-

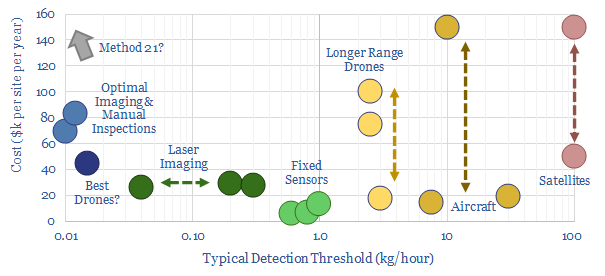

Global gas: catch methane if you can?

Scaling up natural gas is among the largest decarbonisation opportunities. But this requires minimising methane leaks. Exciting new technologies are emerging. This 28-page note ranks producers, positions for new policies and advocates developing more LNG. To seize the opportunity, we also identify 35 companies geared to the theme. Global gas demand will not be derailed…

-

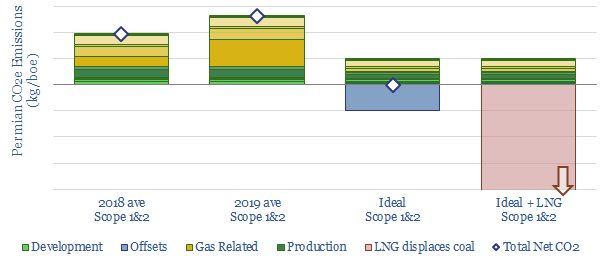

Shale growth: what if the Permian went CO2-neutral?

Shale growth has been slowing due to fears over the energy transition, as Permian upstream CO2 emissions reached a new high in 2019. We disaggregate the CO2 across 14 causes. It could be eliminated by improved technologies, making Permian production carbon neutral: uplifting NPVs by c$4-7/boe, re-attracting a vast wave of capital and growth. This…

-

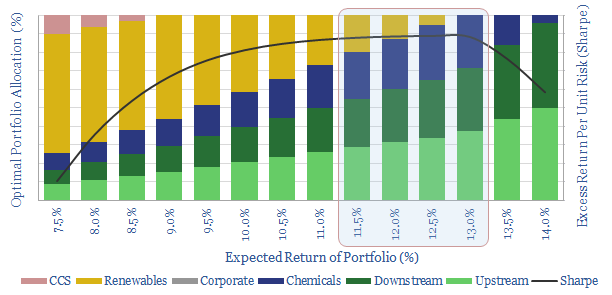

Ramp Renewables? Portfolio Perspectives.

It is often said that Oil Majors should become Energy Majors by transitioning to renewables. But what is the best balance based on portfolio theory? We constructed a mean-variance optimisation model and find a c5-13% weighting to renewables best increases risk-adjusted returns. Beyond 35%, returns decline rapidly.

-

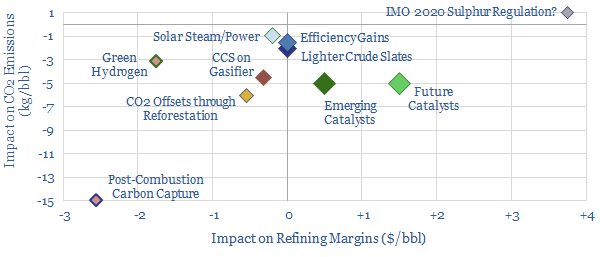

Decarbonise Downstream?

Refining has the highest carbon footprint in global energy. Next-generation catalysts are the best opportunity for improvement: uniquely, they could cut refineries’ CO2 by 15-30%, while also uplifting margins, which get obliterated by other decarbonisation approaches. Catalyst science is undergoing a digitally driven transformation. Hence this 25-page note outlines a new ESG opportunity around refining…

-

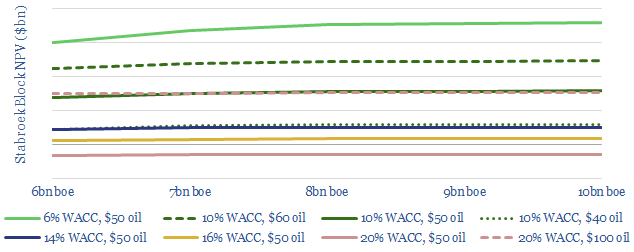

Guyana: carbon credentials & capital costs?

Prioritising low carbon barrels will matter increasingly to investors, as they can reduce total oil industry CO2 by 25%. Hence, these barrels should attract lower WACCs, whereas fears over the energy transition are elevating hurdle rates elsewhere and denting valuations. In Guyana’s case, the upshot could add $8-15bn of NAV, with a total CO2 intensity…

-

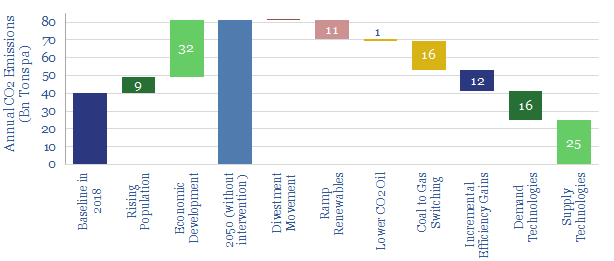

Investing for an energy transition

What is the best way for investors to decarbonise the global energy system? Our new, 18-page report argues this outcome is achievable by 2050, but a new ‘venturing’ model is needed, to incubate better technologies. CO2 budgets can also be stretched furthest by re-allocating to gas, lower-carbon oil and lower-carbon industry. The biggest risk is…

-

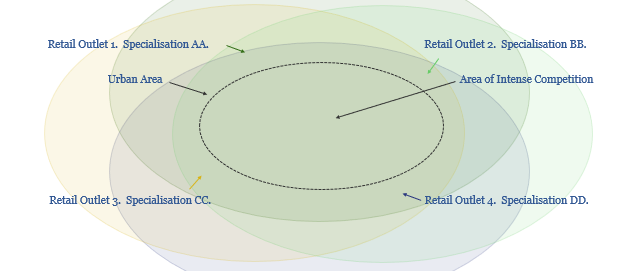

Drones & droids: deliver us from e-commerce

Autonomous, electric delivery vehicles are emerging. They are game-changers: rapidly delivering online purchases to customers, creating vast new economic possibilities, but also driving the energy transition. They could eliminate 500MTpa of CO2, 3.5Mboed of fossil fuels and c$3trn pa of consumer spending across the OECD. The mechanism is a re-shaping of urban consumption habits, retail…

-

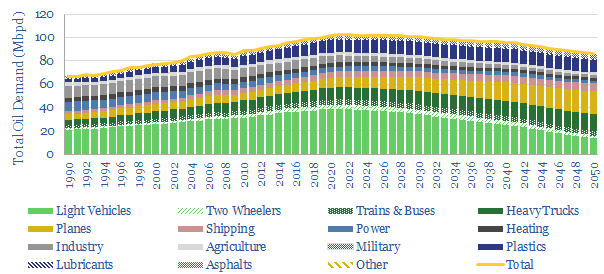

2050 oil markets: opportunities in peak demand?

Our new, 20-page note reviews seven technology themes that can eliminate 45Mbpd of long-term oil demand by 2050. We therefore find oil demand would plateau at 103Mbpd in the early-2020s, before declining gradually. Opportunities greatly outnumber risks for leading companies amidst this transition.

-

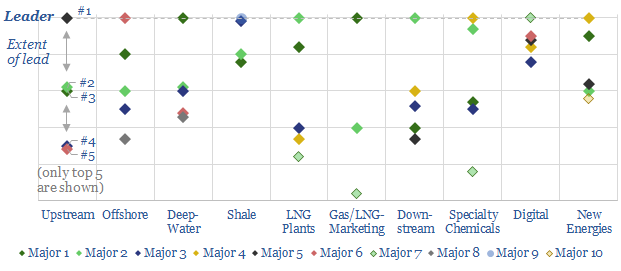

Patent Leaders in Energy

Technology leadership is crucial in energy. It drives costs, returns and future resiliency. Hence, we have reviewed 3,000 recent patent filings, across the 25 largest energy companies. Our 34-page report outlines the “Top 10 Technology Leaders” in energy, ranging across each sub-sector.

-

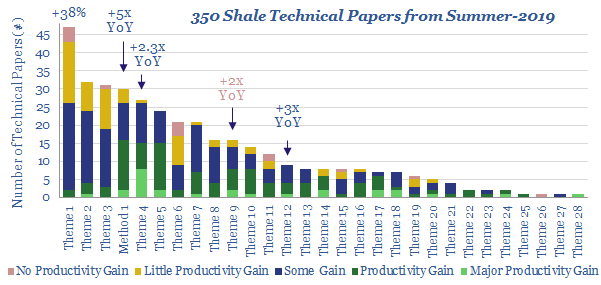

US Shale: No Country for Old Completion Designs

2019 has evoked resource fears in the shale industry. They are unfounded. Weak headline productivity is the benign result of changing completion designs. We review 350 technical papers from the shale industry in summer-2019 to rule out systemic issues. Underlying productivity continues improving at an exciting pace.

Content by Category

- Batteries (87)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (829)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (277)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (126)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (350)