Plastics

-

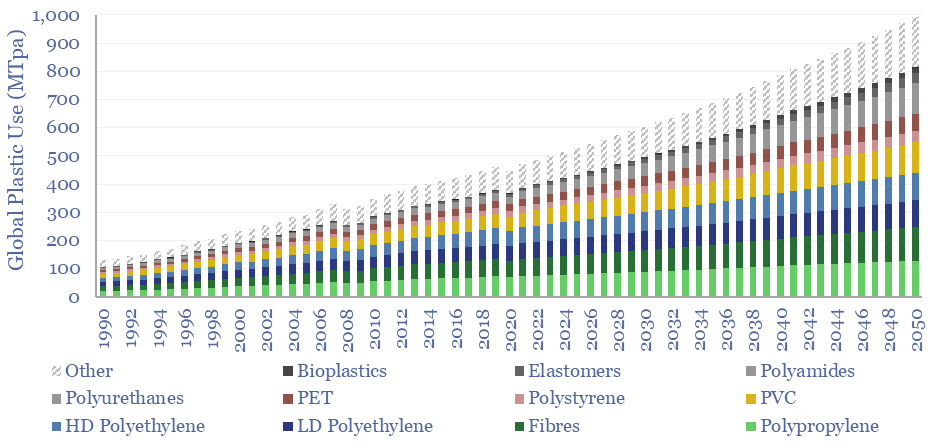

Global plastic demand: breakdown by product, region and use?

Global plastic is estimated at 470MTpa in 2022, rising to at least 800MTpa by 2050. This data-file is a breakdown of global plastic demand, by product, by region and by end use, with historical data back to 1990 and our forecasts out to 2050. Our top conclusions for plastic in the energy transition are summarized.

-

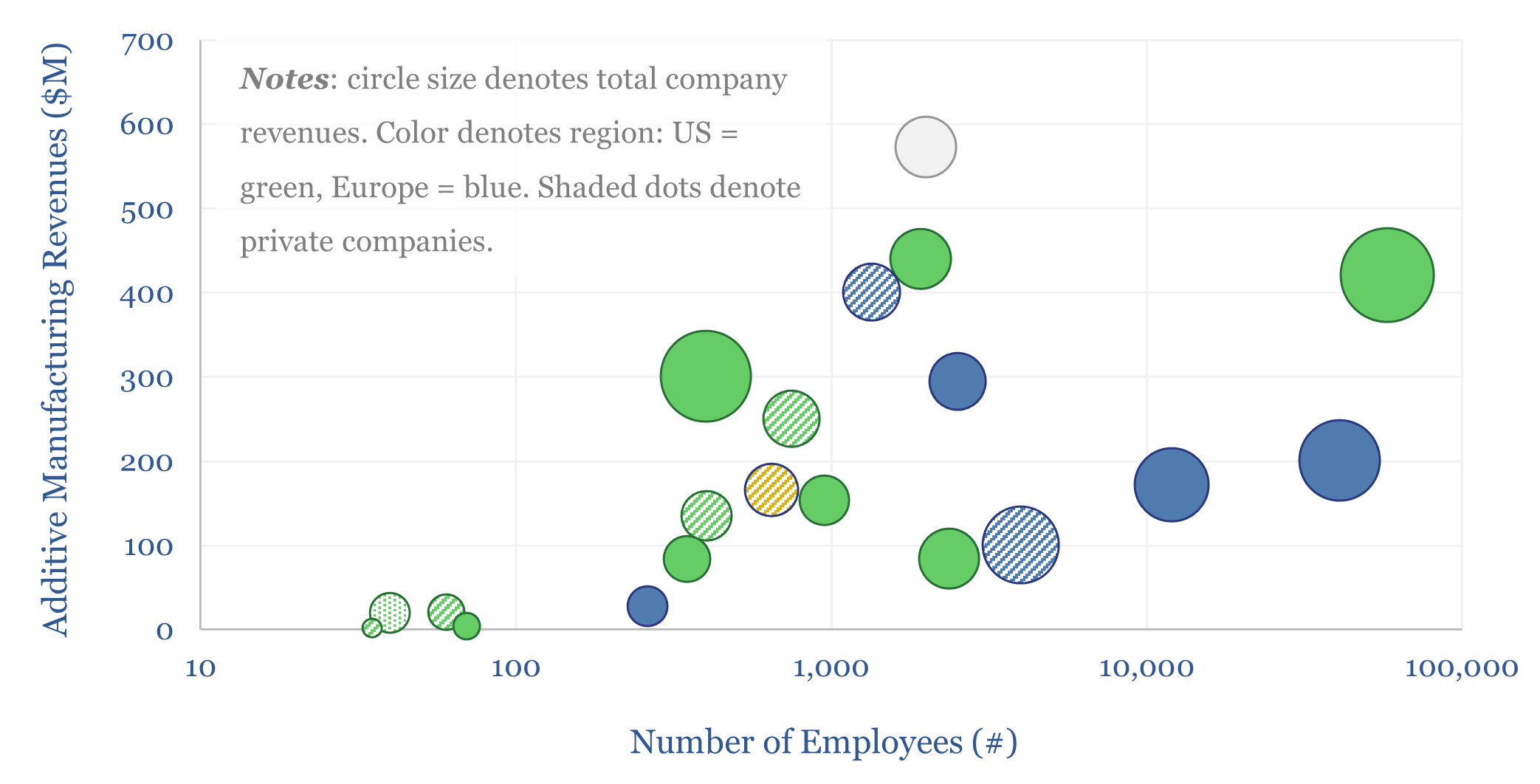

Additive manufacturing: technology leaders?

Additive manufacturing companies are screened in this data-file, across 20 technology leaders. We have also tabulated 25 case studies, where AM reduces weight by 40%, cost by 50%, and lead-time by 60%. The industry remains highly competitive. But could it be turning a corner? Especially for metal components in capital goods and aerospace?

-

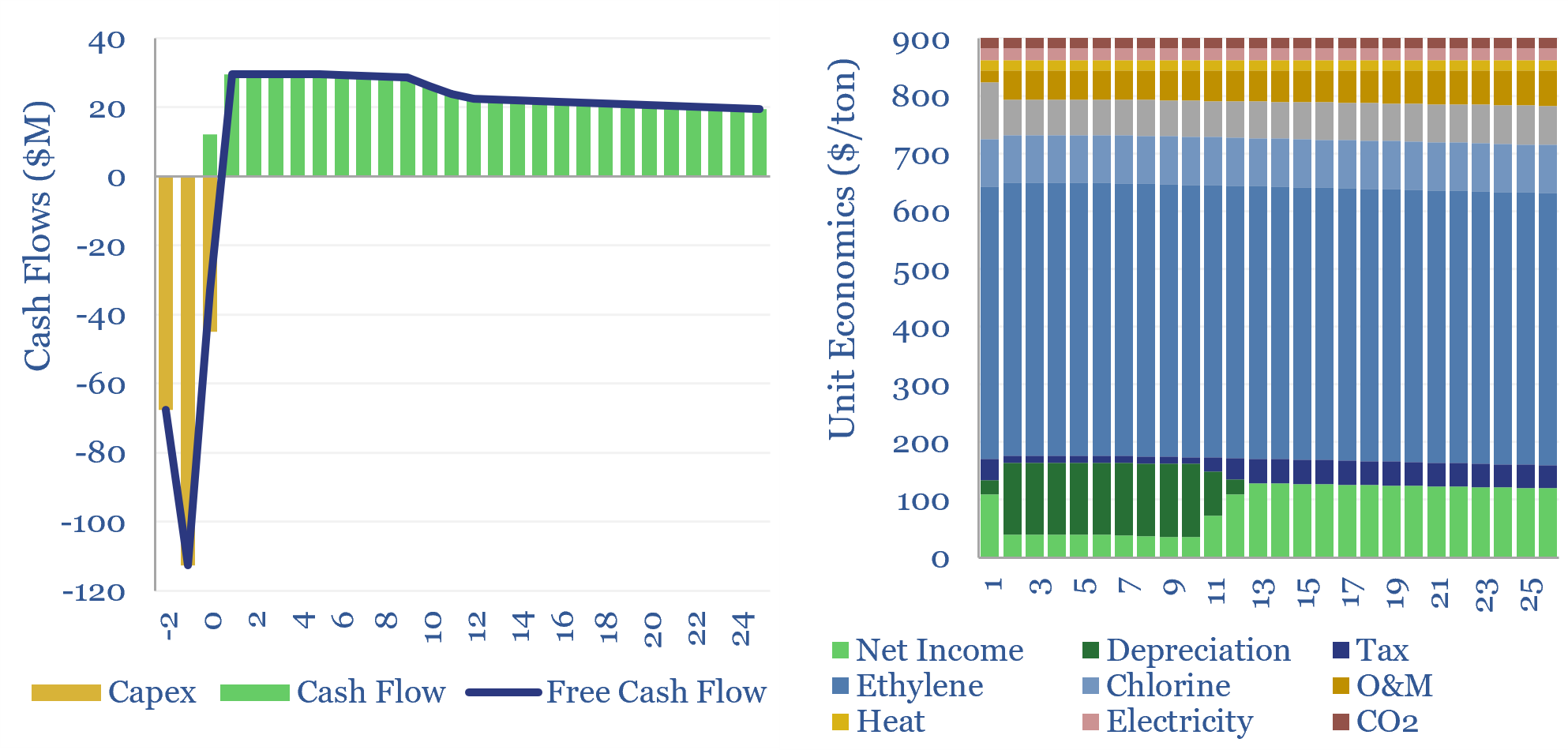

Poly Vinyl Chloride: the economics?

This data-file estimates the cost of PVC production and the cost of VCM production, from first principles, based on capex, input materials, heat, electricity, labor and other opex. As a rule of thumb, 10% IRRs require c$900/ton PVC and c$750/ton VCM, and PVC will embed around 2 tons of CO2 per ton of PVC. Numbers…

-

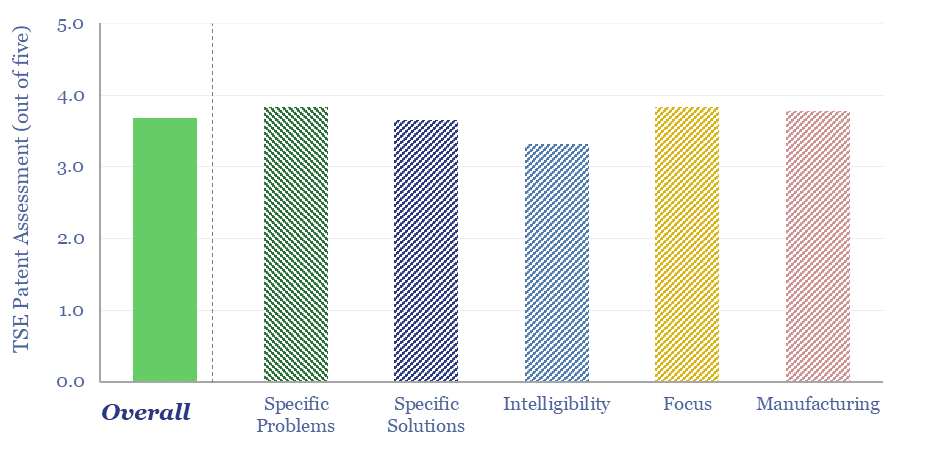

Eastman: molecular recycling technology?

This patent screen reviews Eastman’s molecular recycling technology. Specifically, Eastman is spending over $2bn, to construct 3 plants, with 380kTpa of capacity, to break down hard-to-recycle polyesters back into component monomers, with 20-80% lower CO2 intensity than virgin product. We find evidence for 30-years of fine-tuning, and can bridge to 10% IRRs if buyers pay…

-

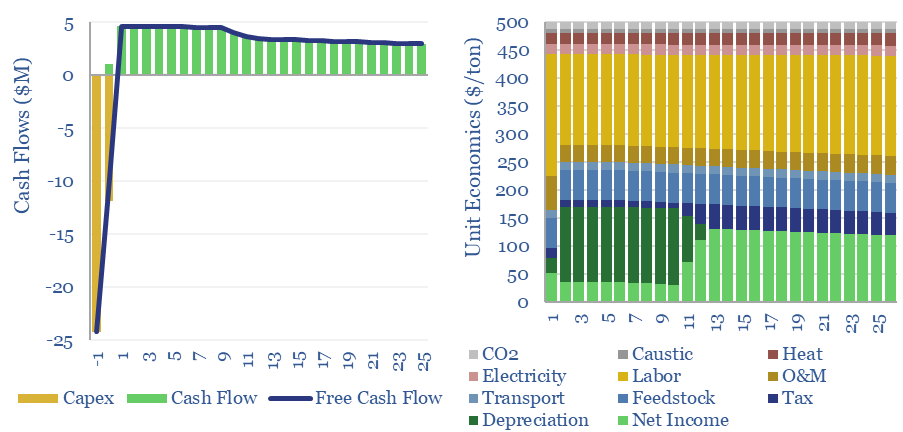

Plastic recycling: the economics?

Plastic recycling requires a $500/ton product price, to earn a 10% IRR off of c$1,000/Tpa of up-front capex, at a mechanical recycling facility with 0.3 tons/ton of CO2 intensity (up to 80-90% below virgin plastics, more than we expected). This data-file captures the economics and the costs of plastic recycling, especially for the mechanical recycling…

-

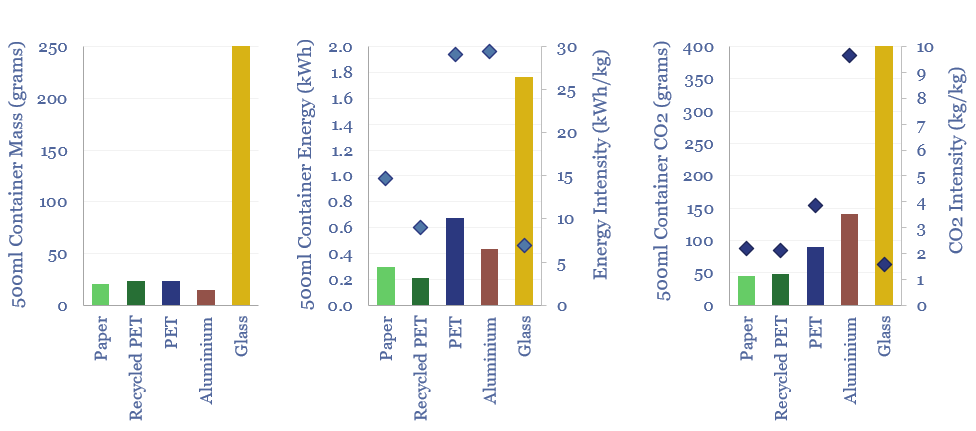

Plastic products: energy and CO2 intensity of plastics?

The energy intensity of plastic products and the CO2 intensity of plastics are built up from first principles in this data-file. Virgin plastic typically embeds 3-4 kg/kg of CO2e. But compared against glass, PET bottles embed 60% less energy and 80% less CO2. Compared against virgin PET, recycled PET embeds 70% less energy and 45%…

-

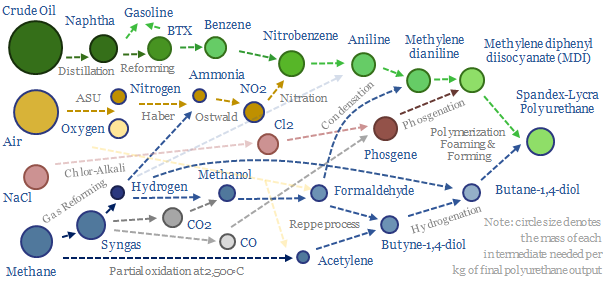

Polyurethanes: what upside in energy transition?

Polyurethanes are elastic polymers, used for insulation, electric vehicles, electronics and apparel. This $75bn pa market expands 3x by 2050. But could energy transition double historically challenging margins, by freeing up feedstock supplies? This 13-page note builds a full mass balance for the 20+ stage polyurethane value chain and screens 20 listed companies.

-

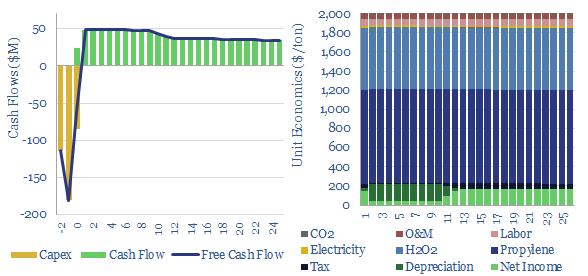

Propylene oxide: production costs?

Propylene oxide production costs average $2,000/ton ($2/kg) in order to derive a 10% IRR at a newbuild chemicals plant with $1,500/Tpa in capex. 80% of the costs are propylene and hydrogen peroxide inputs. 60-70% of this $25bn pa market is processed into polyurethanes. CO2 intensity is 2 tons of CO2 per ton of PO today,…

-

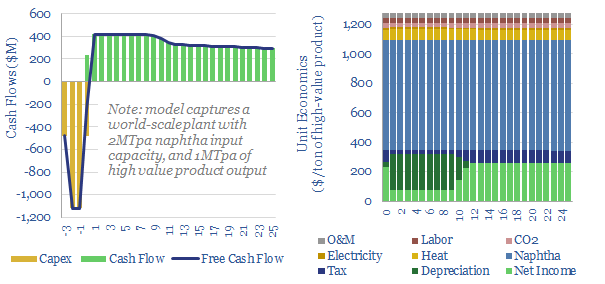

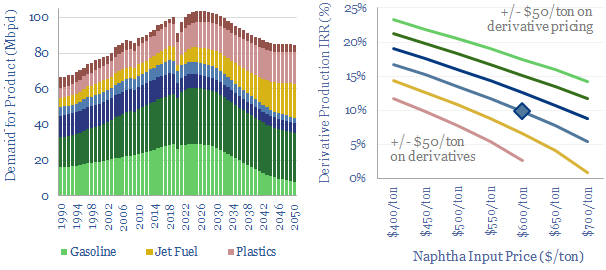

Naphtha cracking: costs of ethylene, propylene and aromatics?

Naphtha cracking costs $1,300/ton for high value products, such as ethylene, propylene, butadiene and BTX aromatics, to derive a 10% IRR constructing a greenfield naphtha cracker, with $1,600/Tpa capex. CO2 intensity averages 1 ton of CO2 per ton of high value products. This data-file captures the economics for naphtha cracking, a cornerstone of the modern…

-

Crude to chemicals: there will be naphtha?

Oil markets are transitioning, with electric vehicles displacing 20Mbpd of gasoline by 2050, while petrochemical demand rises by almost 10Mbpd. So it is often said oil refiners should ‘become chemicals companies’. It depends. This 18-page report charts petrochemical pathways and sees greater opportunity in chemicals that can absorb surplus BTX.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (837)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (129)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (353)