Demand

-

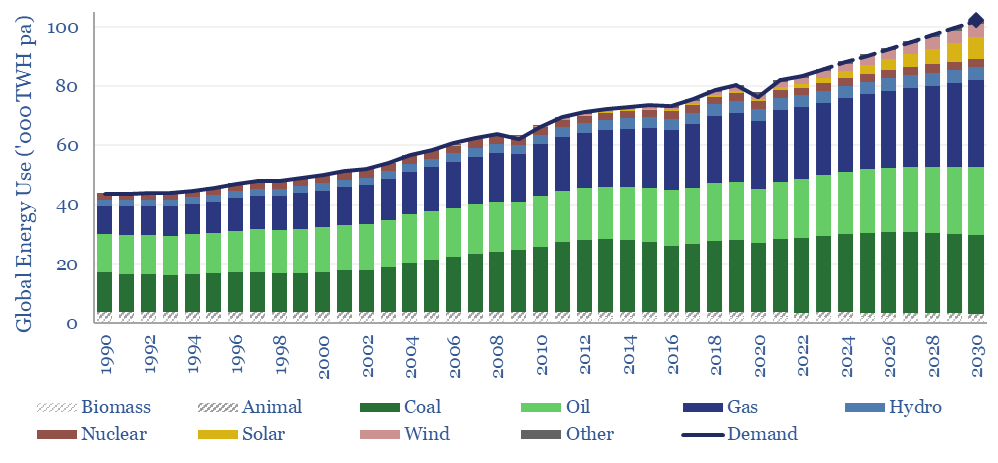

Global energy: supply-demand model?

This global energy supply-demand model combines our supply outlooks for coal, oil, gas, LNG, wind and solar, nuclear and hydro, into a build-up of useful global energy balances in 2023-30. Energy markets can be well-supplied from 2025-30, barring and disruptions, but only because emerging industrial superpowers will continuing using high-carbon coal.

-

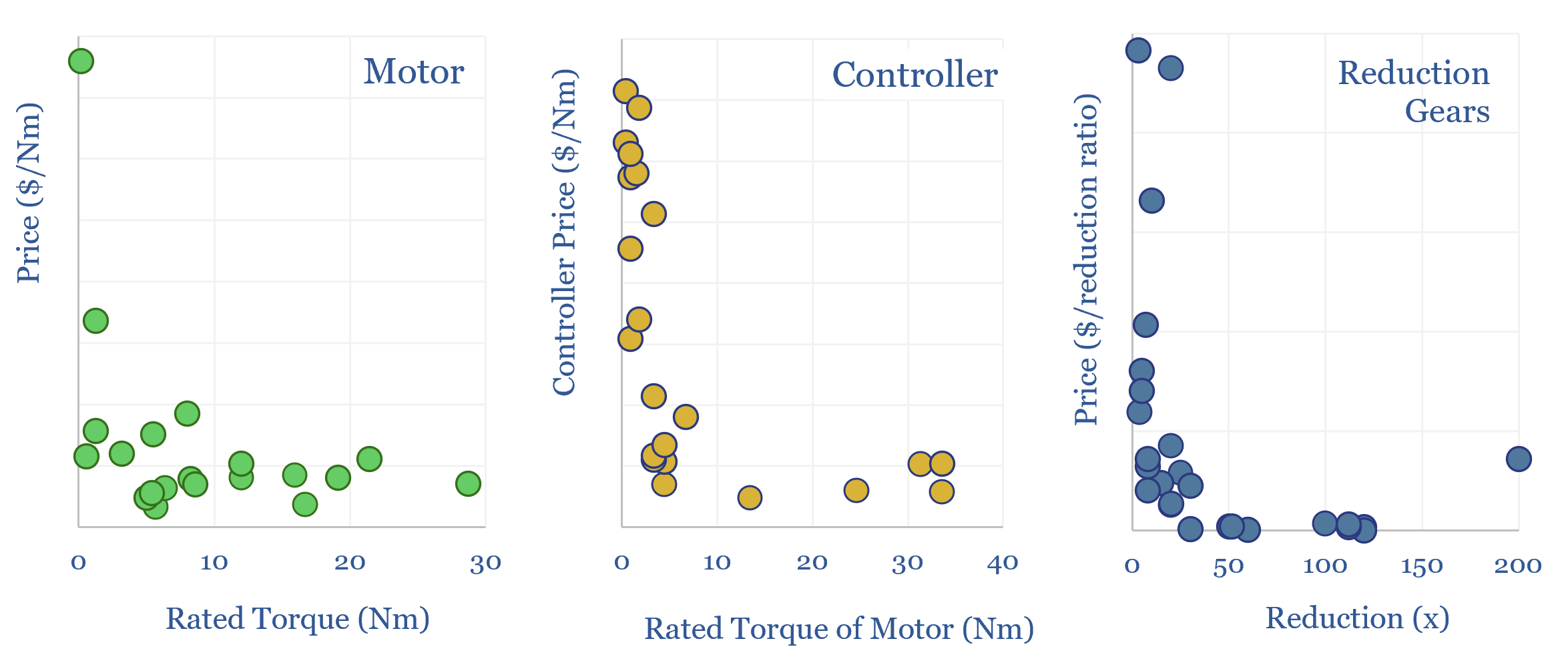

Servo motors: cost calculator?

Servo motors form a $16bn pa market, used in robotics, precision manufacturing equipment, CNC machines, aerospace and med-tech. This data-file estimates the costs of servo-motors, based on underlying controller costs, motor costs and reduction gear costs. Hence we have attempted a simple servo motor cost calculator.

-

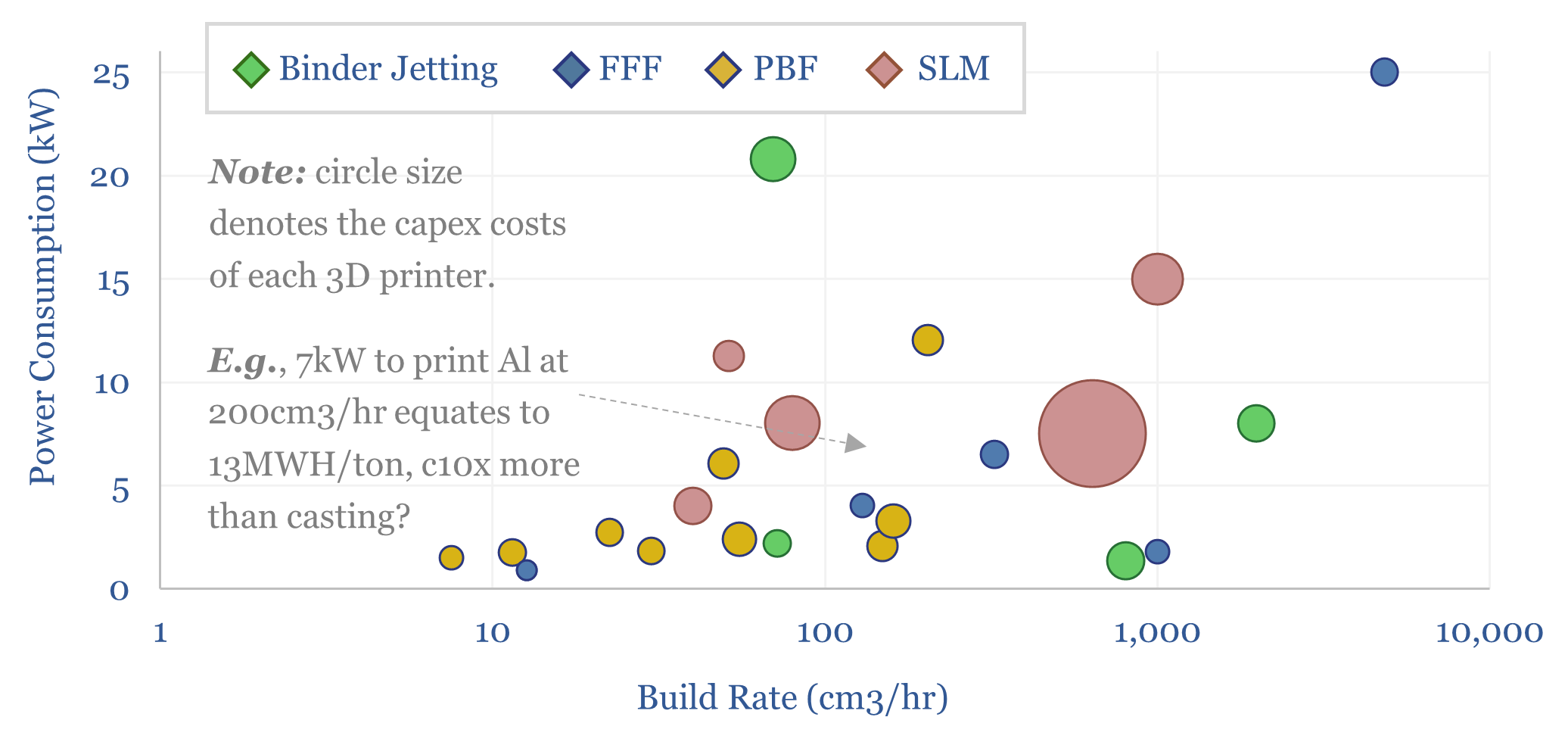

Additive manufacturing: fine print?

Can additive manufacturing overcome bottlenecks in gas turbine components, aerospace-related capital goods, and custom products that are unlocked by AI? This 16-page report re-evaluates the outlook for 3D printing, its economics, energy use, and company implications.

-

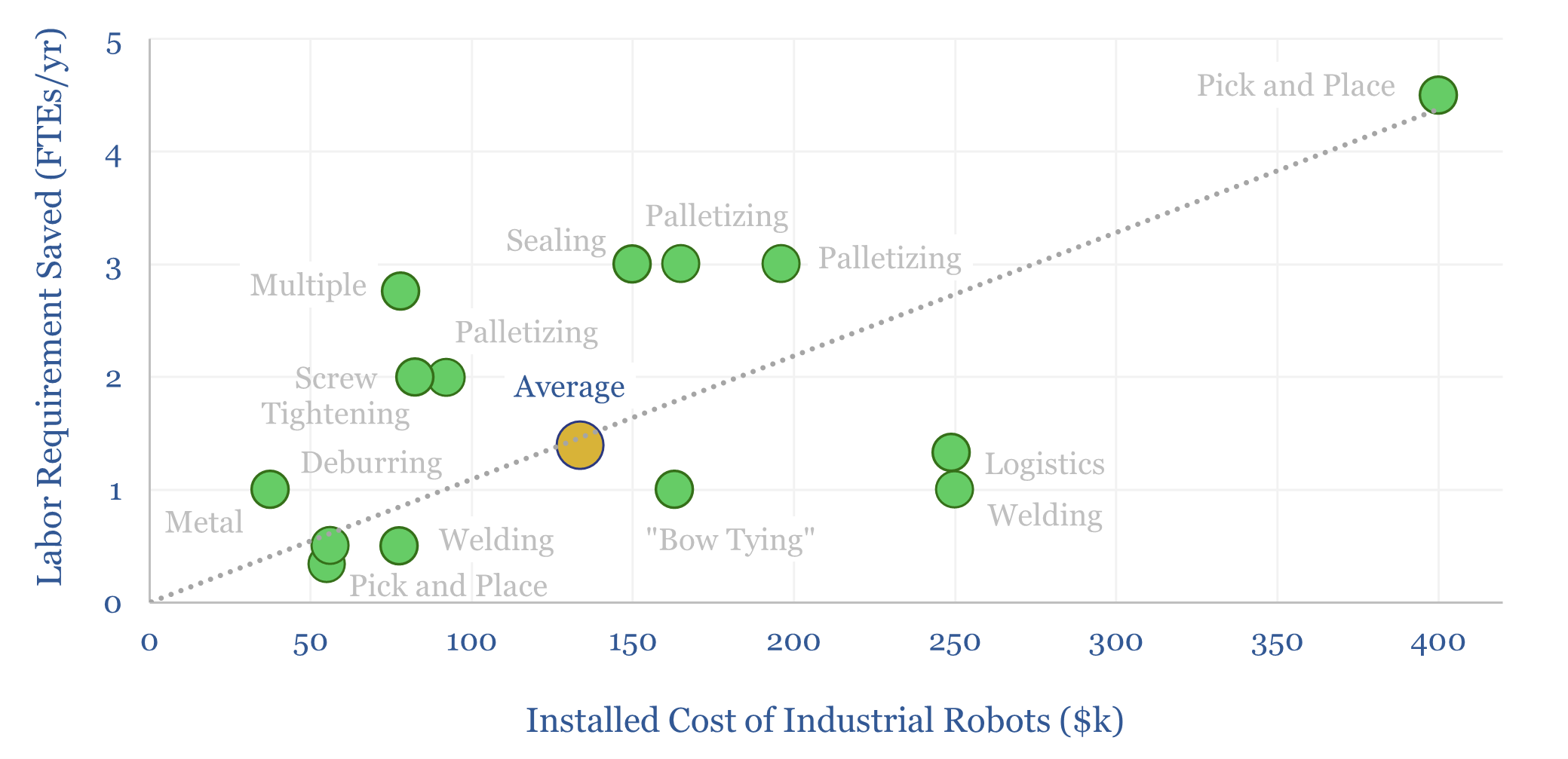

Industrial robots: arm’s reach?

5 million industrial robots have now been deployed globally, in an $18bn pa market. But growth could inflect, with the rise of AI, and to solve labor bottlenecks, as strategic value chains are re-shored. Robotics effectively substitute labor inputs for electricity inputs. Hence today’s 18-page report compiles 25 case studies, explores the theme and who…

-

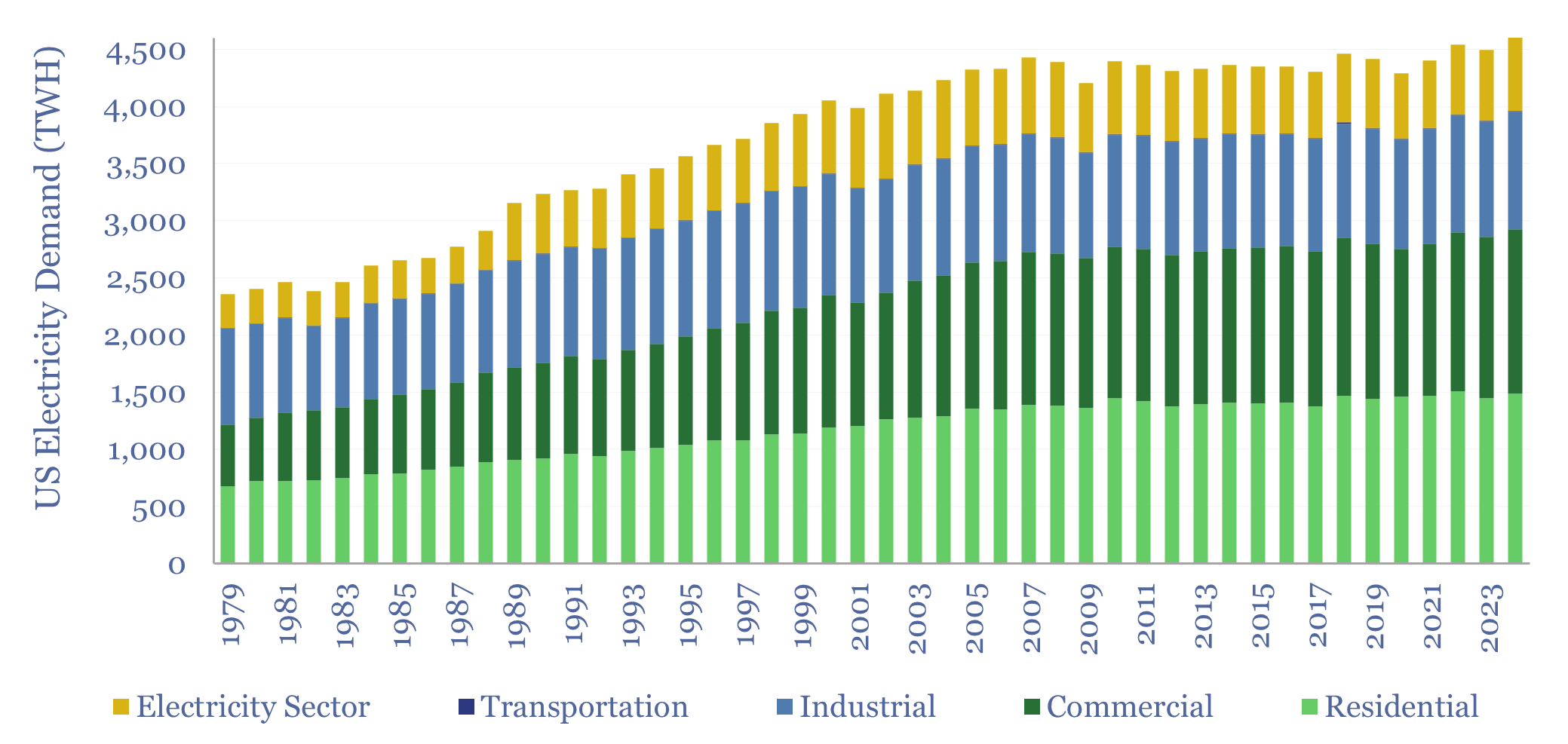

US electricity demand: by sector, by use, over time?

US electricity sales reached 4,000 TWH in 2024, rising +2.3% YoY, and bringing the trailing ten-year CAGR to 0.5% pa. The current breakdown is 38% residential, 36% commercial, 26% industrial. All three are now growing. To help understand load growth, this data-file is a breakdown of US electricity demand by sector, by use and over…

-

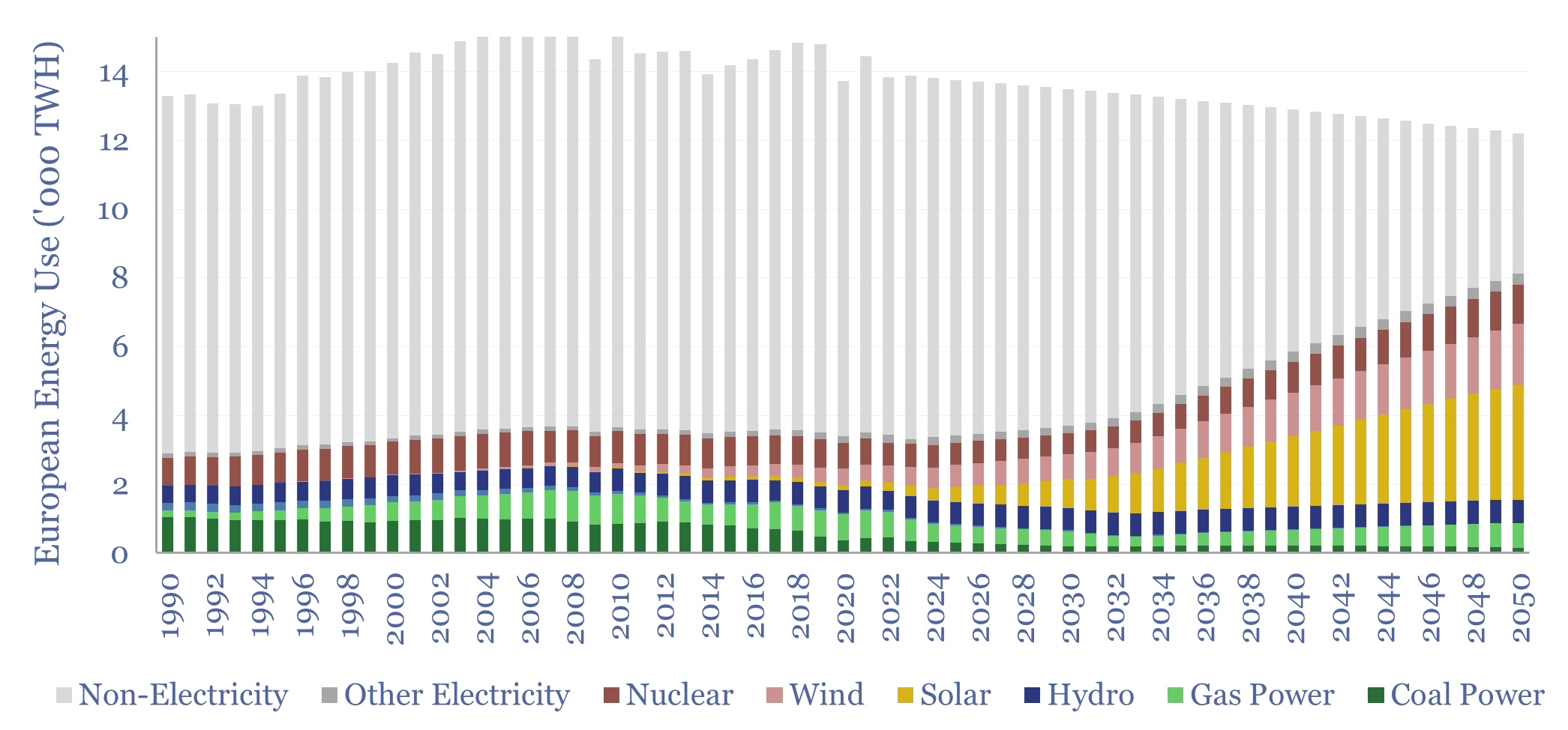

European energy: the burial of the dead?

Europe’s energy ambitions are now intractable: It is just not feasible to satisfy former climate goals, new geopolitical realities, and also power future AI data centers. Hence this 18-page report evaluates Europe’s energy options; predicts how policies are going to change; and re-forecasts Europe’s gas and power balances, both to 2030 and to 2050.

-

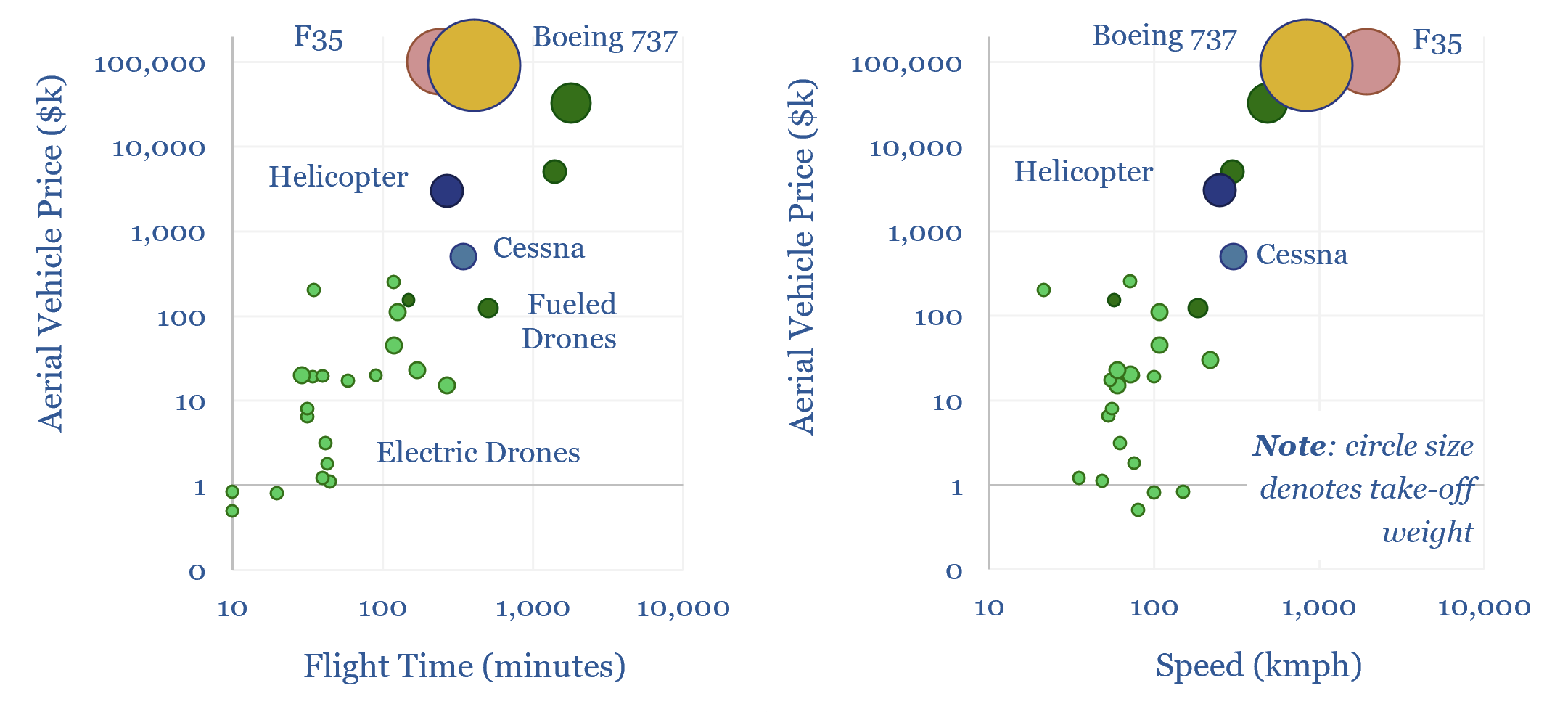

Drone deployment: vertical take-off?

Drones cost just $1k-100k each. They may use 95-99% less energy than traditional vehicles. Their ascent is being helped by battery technology and AI. Hence this 14-page report reviews recent progress from 40 leading drone companies. What stood out most was a re-shaping of the defense industry, plus helpful deflation across power grids, renewables, agriculture,…

-

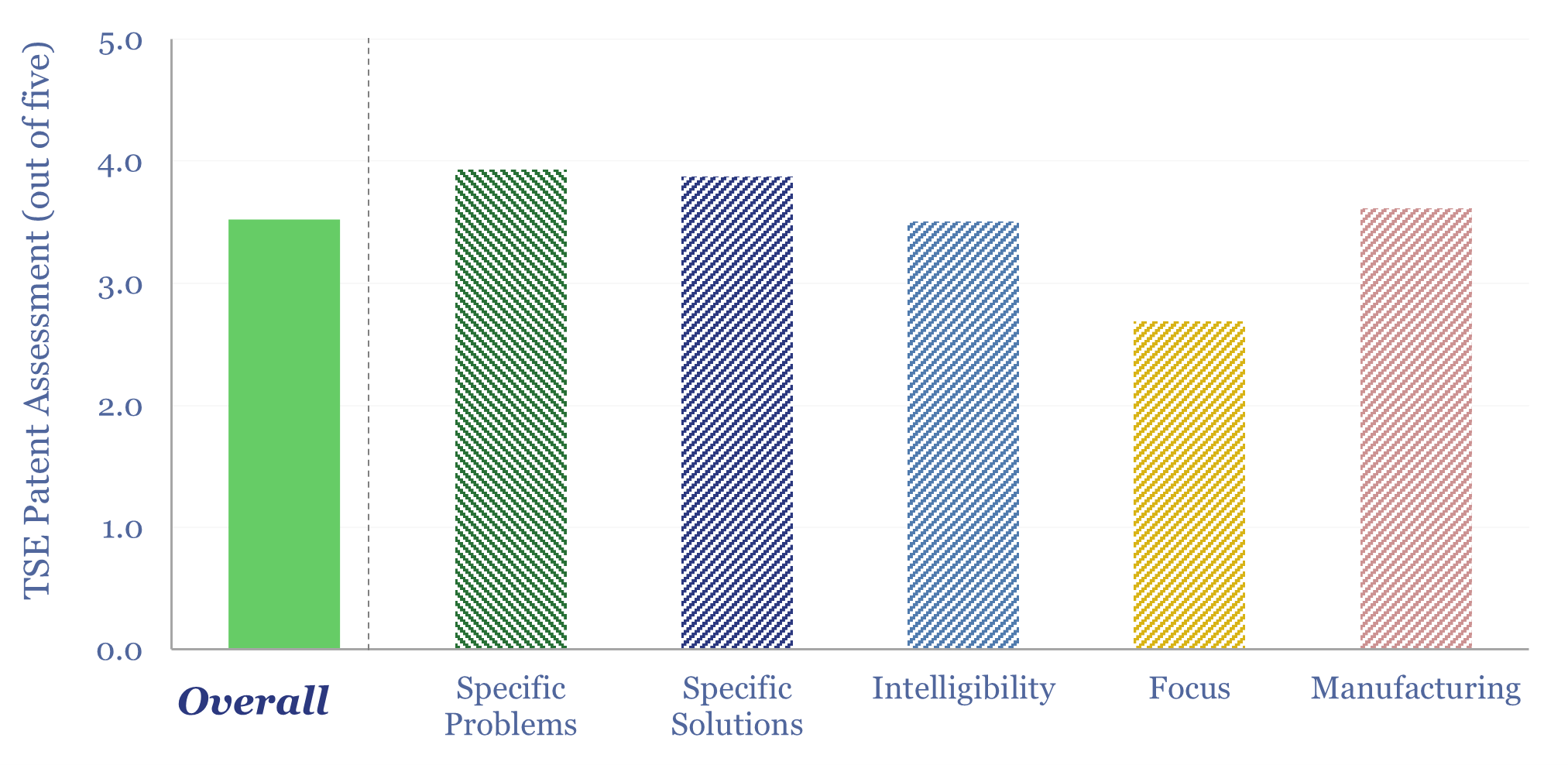

Microwave Chemical: electrical heating?

Microwave Chemical is a small-cap company, developing microwave-based heating solutions, across over a dozen use cases, from acrylic recyling, to producing food/cosmetic compounds, to carbon fiber (particularly interesting!). We reviewed a dozen of the company’s patents in this data-file, which is a Microwave Chemical technology review and finds a moat in efficient microwave heating.

-

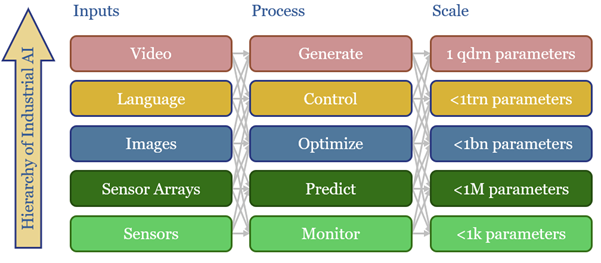

AI energy: industrial demand and the Jevons effect?

Increasingly efficient AI should unlock ever more widespread and more sophisticated uses of AI. This is shown by reviewing 40,000 patents from 200 industrial companies. This 15-page report summarizes notable companies, patent filings, and updates our 2030 forecasts for AI energy.

-

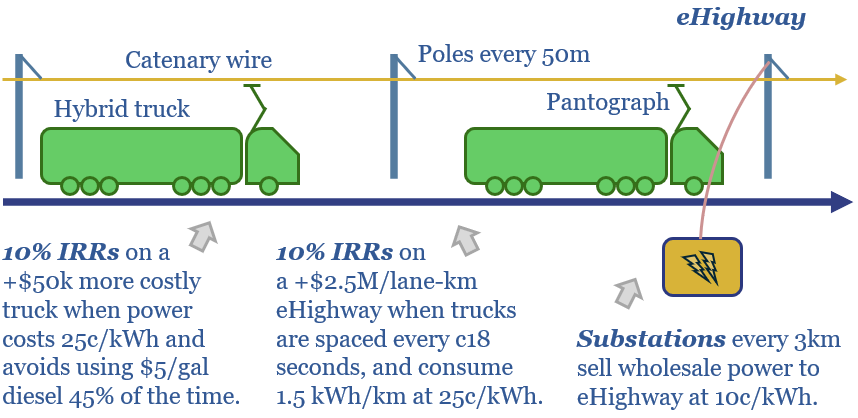

eHighways: trucking by wire?

eHighways electrify heavy trucks via overhead catenary wires. They have been de-risked by half-a-dozen real-world pilots. High-utilization routes can support 10% IRRs on both road infrastructure and hybrid trucks. This 15-page report finds benefits in logistics networks and for integrating renewables?

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (834)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (79)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (116)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (352)