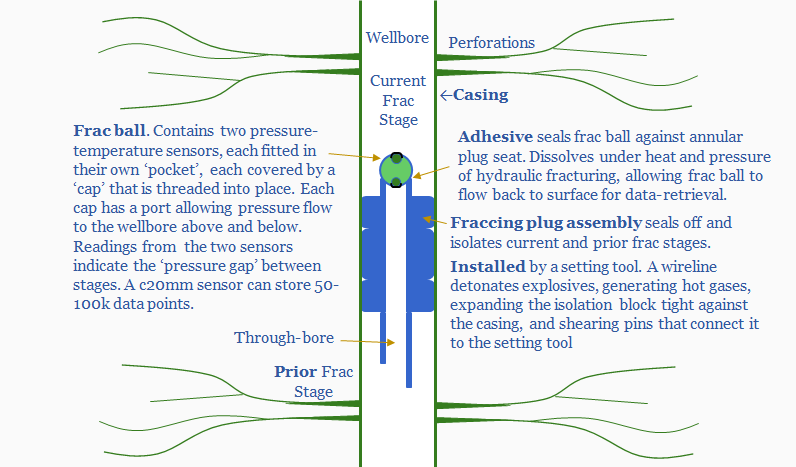

EOG has patented a system to run pressure and temperature sensors in its frac plugs, which are then retrieved at the surface, providing low cost data on each frac stage. The data improve subsequent stages. We estimate the NPV uplifts at $1M/well.

-

Is gas a competitive truck-fuel?

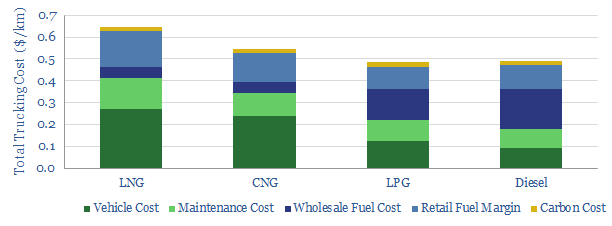

We have assessed whether gas is a competitive trucking fuel, comparing LNG and CNG head-to-head against diesel, across 35 different metrics (from the environmental to the economic). Total costs per km are still 10-30% higher for natural gas, even based on $3/mcf Henry Hub, which is 5x cheaper than US diesel.

-

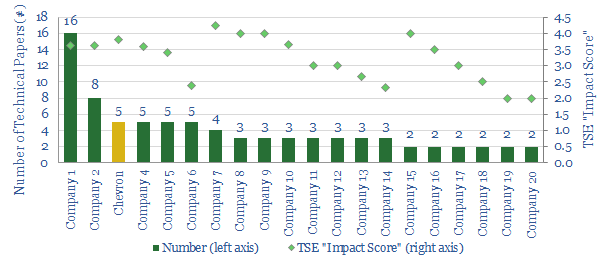

Who else wants more shale?

The Majors’ deepening interest in shale was illustrated by Chevron’s $50bn acquisition of Anadarko. To see who else wants more shale, we have counted the number of shale research-studies, by company, in our databases from 2018.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)