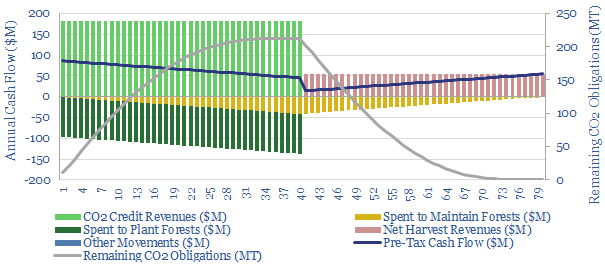

This economic model illustrates a carbon fund to decarbonize natural gas by planting new forests, while also generating passable economics, attracting investment and incentivizing CO2 savings.

The mechanics are that the fund collects carbon credits, which are bundled into the contractual sales price of natural gas (typically costing less than $1/mcf). Part of the carbon credits are used to plant forests. The remainder are kept as financial reserves, to ensure the fund can meet its future offset obligations. Once these obligations have been met, the financial reserves can be disbursed to the fund’s limited partners.

Please download the data-file to stress-test forestry costs, carbon pricing, gas pricing and optimisation opportunities.