Biofuels

-

Biofuel technologies: an overview?

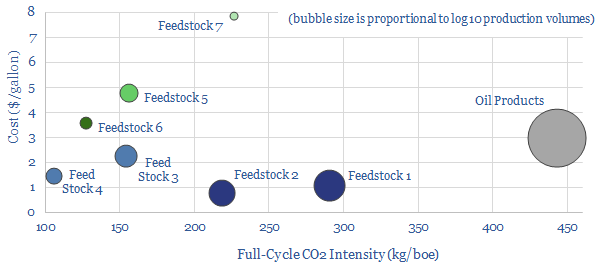

Biofuels are currently displacing 3.5Mboed of oil and gas. But they are not carbon-free, and their weighted average CO2 emissions are only c50% lower. This data-file breaks down the biofuels market across seven key feedstocks, to help identify which opportunities can scale for the lowest costs and CO2, versus others that require further technical progress.

-

Sustainable aviation fuel: flight path?

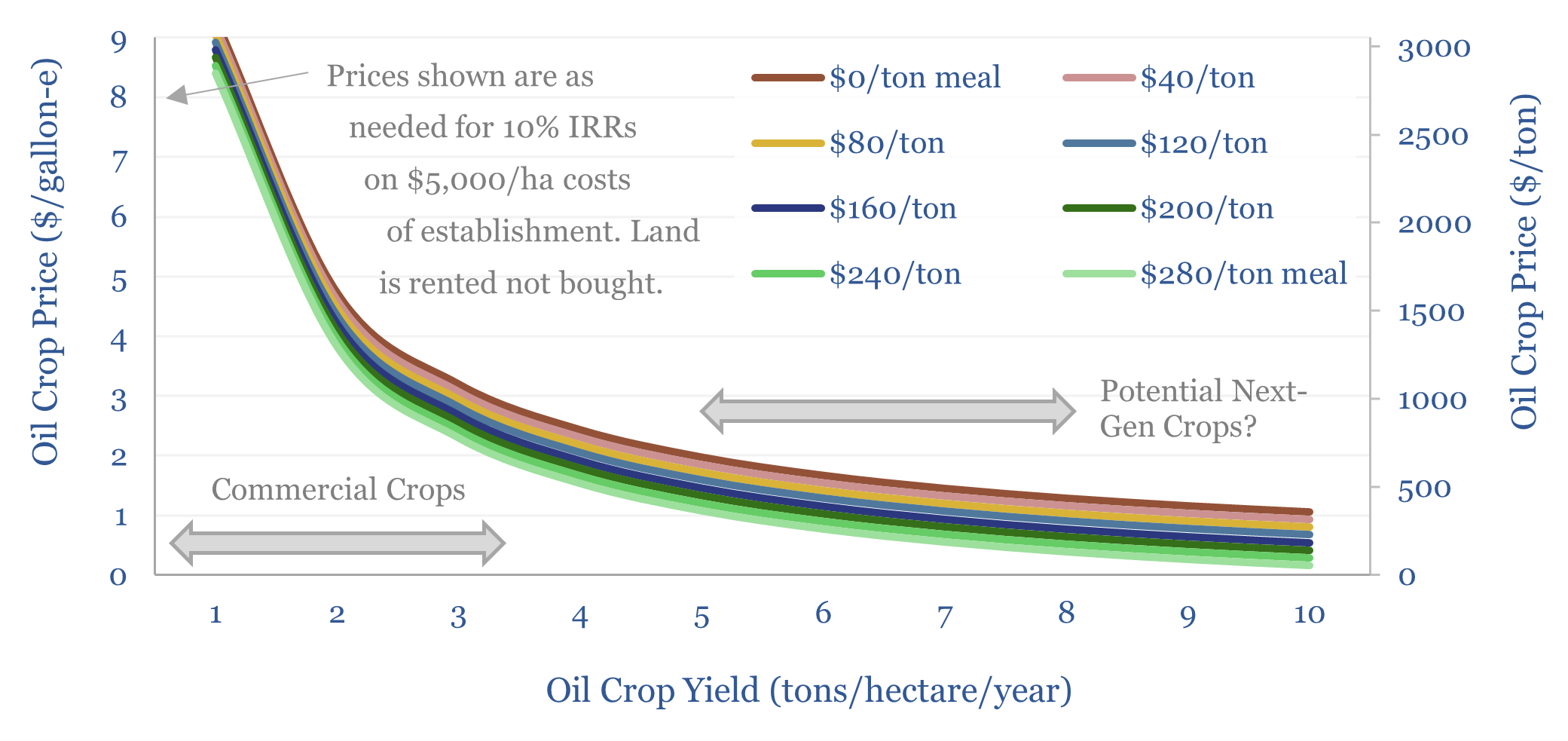

As things stand, we argue Europe will be forced to scale back its SAF targets, due to Sustainable Aviation Fuel costs and land constraints. However, our 17-page report asks what could improve the outlook. Specifically, what yields, costs and other properties would we need to see from an oil crop to get excited about unlocking…

-

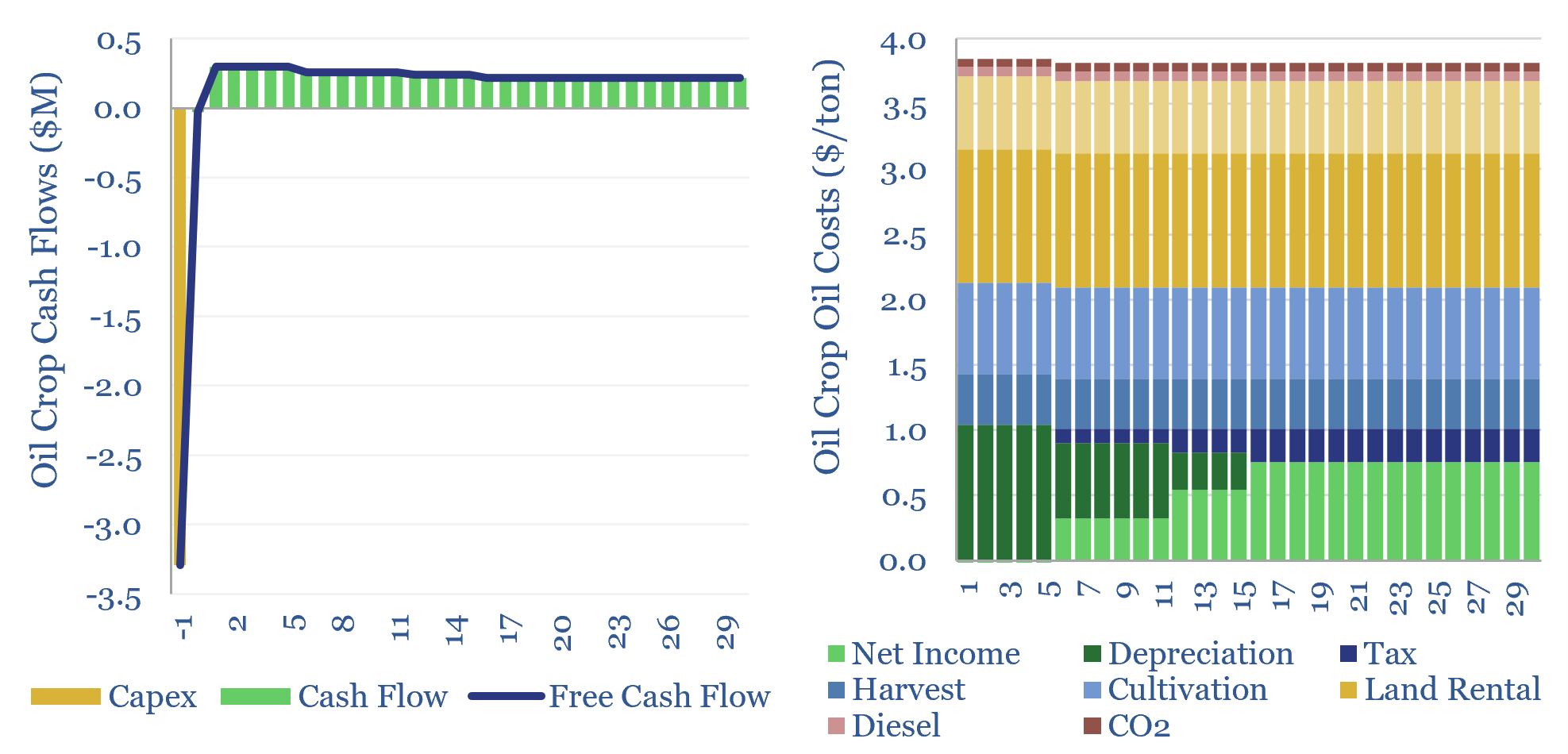

Oil crops: the economics?

The costs of oil crops, a crucial input for bio-diesel and SAF, will usually range from $900-1,200/ton, in order to generate acceptable 6-15% IRRs for producers. This translates into $3-4/gallon in feedstock costs. These oil crops also likely embed over 2 kg/gallon of CO2 intensity. The economics of oil crops can be stress-tested in this…

-

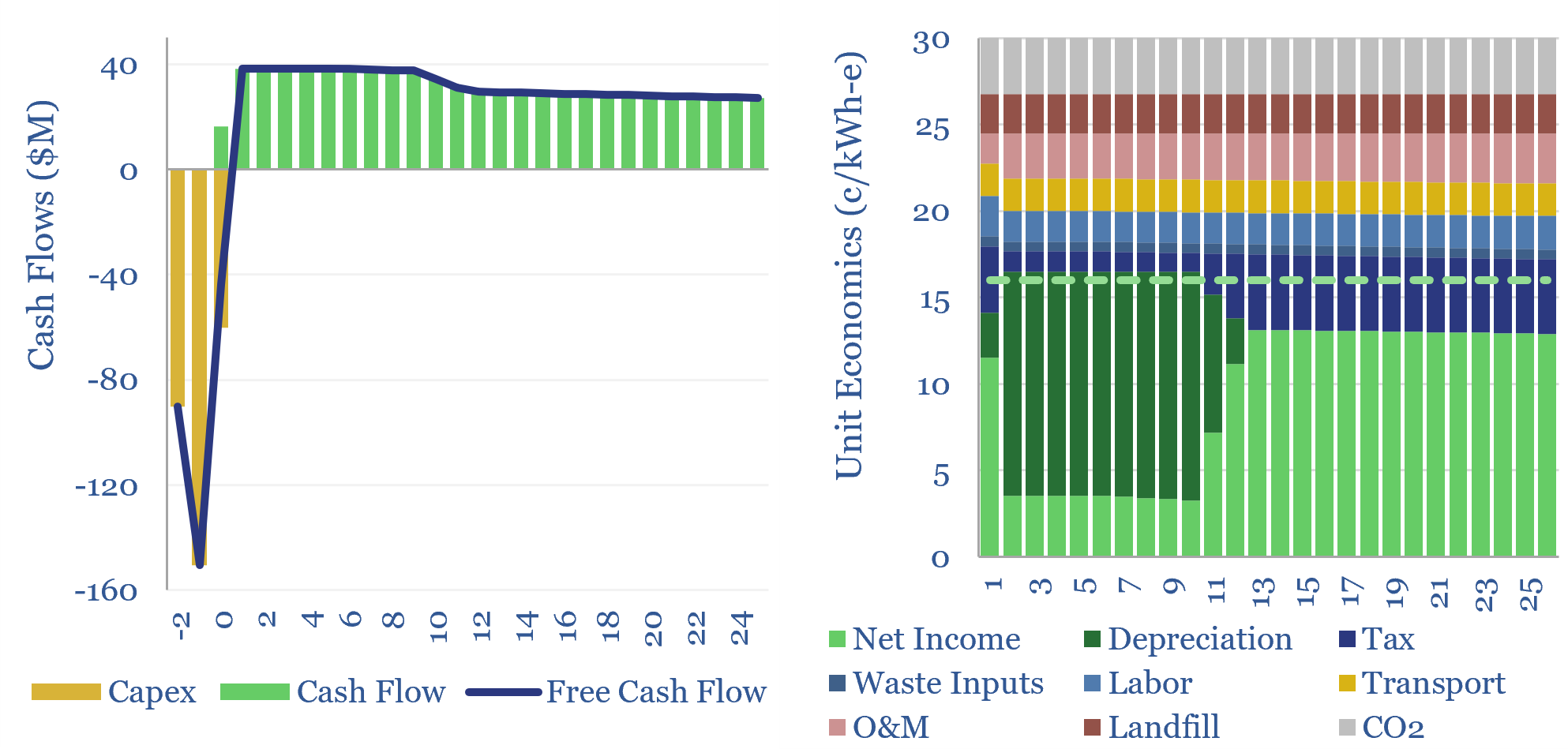

Waste-to-energy: levelized costs of electricity?

A typical waste-to-energy plant, without subsidies, must charge 16c/kWh to generate a 10% IRR off of c$7,000/kW in capex costs, plus another 14c/kwh-equivalent of revenues from avoided landfilling and metals recovery. This economic model covers waste-to-energy levelized costs of electricity.

-

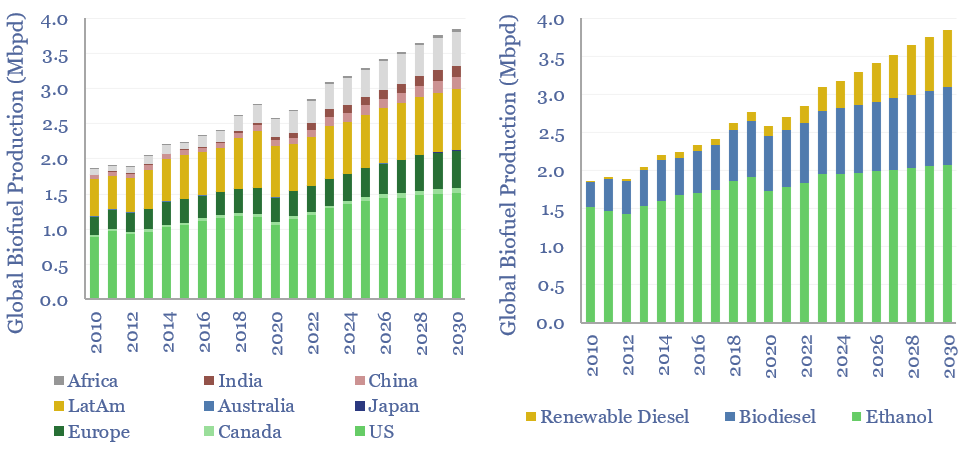

Global biofuel production: by region, by liquid fuel?

Global liquid biofuel production ran at 3.2Mbpd in 2024, of which c60% is ethanol, c30% is biodiesel and c10% is renewable diesel. 65% of global production is from the US and Brazil. Global liquid biofuel production reaches 3.8Mbpd by 2030 on our forecasts.

-

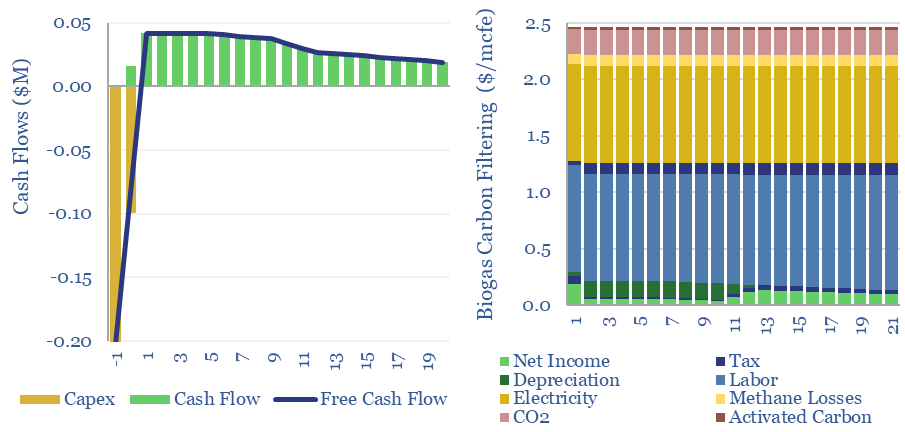

Costs of biogas upgrading to biomethane?

Costs of biogas upgrading into biomethane are estimated at $7/mcf off of capex cost of $400/ton, in this data-file. The largest contributor to total costs is carbon filtering, to remove siloxanes, VOCs and H2S, which we have modelled from first principles, at $2/mcfe. Underlying data into biogas compositions and impurities are also tabulated for reference.

-

Sugar to ethanol: value in volatility?

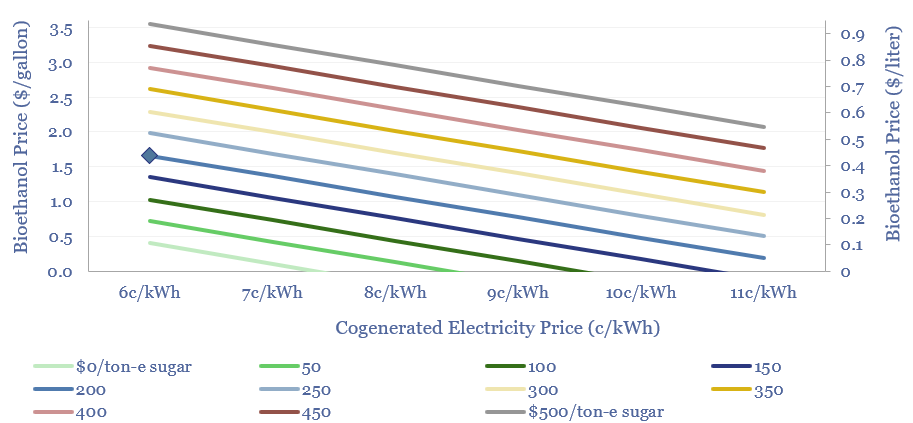

Sugar cane is an amazing energy crop, yielding 70 tons per hectare per year, of which 10-15% is sugar and 20-25% is bagasse. Crushing facilities create value from sugar, sugar-to-ethanol and cogenerated power. This 11-page note argues that more volatile electricity prices could halve ethanol costs or raise cash margins by 2-4x.

-

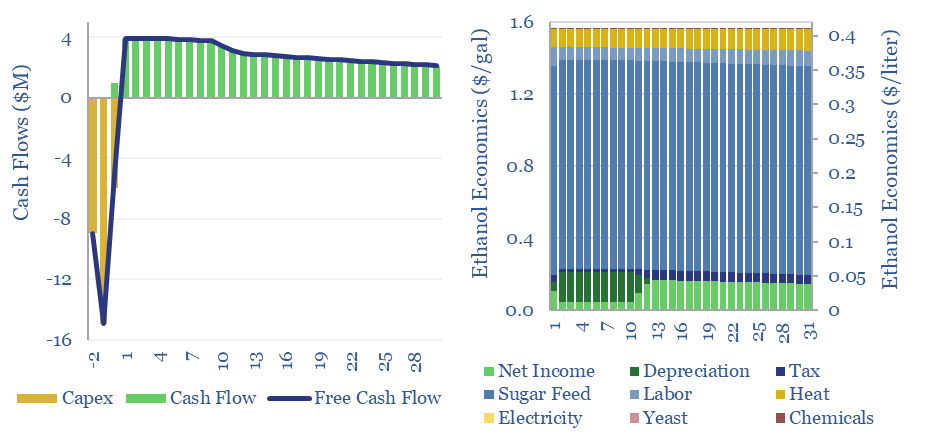

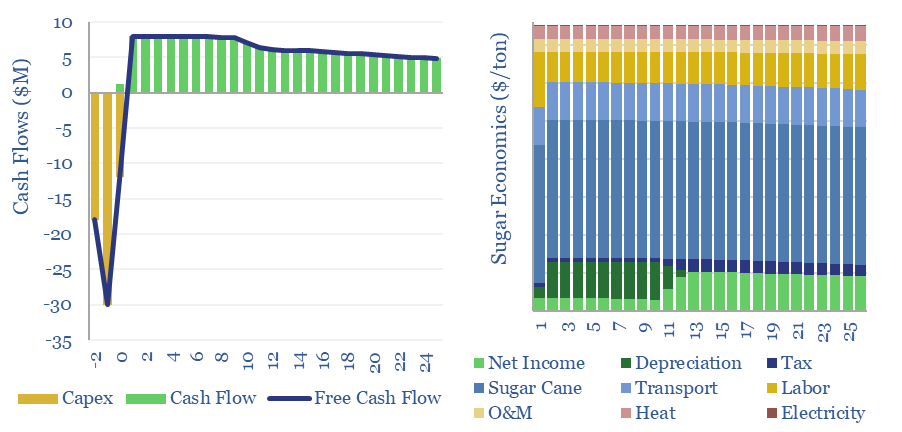

Sugar to ethanol: the economics?

This data-file captures the economics of ethanol production, as a biofuel derived from sugar. A 10% IRR requires $1-4/gallon ethanol, equivalent to $0.25-1/liter, or $60-250/boe. Economics are most sensitive to input sugar prices. Net CO2 intensity is at least 50% lower than hydrocarbons.

-

Sugar production: the economics?

The costs of sugar production are estimated at $260/ton for a 10% IRR at a world-scale sugar refinery, in a major sugar-producing region. Higher returns are achievable at recent world sugar prices, and by valorizing waste streams such as molasses for ethanol and bagasse for cogenerated electricity.

-

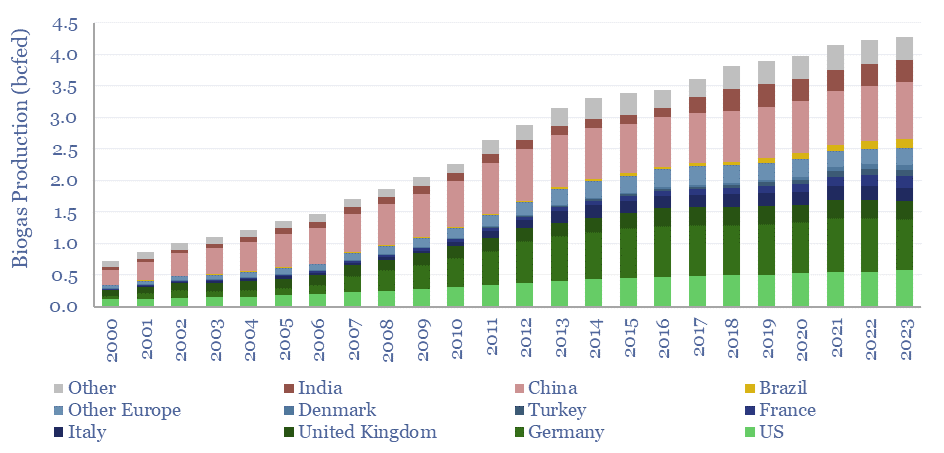

Global biogas production by country?

Global biogas production has risen at a 10-year CAGR of 3% to reach 4.3bcfed in 2023, equivalent to 1.1% of global gas consumption. Europe accounts for half of global biogas, helped by $4-40/mcfe subsidies. This data-file aggregates global biogas production by country, plus notes into feedstock sources, uses of biogas and biomethane.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)