Semiconductors

-

Semiconductors: outlook in energy transition?

Semiconductors are an energy technology. And they are transforming the future global energy complex, across AI, solar, electric vehicles, LEDs and other new energies. This short article summarizes our outlook for semiconductors in energy transition, and resultant opportunities across our work.

-

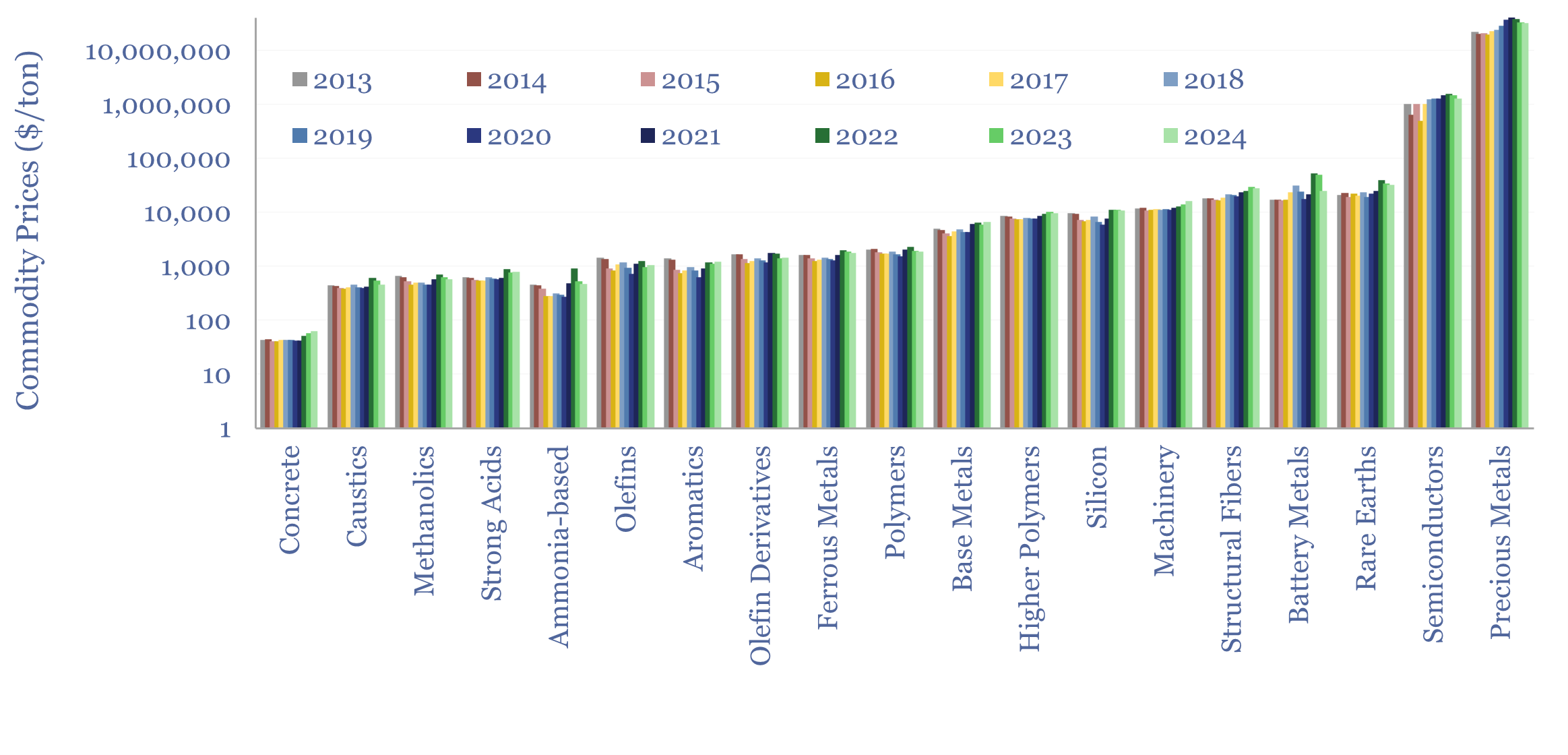

Commodity prices: metals, materials and chemicals?

Annual commodity prices are tabulated in this database for 70 material commodities, as a useful reference file; covering steel prices, other metal prices, chemicals prices, polymer prices, with data going back to 2012, all compared in $/ton. We have updated the data-file for 2024 data in May-2025.

-

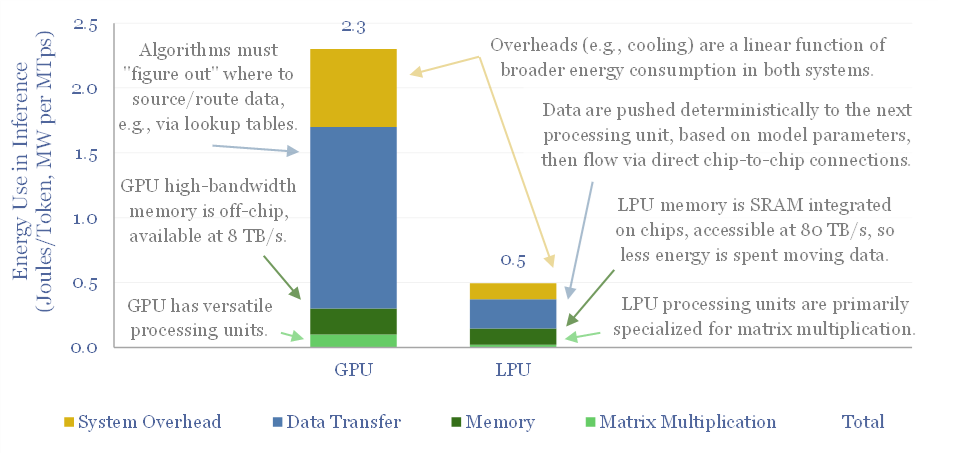

Groq: AI inference breakthrough?

Groq has developed LPUs for AI inference, which are up to 10x faster and 80-90% more energy efficient than today’s GPUs. This 8-page Groq technology review assesses its patent moat, LPU costs, implications for our AI energy models, and whether Groq could ever dethrone NVIDIA’s GPUs?

-

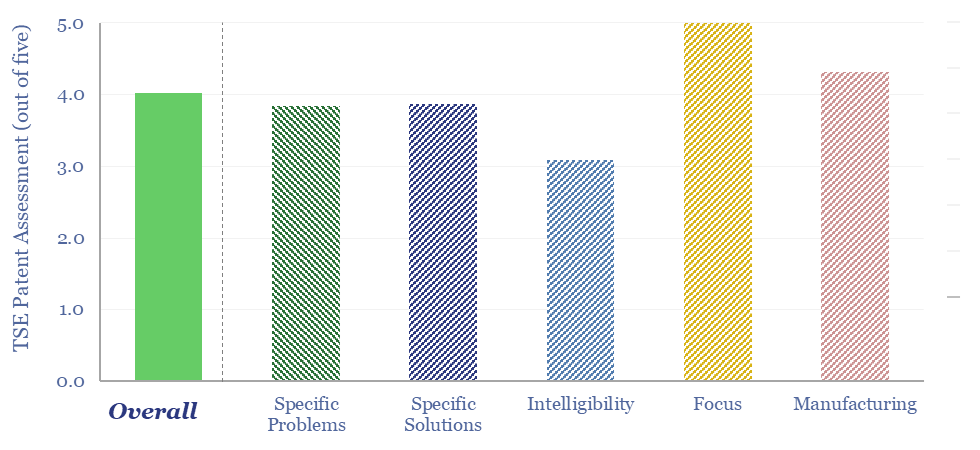

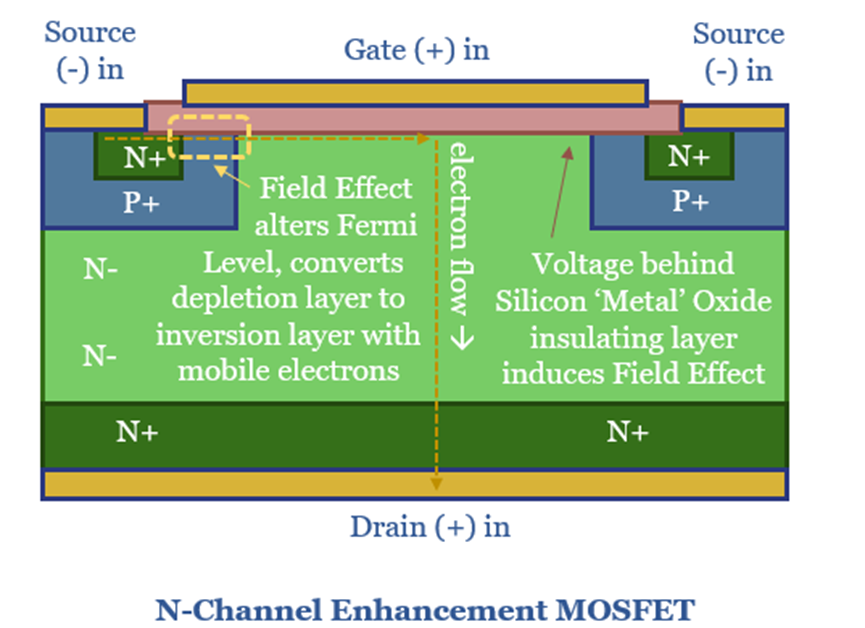

Ideal Power: Bi-Directional Bipolar Junction Transistors?

Bi-Directional Bipolar Junction Transistors are an emerging category of semiconductor-based switching device, that can achieve lower on-state voltage drops than MOSFETs and softer, faster switching than IGBTs, to improve efficiency and lower component count in bi-directional power converters. This data-file screens B-TRAN patents from Ideal Power.

-

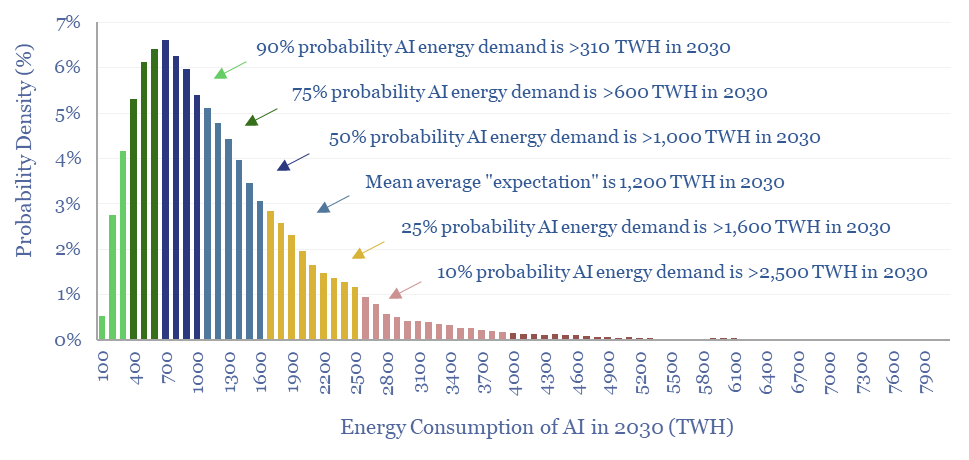

Energy intensity of AI: chomping at the bit?

Rising energy demands of AI are now the biggest uncertainty in all of global energy. To understand why, this 17-page note is an overview of AI computing from first principles, across transistors, DRAM, GPUs and deep learning. GPU efficiency will inevitably increase, but compute increases faster. AI most likely uses 300-2,500 TWH in 2030, with…

-

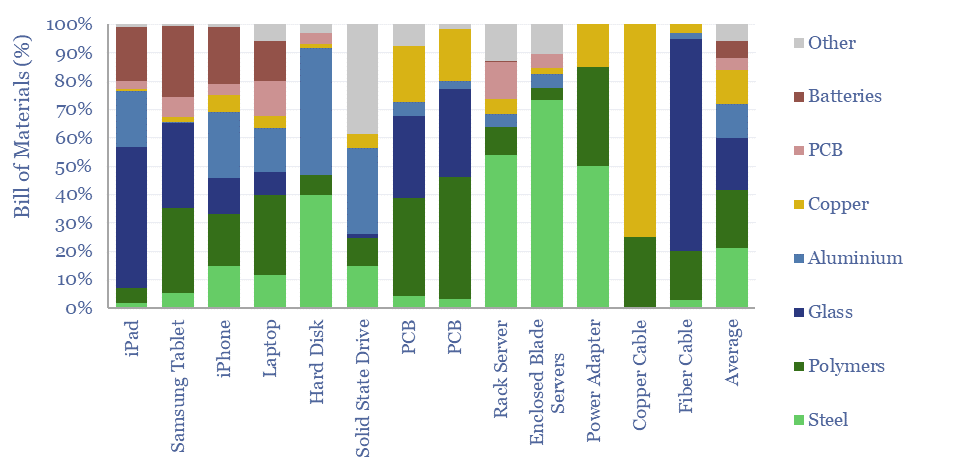

Bill of materials: electronic devices and data-centers?

Electronic devices are changing the world, from portable electronics to AI data centers. Hence what materials are used in electronic devices, as percentage of mass, and in kg/kW terms? This data-file tabualates the bill of materials, for different devices, across different studies.

-

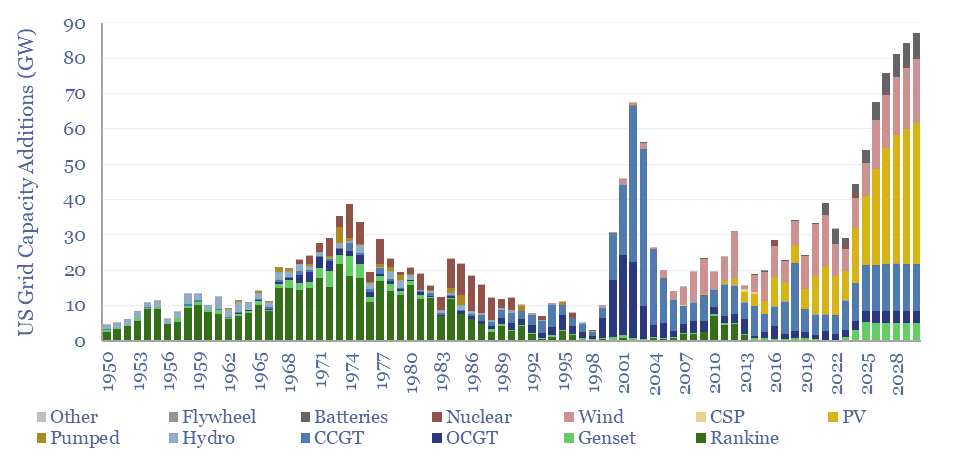

Energy and AI: the power and the glory?

The power demands of AI will contribute to the largest growth of new generation capacity in history. This 18-page note evaluates the power implications of AI data-centers. Reliability is crucial. Gas demand grows. Annual sales of CCGTs and back-up gensets in the US both rise by 2.5x? This is our most detailed AI report to…

-

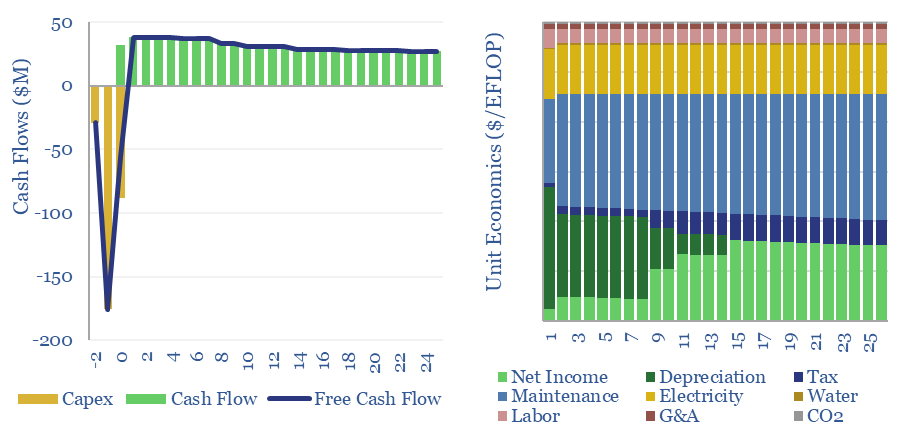

Data-centers: the economics?

The capex costs of data-centers are typically $10M/MW, with opex costs dominated by maintenance (c40%), electricity (c15-25%), labor, water, G&A and other. A 30MW data-center must generate $100M of revenues for a 10% IRR, while an AI data-center in 2024 may need to charge $5/EFLOP of compute.

-

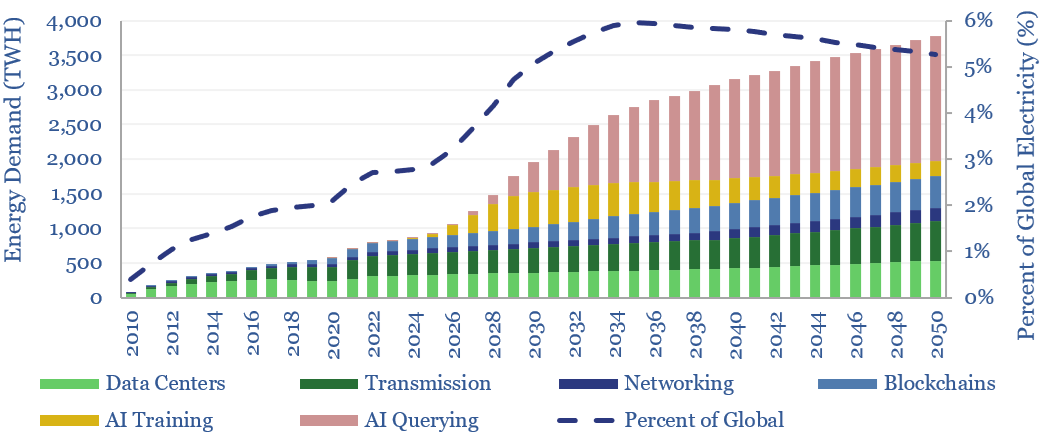

Internet energy consumption: data, models, forecasts?

This data-file forecasts the energy consumption of the internet, rising from 800 TWH in 2022 to 2,000 TWH in 2030 and 3,750 TWH by 2050. The main driver is the energy consumption of AI, plus blockchains, rising traffic, and offset by rising efficiency. Input assumptions to the model can be flexed. Underlying data are from…

-

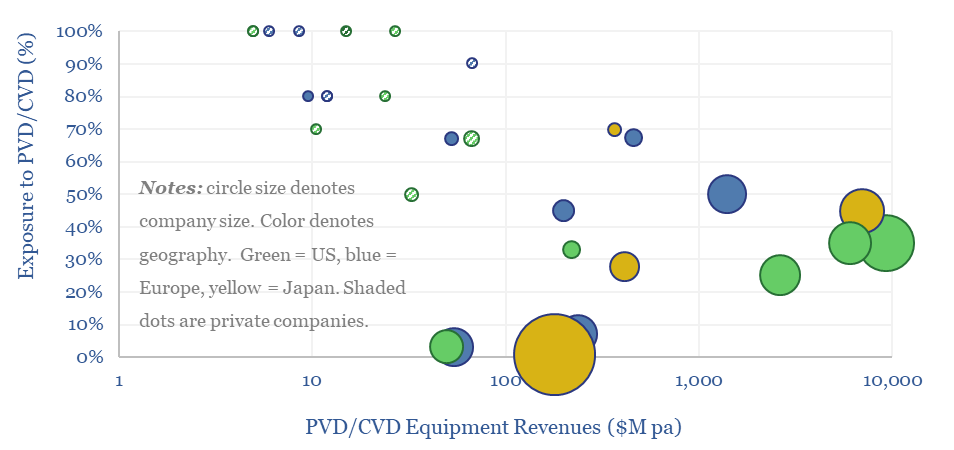

Vapor deposition: leading companies?

This data-file is a screen of leading companies in vapor deposition, manufacturing the key equipment for making PV silicon, solar, AI chips and LED lighting solutions. The market for vapor deposition equipment is worth $50bn pa and growing at 8% per year. Who stands out?

Content by Category

- Batteries (87)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (827)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (202)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (277)

- LNG (48)

- Materials (81)

- Metals (76)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (125)

- Renewables (149)

- Screen (113)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (349)